Making India the Global Entertainment Superpower, KPMG Report

The Media and Entertainment Industry in India is poised to grow at a CAGR of 13.9 per cent, to grow from INR1026 billion in 2014 to reach INR1964 billion by 2019. Reflecting the macro economic growth rate, advertising witnessed a healthy year largely on the back of heavy spending during the national and state elections, and a significant surge in spends by e-commerce companies. The growth in popularity of digital media continued to surge in 2014 with a significant growth in digital advertising of 44.5 per cent over 2013. Critical tax and regulatory interventions were key for enabling growth.

Television sector

In the television sector, the ongoing digitization of cable continued to progress. However, the promise of addressability, greater transparency and higher ARPUs is yet to be realized. This was chiefly on account of account of implementation challenges and hence delays in putting in place tiered packages and billing. On the other hand, DTH operators continued improve realisations by increasing penetration of HD channels, premium channels and value added services.

The Ministry of Information and Broadcasting (MIB) extended the deadlines for Phases III and IV of Digital Addressable System (DAS) implementation to 31 December 2015 and 31 December 2016, respectively. DAS rollout in Phases III and IV is expected to be more challenging on account of the larger geographical spread, funding requirements and low potential for ARPUs. Overall, the sector saw a healthy advertising growth on the back of the boost from general elections spend and the emergence of e-commerce as a significant spender across media in 2014

‘Advertising will continue to show robust growth over the next five years as economic growth comes back and categories like e-commerce and telecom increase spending. However, the real pot of gold at the end of the rainbow is subscription revenue – if new pricing structures take hold within the industry, then Average Revenue per User will rise, benefiting the entire TV value chain’, says Jehil Thakkar, Head of Media and Entertainment at KPMG in India

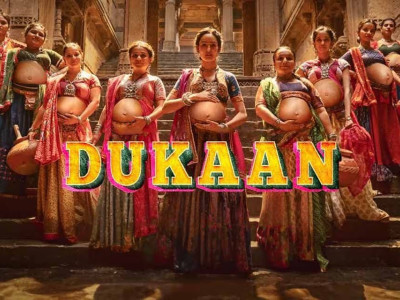

Films sector

During the year, the gap between the top 10 films and the contribution of the rest of the industry further widened. The category-A films with top league actors continued to perform well at the box office, however the same was not true for films which lacked both strong content and a top league actor to attract audiences to the theatres. At the same time, C&S sales of most films also saw corrections in price and a drop in bulk deals.

The exhibition sector saw expansion, both organic (in particular in tier II and tier III cities) and inorganic, with significant consolidation deals in 2014. This is enabling both economies of scale for exhibitors and stimulating growth for the sector, including a rise in in-cinema advertising deals.

‘2014 was a real wake-up call for the Hindi film industry. I think its time for the industry to go back and revisit some business models, cost structures and content. The drivers of growth in previous years, multiplex expansion, rise in ticket prices and theatre digitization, all hit maturity levels. Cost structures and content will be paramount to ensure the health of the industry in the coming years’, says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Print Media

The structure of the Indian print industry continues to be highly fragmented at a national and regional level. While advertisement revenue held a significant part in the total revenue pie and continues to be the growth driver for the industry, circulation revenue growth was higher than that of advertising revenue for Hindi and English markets last year. In 2014, the Indian print industry experienced a growth of 8.3 per cent from INR243 billion in 2013 to INR263 billion in 2014. We also saw concepts such as integrated newsroom, OneIndia, and capacity sharing gain foothold in the industry.

The print industry is expected to grow in the coming years, riding on the back of growth in tier II and tier III cities – the disposable income and literacy rate is on rise in these cities, providing a steady impetus to growth.‘Print still commands the largest share of advertising in India. While the English market may see some challenges from digital in the years ahead, regional print continues to grow in low double digits – a rate that is the envy of most of the print world’, says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Digital Media

Digital Media continued to show stupendous growth in 2014. India became the second largest country in terms of number of internet users. The adoption of smartphones, healthy growth in number of 3G subscribers, continued adoption of 2G by masses in the hinterland and concerted efforts by various digital ecosystem players under the Digital India Programme have played a major role in making this possible.

As can be expected, as the eye-balls have shifted into the digital world, the media spend has been following suit. The digital advertising industry grew from INR 30.1 billion in 2013 to INR 43.5 billion in 2014, a growth of 44.5 per cent, driven by a steady growth in ad spends across most digital platforms.

In the music sector alone, the revenue from distribution of music through digital channels or digital music, as it is generally understood, today accounts for nearly 50 to 60 per cent of the overall size of the music industry.

‘Digital media surpassed our earlier projections. With internet on mobile finding broader adoption than previously anticipated, driven by cheaper smartphones and data plans, this sector will continue to power ahead. Mobile will be the defining medium for digital media with 435 million smartphones expected to be in use by 2019’, says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Radio

The radio industry showed one of the highest growth rates amongst other traditional media segments, and this, despite further delays in the Phase III auctions. The Government has now started proceedings on the auctions, planned for 135 channels in 69 cities, and this bodes well for continued growth of the sector going forward.

Advertisers increasingly view the medium less as an add-on but more as an integral part of their media plans. At the same time, challenges continued to hound the industry with smaller and standalone stations feeling the pressure of rising cost structures, measurement and royalty fee issues and the rising threat of the digital medium eating into the radio pie.

“The much anticipated Phase III of radio is finally upon us. In addition to additional radio licenses that will give the industry the ability to offer wide reach to match other media, Phase III will also introduce a host of regulations to enable a better business environment for the industry. The ability to own more than one station in a market and to be able to network nationally will be key to radio companies becoming more competitive’, says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Out of home Media

The Indian Outdoor advertising (‘OOH’) industry saw robust growth in 2014. Exceeding expectations, the industry grew by 14% primarily on the back of election spending, and growth of e-commerce and transit media.

Metros continue to dominate and enjoy more than 50 per cent of the OOH market share. Inventory utilization has improved but prices have not seen any significant changes. Tier II and III cities continue to grow, largely on account of development of better infrastructure such as malls, airports, roads, etc. in these cities.

Billboards continue to dominate the OOH landscape. However, Airport and other transit media has been consistently growing over the last couple of years; a major factor for this growth has been the rapid infrastructure development seen in the country. With the new government’s focus on infrastructure development, this is expected to continue to boost the outdoor industry in the coming years.

Technological advancements and exploration of new avenues for advertising will likely increase in 2015 and this will prove critical for the OOH sector. Digitization of the OOH media in India has been long overdue and industry leaders expect that 2015 would see the necessary technological upgrades to the OOH display units

Measurability continues to be the bete noire for the industry. As such, the industry’s effort to address this gap by creating a methodology through a third party is a welcome move. In terms of growth, Transit media will continue to expand, with the government making large investments in transport infrastructure’, says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Live Events

The general positive shift in business sentiment, and increased spending by the government and corporates on events, resulted in a positive growth in Live events, particularly after the general elections. At the same time, the sector remains challenged by issues of fragmentation, poor infrastructure, and the need for more enabling taxation and regulatory interventions.

Targeted brand communications and experiential marketing has been on the rise. In particular, there has been an explosion in IP or branded event properties, across segments like music, literature and the arts.

Events are now considered a part of integrated communications programmes, which include traditional and digital media platforms as well. Growth in this sector has also been observed particularly in tier II and tier III cities, which are likely to continue to be the focus for marketers and advertisers going forward.

This sector shows great promise across the country. However, the industry still remains plagued by several issues that a forward looking government could help with. Rationalizing processes for local permissions would be a big help. They industry also remains fragmented but is on its way to producing a few large companies that can compete at a global level’, says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Sports

Consumption of sports in India is driven by a large young population and increasing disposable income. An increase in consumption demand is supplemented by a rise in television and media penetration, and coverage of domestic and global sporting events by dedicated sports channels. The number of sporting leagues in India has also increased in recent years.

A key trend in 2014 was the growth of non-cricket sports in India. The success of hosting international sporting events such as the Indian Premier League (IPL), Commonwealth Games and Indian Formula One Grand Prix has placed India in the list of countries that are witnessing fast growth in sports business, and this had led to the creation of a number of league-format tournaments.

The success seen by the IPL, which was estimated to have ad revenue of INR 8 billion in 2014 has led to the creation of several other league-format sporting events, such as the Indian Badminton League, Hockey India League and the recently launched Pro-Kabaddi League, which had an estimated 66 million people tune in for the first game of the season. The inaugural season of football’s Indian Super League has been fairly successful as well.

Newer business models, exploration of diverse revenues streams and new financing structures all bode well for better economics for players in this sector going forward.

The acceptance of sports other than cricket by viewers is a welcome development. The reception that Kabaddi received surpassed all expectations and created a sports vehicle that has broad national reach. As TV develops the viewership for several sports, we will see greater sophistication and traction come to all sports’ says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Corporate Governance

KPMG in India conducted a Corporate Governance Survey - M&E sector -FICCI 2015 during January to March 2015 across leading M&E companies (covering segments such TV, print, film content, animation, direct broadcast and satellite television) to understand the current state of the governance maturity across the sector and obtain an industry view on the road map for the future state of Governance in this industry. The survey highlighted some interesting themes and the industry seems to have consistently echoed their views on the growing significance of governance within the M&E industry. Generally the top executives agree that the governance maturity is evolving across the industry.

71 per cent of the respondents believe that senior management and board succession planning needs to be enhanced. Though 59 per cent of the respondents believed that senior management focus in the M&E sector is business centric as against governance consciousness which poses a challenge to strengthen governance across the sector, 76 per cent of the respondents believe that their senior management actively promotes control consciousness and provides adequate oversight to strengthen processes and controls. Thus suggesting that though there is intent to promote a control conscious culture, business takes precedence when it comes to governance matters.

Findings clarifies that top executives across the M&E sector fully understand the role that good governance plays in building sustainable organisations. The regulatory impetus has further pushed the governance agenda. However the sector as such is evolving in terms of governance practices. As a result M&E companies need to enhance their governance mechanisms such as a well implemented code of conduct, a robust enterprise risk management framework and an objective board performance evaluation process. Capabilities may also need to be enhanced in certain support functions to support the governance initiatives. There also needs to be a significant shift in the manner in which CSR is looked upon by the M&E sector to help ensure that is looked upon as business as usual as against an enforced initiative.

‘As the business of media and entertainment grows in India, it is imperative that companies in this industry do not lose sight of good corporate governance. Good governance has shown to increase long term value and as companies focus more on building long term value and not just focus on short term gains, they will seek to implement best practice in the area of governance’ says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Digital piracy and theft in the M&E sector

The Indian government’s focus on the National IPR policy as a guiding principle for creation and innovation is expected to translate into creating significant new market opportunities for the Intellectual Property right holders and beneficiaries across industries. In view of the above discussion, it will be interesting to examine one of India’s most creative and innovative sectors – Media and Entertainment (M&E) that registered a growth of 11.7 per cent amounting to INR1026 billion in 2014. In the coming few years, this sector is expected to register a growth of 13.9 per cent touching approximately INR1964 billion by 2019.

There exists a need to establish a longterm solution with proactive compliance, stricter vigilance, quicker enforcement with focus on educating stakeholders (copyright owners, intermediaries, ISPs) and spreading awareness among users about the deterrents of using pirated content.

As the Intellectual Property assets grow in number, there is a clear need for the organisation to revamp its governance and enforcement system to bring about effective intellectual property management. Organisations that have found a way to identify the right opportunity for intellectual property at the right time, often have a better return from the business.

’ While piracy has been a problem for the M&E industry for years, the urgency to take measures against piracy is now heightened with India’s digital infrastructure spreading out. A set of measures – enforcement of existing laws, new laws and most critical – consumer education, need to be activated as soon as possible’ says Jehil Thakkar, Head of Media and Entertainment at KPMG in India.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn