Are toxic content & TRP scam casting their shadow on advertisers’ media plans?

Credibility and integrity of TV news channels has come under increased fire. Veteran ad man R Balki questioned the toxic role of news channels in the coverage of Sushant Singh Rajput death case and opined that brands must review their associations with such channels. Brands like Parle Products, Bajaj Group and Dollar Industries have come out in the open to criticise the coverage of news channels and growing instances of fake news as well as misleading and biased reportage.

Adgully investigated whether toxic coverage of Sushant Singh Rajput death case, the trial by media of the people taken for questioning in this case, the entire drugs scam busted in Bollywood by the NCB and the subsequent TRP scam has significantly impacted the ad spends on news channels.

Also read: TRP scam: BARC’s decision is one-sided and undemocratic, says NBF

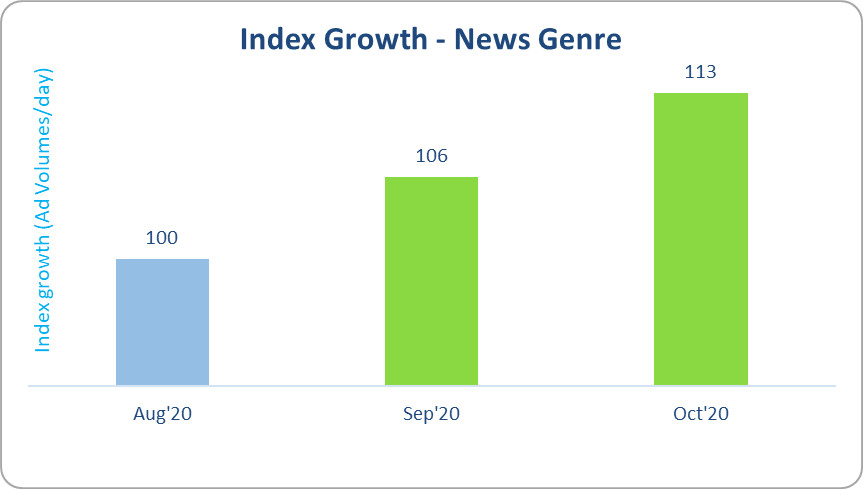

According to data provided by TAM Media Research, during Sep'20 and Oct'20 Average Ad Volumes/ Day for the News Genre increased by 6 per cent and 13 per cent, respectively, compared to Aug'20.

‘Sushant Singh Rajput Suicide’ was the most watched and most trending story on news channels in Week 32 (August 8-14) and continued to be the most watched and most trending news until Week 35 (August 25-31). The story continued to garner eyeballs well into Week 39 (September 22-28).

On October 8, Mumbai Police announced the early details of the TRP scam, naming the three channels. Subsequently on October 15, BARC announced that it would suspend ratings for news channels for a period of three months – all this, with just two days to go for the Navratri festivities on October 17.

Why advertisers opt for news channels?

A senior industry source, who is head of media at a major FMCG, told Adgully, “News channels are not bought solely using ratings, because they are relatively low in the decimals. You would ideally look at channel share. News channels are broadly categorised into three buckets – top channels, mid channels and tail channels. Typically, a media plan would include a mix of one or two top channels, two of the middle and two of the tail channels.” He did not wish to be named as his company advertises on news channels.

A top media planner working with a Rs 1,200-crore company said, “Without news channels, our media plans will not be complete. Why? Primetime rates for a GEC are between Rs 1 lakh and Rs 2.5 lakh for 10 seconds. If you run a 30-second commercial 100 times, it will cost you Rs 3 crore. Suppose you have a budget of Rs 12 crore spread across 90 days, then to appear in every second commercial break on GEC channels is not affordable. You have to smartly spread your media between primetime and non-primetime.”

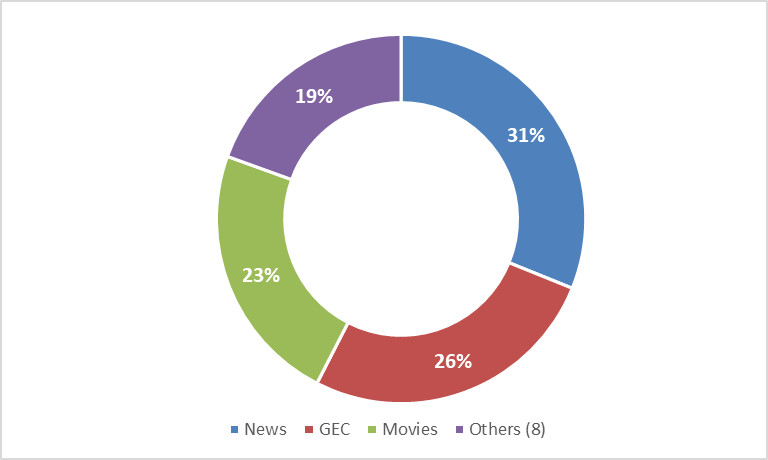

Data from TAM Media Research shows the share of GEC vs. Movies vs. News for Sep'20 to 13th Oct’20. As can been seen in the graph below, news genre had the highest share of ad volumes.

“In the short term, I think only the relatively smaller non-core category advertisers, such as FMCGs, Food and Beverages, Cosmetics, Lifestyle, etc., could pull out of news channels. Core category advertisers like BFSI, Automobiles, Durables, Telecom, etc., are unlikely to reverse their decisions to make their presence felt on News channels,” observed Sundeep Nagpal, Founder Director, Stratagem Media, adding, “because these brands opt for news channels mostly based on contextual synergies and hence, they do not necessarily rely on data for advertising on news channels. What’s more, the popularity of news channels is at an all-time high, and it is likely to remain that way over the short term.”

What’s important to understand is that while GECs predominantly cater to a largely female viewership, news channels predominantly attract male viewership. Shanti Swarup Panda, CMO, Raymond, shared, “Our target audience are adult affluent men. News and Sports are two genres of content on TV which have very high affinity with our audience. We advertise across many news channels, including regional news as well, and news gives us great reach and recall along with good efficiency of planning.”

Other channel genres that media planners explore include movies, reality shows, and even music channels, which show relatively less of a female viewership skew. And such channels would welcome advertisers from core news category.

Will toxic content compel advertisers to withdraw support?

News channels are cost effective and brands plan their media well in advance and buy inventory in bulk. Marketers plan their spends on these channels based on their Effective Rate and inventory availability. There are about 50 news channels, including English, Hindi and regional channels, and keeping track of the programming at a micro level is a challenge. It’s even harder to pin point what constitutes toxic news.

“80 per cent of news content is toxic and not channel specific,” according to the media planner quoted earlier. “One day it is Sushant Singh Rajput, next day it is Hathras and later it is Mandir. The problem is that all news channels have collectively diluted news. News channels openly speak in favour of political parties and audiences know which channel supports which party. As a media planner, you have to manage media spends efficiently and not control the news.”

Adding further, he said, “It is the Government or Industry body’s responsibility to monitor and pull up news channels if they have crossed a line.”

Raymond’s Panda referred to the Indian Society of Advertisers and said, “Raymond is a responsible corporate and member of Indian Society of Advertisers (ISA), which is an industry body. We would be guided by the wisdom of this industry body, which has its own stake and representation in BARC. As of now, we do not see any reason or guidance from ISA or BARC to change our media plans.”

Will ratings suspension of BARC affect media plans?

The spokesperson from the FMCG major quoted earlier recalled, “When the migration from TAM data to BARC data was happening in 2015, there was no data on any of the channels, forget news channels. Yet plans and spends continued to happen. The only difference was that certain investments in niche and infotainment channels were reduced because of lack of data.”

This scenario repeated itself when BARC suspended ratings during the implementation of New Tariff Order (NTO). Adding further he said, “The point is that none of these channels were born yesterday and there is a certain level of gut call, experience and trend line that marketers can rely on.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn