Manoj Malkani, Executive Director, Media & New Business, Concept Communication, does an indepth financial analysis to understand the growth drivers of the Sun Network business.

Sun TV started as a standalone channel on the eve of Tamil New Year in 1993. Sun has become a dominant force in South India. It has grown to offer a bouquet of TV channels catering to different taste space in South India, DTH network, a network of Radio stations – Sun & Red FM & also launched SUN NXT its OTT platform apart from a network of regional dailies in Tamil Nadu. Sun TV has been able to leverage the hugetailwind in M&E sector due to its first mover advantage in the region apart from broad trends like technology, Life style changes, innovation and greater disposable income across households in the region.

The current digitisation drive of the GOI/ TRAI has a huge positive impact as being the lead player Sun Network with its presence across genres like general entertainment, movies, music, news, kids, action, life and with a robust market share in the southern states of India (Tamil Nadu, Kerala, Karnataka, and Andhra Pradesh.)

However, one of the major threats for Sun TV is on account of competition for talent which will increase cost of content/ talent, decline in the broader stream of revenue on account of various factors, ability to hold on to audiences and maintain shares and the network effect impact of National broadcasters like Zee/ Sony/ Disney and Viacom who have a larger market as compared to Sun Network.

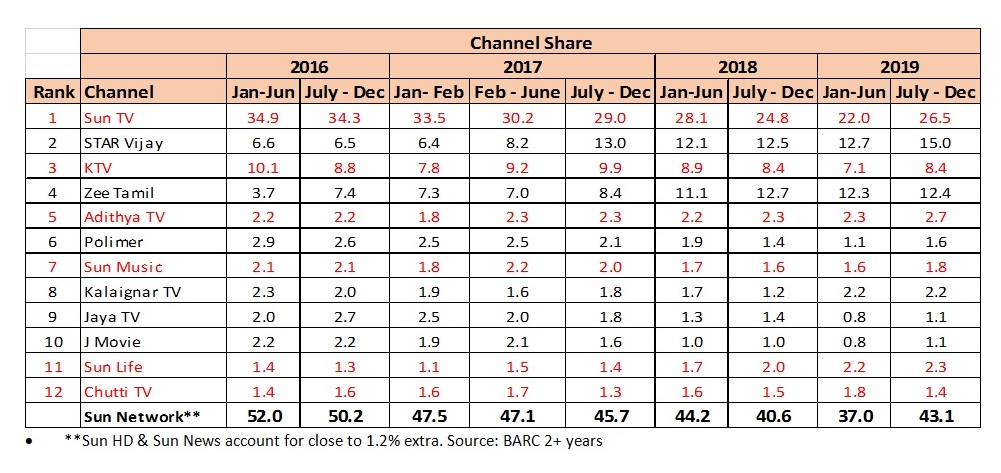

Understanding the Competitive Landscape in TN

Dominant Share of Sun TV is under attack. Rise of Star Vijay (2.5X) and Zee Tamil (4X) have started to lure audiences with a differentiated programming strategy.

South Market Network channel Shares 2+ yrs BARC

|

Network |

TN |

AP/ Tel |

Kar |

Kerala |

|

Star |

20 |

31 |

13 |

41 |

|

Sun |

44 |

20 |

20 |

13 |

|

Colors |

3 |

17 |

20 |

0.3 |

|

Zee |

13 |

16 |

20 |

5 |

|

Total |

79 |

84 |

73 |

59 |

Deep Diving further into the financial performance of Sun Network:

Revenue has grown 10% CAGR over the last 10 years. Operating Margin has dropped from 62% to 58%, but it’s a healthy margin. The company has been distributing dividends to stock holders regularly.

|

Key Indicators |

|||||||||||

|

Particulars |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

CAGR |

|

EPS |

14.4 |

19.6 |

17.63 |

17.34 |

18.19 |

18.71 |

22.07 |

24.65 |

27.74 |

35.3 |

9% |

|

Book Value per share |

51.3 |

60.54 |

67.12 |

73.41 |

80.49 |

85.76 |

89.26 |

102.5 |

117.75 |

138 |

10% |

|

PBITDA% |

80 |

81 |

80 |

76 |

70 |

76 |

72 |

70 |

70 |

72 |

-1% |

|

NPM % |

39 |

39 |

38 |

36 |

33 |

32 |

35 |

36 |

36 |

36 |

-1% |

|

ROCE % |

45 |

52 |

40 |

36 |

36 |

34 |

35 |

35 |

35 |

38 |

-2% |

|

RONW % |

30 |

35 |

28 |

25 |

24 |

23 |

25 |

26 |

25 |

28 |

-1% |

ROCE has dropped from a high of 45% to 38% which too is robust.

RONW is more or less stable & NPM has been more or less retained.

Drivers of Sun Network Business:

Sun TV has a diverse revenue stream. Ad/ slot sales account for just 43% in the current year. Subscription accounts for close to 40% (DTH/ Cable/ OTT). IPL has been a revelation, contributing close to 12% of FY 2019 revenues. Movies are title dependent and will depend on the release schedule and pricing of tickets. South being regulated market for ticket price there is an issue of pricing power unless it’s a huge blockbuster (‘Thalaiva’).

Sun Network’s greatest strength is its ability to keep costs under control and the free cash flow leak is about 30% to Sales. Business is growing CAGR 10% and FCF is also growing 9%. It is good capital allocation and there is no major deviation in Operating Cash flow and Net Profits

Using the DCF method of valuation: The stock is pegged at 576 and is currently trading at 468.

The Sun Network is a robust franchise that has zero debt, great cost management, huge movie & music library. There is hardly any goodwill or bad acquisition. If you compare it to Disney – Disney’s overall balance sheet size is close to US$210 billion. Goodwill ~US$77 billion and long term debt of US$36 billion, which accounts for more than 50% of the balance sheet.

Disney has been built on large scale acquisitions over the last 2 decades ~ 100 billion.

Sun Network has grown mainly organically and it is still shining brightly in South India.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn