Ad volumes of e-com sector in Digital up by 54% in Q4 of 2020: TAM AdEx

TAM AdEx’s overview of advertising by the E-commerce sector across TV, Digital, Print and Radio in the year 2020, reveals that compared to Q1 of 2020, Digital witnesses a 54% growth in ad insertions in Q4. Meanwhile, TB saw 40% ad volume growth in Q4, compared to Q1. Ad Space in Print witnessed double digit share from October 2020 onwards. Ad volumes for the E-Commerce sector saw an increase on Radio as well, growing by 3x in Q4 over Q2 of 2020.

Television

Ad Volumes of the E-Commerce sector on Television increased by 24% in 2020 over 2019. Compared to Q1 of 2020, Q4 witnessed 40% growth in ad volumes. In the Lockdown period, ad volumes of the E-Commerce sector rose by 9% over the Pre-Lockdown period. A small drop was recorded in this sector’s advertising during May 2020 over April 2020 due to the nationwide lockdown. During August-October 2020, ad volumes on Television witnessed double digit share.

The Top 3 categories contributed more than 60% to the ad volume share of the E-Commerce sector. The Top 10 Advertisers accounted more than 45% share of ad volumes in 2020, with Amazon Online India topping the list. Among the Top 10 brands, 6 belonged to the Ecom-Media/ Entertainment/ Social Media category. The Top 10 Brands accounted more than 30% share of ad volumes in 2020, with Amazon.in topping the list.

News and Movies were the Top 2 channel genres on TV, which together accounted for more than 50% of ad volumes share for the E-Commerce sector during 2020. Feature Films was the most preferred program genre for promoting E-Commerce brands on Television. The Top 2 program genres, i.e. Feature Films and News Bulletins, together added more than 45% to the total ad volume of the E-Commerce sector.

Prime Time was the most preferred time-band on TV, followed by Afternoon and Morning time-bands. Prime time, Afternoon & Morning time bands together accounted more than 65% share of ad volumes. Advertisers of the E-Commerce sector preferred 20-40 seconds ad size on TV. 20-40 seconds and <20 seconds ads together covered more than 90% shares in 2020.

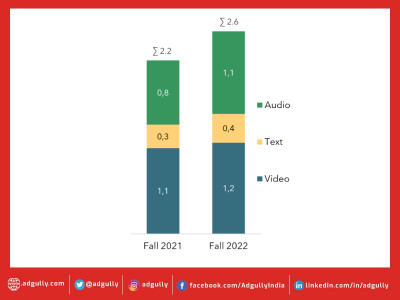

Digital

Ad insertions in Digital for the E-commerce sector witnessed 42% and 54% growth in Q3 and Q4, respectively, compared to Q1 of 2020. Ad insertions of the sector decreased by 14% in 2020 over 2019. Highest share of Digital was observed during the Festive period, that is, October-December 2020, which had 31% of total Digital ad insertions. In the post-lockdown period, September 2020 and October 2020 witnessed the similar share of ad insertion.

On the Digital medium, Media/ Entertainment/ Social Media and Online Shopping were the top E-Commerce categories with 22% and 21% share, respectively. The Top 10 Advertisers accounted for more than 36% share of ad insertions in 2020, with Amazon Online India leading the list. The Top 10 Brands accounted for 34% share of ad insertions in 2020, with Amazon.in leading the list with 12% share of the total ad insertions of the E-Commerce sector.

Ad Network topped with 41% share of transaction method for Digital advertising of the E-Commerce sector in 2020. Programmatic/ Ad Network and Programmatic transaction methods had almost same share of E-Commerce ad insertions on Digital.

Compares to Q1 of 2020, Q4 witnessed 2.5x ad space growth for the E-Commerce sector in Print. Due to COVID-19, lowest Ad Volumes were registered in Q2, which includes the lockdown period. Ad space of the E-Commerce sector in Print decreased by 20% in 2020 over 2019. Print Ad Space recovered to Pre-Lockdown levels within 4 months of the post-Lockdown period. Ad Space in Print witnessed double digit share from October 2020 onwards due to the festive season.

E-commerce-Education leads the list of Top 10 categories of the E-Commerce sector. The Top 10 Advertisers accounted for more than half of the ad space in 2020, with Amazon Online India leading the list. The Top 10 Brands accounted for 44% share of the ad space in 2020, with Amazon.in leading the list. Among the Top 10 brands, 2 brands were from Amazon Online India, with 15% share of the ad space.

The Top 5 Publication Languages accounted for 89% share of the E-Commerce sector’s ad space. General Interest publication genre added 96% share of the E-Commerce sector’s ad space.

Among the 4 zones, South topped for E-Commerce advertising, with a 38% share in Print during 2020. Mumbai and Bangalore were the top cities in West and South Zones, respectively, as well as in overall India.

Sales Promotion for the E-Commerce sector accounted for 50% of the Ad Space in the Print medium. Among Sales Promotions, Multiple Promotion occupied 53% share of the pie, followed by Discount Promotion with 30% share in 2020.

Radio

Ad Volume for the E-Commerce sector on Radio dropped by 45% in 2020 over 2019. Compared to Q2 of 2020, Q4 witnessed 3x ad volume growth. Due to COVID-19, lowest ad volumes were observed in Q2, which includes the lockdown period. The lowest ad volumes for the E-Commerce sector on Radio were observed in May 20, which was during the lockdown period. The Festive period boosted Ad Volumes for this sector during October-November 2020.

On Radio, ads for E-commerce-Media/ Entertainment/ Social Media and Other Services ruled with more than 45% share of the total ad volumes. The Top 10 Advertisers accounted for 44% share of the ad volumes in 2020, with Amazon Online India leading the list. Among the Top 10 E-Commerce brands, 3 brands belonged to E-commerce-Media/ Entertainment/ Social Media category. The Top 10 Brands accounted for 44% share of the Ad Volumes in 2020, with Homeonline.com advertiser heading the list.

The Top 3 states occupied 45% share of Ad Volumes for the E-Commerce sector. Maharashtra state was on top with 20% share of Radio Ad Volumes, followed by Gujarat with 16% share. Delhi, Uttar Pradesh and Karnataka had 9 per chare share each.

Evening and Morning time-bands accounted for 68% share of the E-commerce sector’s ad volumes on Radio in 2020.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn