DishTV strengthens Incremental market share leadership to 28%

Dish TV India Limited (Dishtv) (BSE: 532839, NSE: DISHTV) today reported third quarter fiscal 2015 standalone subscription and total operating revenues of Rs. 6,554 million, up 17.4% Y-o-Y and Rs. 7,139 million, up 16.5% Y-o-Y respectively. EBITDA for the quarter stood at Rs. 1,912 million compared to Rs. 1,355 million in the corresponding quarter last fiscal. Net Loss for the quarter reduced to Rs. 29 million.

The Board of Directors in its meeting held today, has approved and taken on record the unaudited standalone results of Dish TV for the quarter ended on December 31, 2014.

Dr. Subhash Chandra, Chairman, Dish TV India Limited, said, “The world economy continues to keep policy makers around the globe busy. India helped by its monetary policy stance, a stable government at the Centre and unwinding of the commodities super-cycle is favorably placed to outrun other emerging markets. An imminent pick-up in investment and demand is expected to be favorable both for Dish TV as well as the DTH industry.”

“Dish TV recorded marked improvements in its key financials while maintaining market supremacy during the third quarter of fiscal 2015. Overall, the DTH industry led by Dish TV recorded a healthy 29% Y-o-Y growth in gross additions compared to the corresponding quarter last fiscal,” he added.

Highlighting Dish TV’s third quarter performance, Mr. Jawahar Goel, Managing Director, Dish TV, said, “We continued to strengthen our reach in Phase 3 &4 towns much ahead of the government mandated revised deadline for digitization in those markets. Our bouquet of offerings including fully loaded sports packs and High Definition (HD) packages helped us fill in the expectation gap in Phase 1 & 2 households as well. The recently launched ‘Zing’ has been a successful product and now caters to 8 regional markets with the latest being Tamil Nadu.”

The DTH industry finally seems to be getting a level playing field with broadcaster’s efforts towards improving declaration from the cable industry. The implementation of Reference Interconnect Offer (RIO) deals may mark the beginning of a significant upward trend in industry ARPU’s. Anticipating a brighter 2015, Mr. Goel said, “Though we have been doing everything possible to boost ARPU’s, the scope of results has been limited due to sticky cable prices. As MSO’s shell out more for content and increase tax compliance, cable packaging may become a reality in 2015 thus bringing average revenue per user to respectable levels while creating headroom for ARPU expansion in DTH.”

The DTH industry entered 2015 with the same uncertainty around taxes that has been haunting it since its inception. “Though the union budget 2014 was a dampener, we are keeping our fingers crossed with respect to the budget 2015. All industry stakeholders including Indian Broadcasting Foundation (IBF), News Broadcasters Association (NBA), Multi System Operators (MSO) and DTH operators made a joint representation to the Finance Ministry regarding anomalies in the industry’s tax structure. The representation was received well and we look forward to hearing the outcome during the budget this year,” said Mr. Goel.

In view of the Government’s ‘Make in India’ campaign Dish TV has been exploring possibilities for domestic manufacturing of Set-Top-Boxes (STB). “We are closely watching the turn of events and would take a decision basis the tax regime for local manufacturing that might be modified by the government in the days ahead. Our proposed subsidiary Dish Infra Services (Private) Limited will be instrumental in deriving efficiencies from hardware operations,” Mr. Goel said.

Dish TV recorded a quantum jump in its performance during the third quarter compared to the corresponding period last fiscal. Commenting on the results, Mr. Goel said, “Our subscription revenues grew 17.4% on a Y-o-Y basis while EBITDA margin expanded 270 basis points to reach 26.8% during the quarter. Net loss for the quarter reduced to Rs. 29 million while churn was maintained at a comfortable 0.7% per month.”

Condensed statement of operations

The table below shows the condensed statement of operations for Dish TV India Limited for the third quarter ended December ‘14 compared to the quarter ended September ‘14:

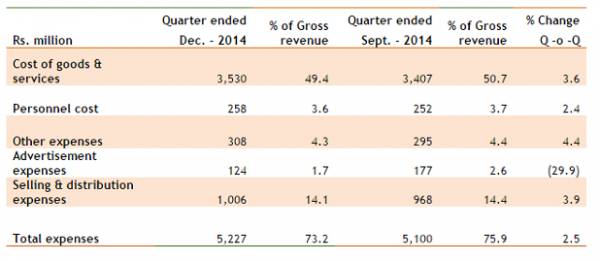

Expenditure

Dish TV’s primary expenses include cost of goods and services, personnel cost, administrative cost, advertisement expenses and selling expenses. The table below shows each as a percentage of total revenue:

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn