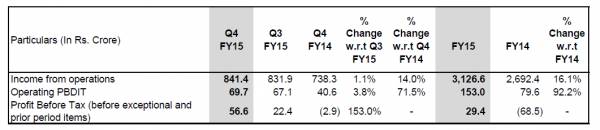

TV18 operating revenues up by 14% YoY for Q4

Network18 Media & Investments Limited today announced its results for the quarter and the year ended March 31, 2015. Highlights of the audited financial results as compared to the previous year are:

Highlights of Operations

Operating revenues on a consolidated basis stood at Rs. 3,126.6 crore in FY15, up by 16% YoY, from

Rs. 2,692.4 crore in FY14.

Q4 FY15 operating revenues on a consolidated basis stood at Rs. 841.4 crore, up by 14% YoY, from

Rs. 738.3 crore in Q4 FY14.

FY15 operating PBDIT on a consolidated basis stood at Rs. 153 crore, up by 92% YoY, from Rs.79.6

crore in FY14.

FY15 Profit Before Tax (before exceptional and prior period items) on a consolidated basis stood at

Rs.29.4 crore, turning positive from a loss of Rs. 68.5 crore in FY14.

Q4 FY15 Profit Before Tax (before exceptional items and prior period items) on a consolidated basis

stood at Rs. 56.6 crore, turning positive from a loss of Rs. 2.9 crore in Q4 FY14.

Network18 Media & Investments Limited Reported Consolidated Financial Performance for the Quarter/Year Ended 31st March, 2015

Notes to the Consolidated Audited Financial Results:

1. Pursuant to the enactment of the Companies Act, 2013 (the Act), the Group has, effective from 1 April, 2014, reassessed the useful life of its fixed assets and has computed depreciation with reference to the useful life of assets as recommended in Schedule II to the Act. Consequently, depreciation for the quarter and year ended 31 March, 2015 is higher by Rs 305.01 lakhs and Rs 1,315.27 lakhs respectively and net loss is higher by Rs 305.01 lakhs and Rs 1,315.27 lakhs respectively. Further, based on the transitional provision provided in Schedule II, an amount of Rs 713.97 lakhs has been adjusted with the opening reserves during the year ended 31 March, 2015.

2. During the year, based on a review of the (i) investments, and (ii) other current and non-current assets, the Group has accounted for (a) diminution in the value of certain investments to the extent of Rs. 14,282.65 lakhs and goodwill Rs. 23,834.98 lakhs; (b) obsolescence/impairment (accelerated depreciation) in the value of certain tangible and intangible assets to the extent of Rs. 8,254.88 lakhs and (b) write-off and provisions of non-recoverable and doubtful loans/advances /receivables to the extent of Rs. 57,159.06 lakhs and the same has been disclosed as Exceptional Items. Further, Exceptional Items for the year, also include Rs. 2,005.57 lakhs towards severance pay and consultancy charges. During the quarter ended 31st March 2015, the Group has accounted for (a) diminution in the value of goodwill Rs. 357.30 lakhs (b) write-off and provisions of non-recoverable and doubtful loans/advances /receivables to the extent of Rs. 5,744.07 lakhs and written back (i) obsolescence/impairment (accelerated depreciation) in the value of certain tangible and intangible assets to the extent of Rs. 3,575.89 lakhs and (ii) Rs. 88.00 lakhs towards severance pay and consultancy charges. However, these adjustments will have no impact on the future operating profit and cash flows of the businesses of the Group.

3. Equator Trading Enterprises Private Limited ("Equator") including its subsidiaries Panorama Television Private Limited and Prism TV Private Limited had become wholly owned subsidiary of the Company with effect from 22 January, 2014. Hence, the consolidated results of the current year include the results of these subsidiary companies. Eenadu Television Private Limited had also become an associate with effect from 22 January, 2014 and its results have been accounted as “Associate” under Accounting Standard 23 on Accounting for Investments in Associates in Consolidated Financial Statements. To this extent, the results of the current year are not comparable with the previous year.

TV18 Broadcast Limited Reported Consolidated Financial Performance for the Quarter/Year Ended 31st March, 2015

Business Highlights

Network18 Digital

Network18 is one of the largest digital media companies in India attracting close to 25 million* unique visitors per month in FY15.

Digital Content

Business / Finance – Moneycontrol.com continued to lead the business news category on the web, catering to an average of over 7 million unique visitors per month in the first two months of Q4 FY15, recording double digit QoQ growth.

News – Ibnlive.com, Firstpost.com and News18.com: Together the news offerings continued their strong performance by attracting close to 10 million monthly unique visitors in Q4 FY15.

Digital Commerce

HomeShop18 continued on its growth path, with the TV business growing by 13% year-on-year. During Q4 FY15, HomeShop18 further strengthened its distribution by adding 20 more cities, with the cumulative customer base crossing 14 million. During FY15, HomeShop18 reached close to 54 million++ viewers on TV, and an average of close to 6 million users per month on the web and had over 1 million Facebook followers while HomeShop18 app had more than 2 million downloads. Throughout FY15, HomeShop18 continued to launch new categories like kids wear, licensed merchandise, tablets, and printers with offerings from market leading brands. HomeShop18 won the “eRetail Leadership of the year” at Indian eRetail Awards 2014 for its exceptional performance.

Bookmyshow.com had close to 5 million average monthly unique visitors, with an average of approximately 45 million page views per month during Q4 FY15. During the year, it recorded a growth of 60% over FY14 in the number of tickets sold. Bookmyshow manages ticketing as well as on ground operations for 6 out of 8 IPL teams.

++(Source: TAM| All India| CS 4+| 01 Apr'14- 28 Mar'15| All days, 24 hours| Avg. Monthly Reach) *As per Independent Sources Network18 Publishing Under its publishing division, Network18 operates 3 leading brands- “Overdrive”, “Better Photography” and “Better Interiors” across print and digital media. During FY15, these brands reached out to over 1 million readers on a monthly basis across platforms. Overdrive introduced a unique concept of "Live Life in Overdrive" to host drives and rides with partners across the globe. In this financial year, over 8 events were successfully organized, partnering with leading automobile brands.

Television Operations

During Q4 FY15, CNBC-TV18 and CNBC Awaaz maintained leadership positions in their respective genre, with market shares of 58%* and 60%**. CNBC Awaaz marked the completion of 10 illustrious years of leadership since inception during this quarter. CNBC Bajar launched in FY15 to strong positive sentiment from the Gujarati business community, also saw attractive gains in viewership.

CNN-IBN led the English general news category in Q4 FY15 with a 33%# market share and increased its viewership by 43%# over Q3 FY15. IBN Lokmat had an extremely successful FY15 bagging 15 awards at NT Awards 2014, 4 prestigious Ramnath Goenka Excellence in Journalism Awards, and 3 Laadli gender sensitivity Awards.

Colors was the No.1^ channel on weekends prime time across all 4 quarters of the year and rose to No.2 spot on weekday prime time in Q4 FY15, up from No.3 in Q3 FY15. During Q4 FY15, MTV Indies reach grew 13%^^ over Q3 FY15 and Vh1 led the English music and lifestyle genre with a 24%^^^ market share. Nick continued to lead the kids’ genre throughout FY15.

Regional entertainment operations showed strong growth. ETV Marathi, re-christened as Colors Marathi during FY15, became the No.2 channel in the genre with 21%*** market share. ETV Kannada ranked No.2 with a relative share of 26% in Q4 FY15+, its highest in last 5 years. ETV Oriya and Bangla saw viewership gains of 65%++ and 50%+++, respectively over Q3 FY15.

Regional News channels continued strong performance during this quarter, wherein ETV Bihar Jharkhand and ETV Rajasthan led their markets with 47%## and 43% ### market share respectively, while ETV Gujarati stood at No.2 position with a 32% relative share~ .

History TV18 led the factual entertainment genre in 6 metros in Q4 FY15 with 26%~~ market share. The History TV18 app crossed 5, 00,000 downloads and was recognized as the Best Application on both Android and Windows at the MOBBYS Awards 2014.

*(Source: TAM| All India| CS AB Males 25+| Wk 14’14 to Wk 13’15 (till 28th Mar’15)| All days, 24 hours) **(Source: TAM| HSM| Wk 14’ 14 to Wk 13’15(till 28th Mar ‘15)| CS AB Males 25+| All days, 24 hours| Market shares basis GTVTs) #(Source: TAM| All India| CS 4+| Wk 01- 13’15 | All days, 24 hours) ^(Source: TAM| HSM| CS 4+) ^^(Source: TAM| 8 Metros | CS 15-34 AB) ^^^(Source: TAM| 7 metros without Chennai |CS 15-34 AB| 01st Jan- 28th Mar ’15) ***(Source: TAM| Maharashtra |CS 4+| Jan-Mar 2015) +(Source: TAM| Karnataka| CS 4+|Wk 01-13’15 |All days) ++(Source: TAM| Oriya| .1-1mn., C&S4+| Wk 01-13’15) +++(Source: TAM| All Bengal|C&S4+| Wk 01-13’15) ##(Source: TAM| Bihar & Jharkhand| CS 15+| Wk 01-12’15| All days, 24 hours) ### (Source: TAM| Rajasthan| CS 15+| Wk 01-12’15| All days, 24 hours) ~ (Source: TAM| Gujarat| CS 15+| Wk 01-12’15| All days, 24 hours) ~~(Source: TAM| 6 Metros| CS AB Males 15+| Wk 01-13’15|All Days, 24 hours| Market shares (basis sum of 30 min TVTs|)

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn