As HBO Max gears up for India foray, analysing its entry strategy in a growing market

As HBO Max, the OTT streaming platform from WarnerMedia, gears up for launch in India, there are various speculations around its pricing strategy. Earlier this month, a section of the media carried what was called the ‘leaked’ pricing plans of HBO Max in India, which started from Rs 69 per month. As a late entrant in India, HBO Max will have to face some very strong competitors like Netflix, Amazon Prime Video and Disney+ Hotstar, besides homegrown players like ZEE5, SonyLIV, ALTBalaji, MXPlayer and a host of regional OTT players.

Currently, Netflix’s base plan is priced at Rs 199 per month; Amazon Prime Video’s monthly plan is priced at Rs 129; Disney+ Hotstar recently revised its subscription plans, which now start from Rs 499.

How big is the Indian OTT market?

The OTT space in the country is still a growing one and can accommodate more players. The regional markets offer tremendous potential and we are seeing even the global players like Netflix, Amazon Prime Video and Disney+ fortifying their regional play to cater to this audience base.

According to the FICCI-EY 2021 report on India’s M&E industry, in 2020 paid OTT subscriptions crossed 50 million for the first time. The report further estimates that demand for original content will double by 2023 from 2019 levels to over 3,000 hours per year. The share of regional language consumption on OTT platforms will cross 50% of total time spent by 2025.

No wonder then that global players are smitten by the Indian market. In December 2020, Lionsgate launched its direct-to-consumer OTT offering in India. The Starz-owned streamer’s foray was part of its aggressive expansion plan in the sub-continent as the Indian entry was followed by launches in countries like Sri Lanka, Indonesia, and Malaysia.

HBO Max’s entry could stir things up in the OTT space as the streaming service has a strong library of TV favourites, blockbuster movies and a slew of Max Originals.

The OTT player has started to build up its team in India, bringing onboard experienced hands from other established OTT competitors. HBO Max recently appointed SonyLIV’s Sugata Mukherjee as Head of Content for India. He will be reporting to Amit Malhotra, who joined as Managing Director for HBO Max in Southeast Asia and India in June 2021. Malhotra most recently served as Regional Lead for Disney+ in Southeast Asia. Meanwhile, Smita Puranesh has been brought on board as Talent Lead, Direct-to-Consumer for HBO Max, APAC. She joins in from Netflix India, where she was Director - HR.

HBO Max and the Indian market

While there is a growing audience base for OTT content, the question is how a late entrant like HBO Max need to strategise to penetrate into this market and make an indelible mark in a market filled with 40-plus small and big streamers.

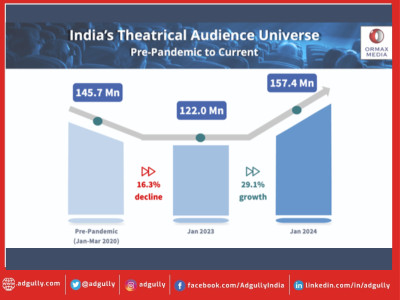

Keerat Grewal, Partner, Ormax Media, pointed out, “While the paying-SVOD audience base is currently only 40.7 million, almost six states in India, like Maharashtra, Karnataka, etc., are ripe for AVOD to SVOD transition, giving both the new and existing players the opportunity to expand the market. As per the Ormax OTT Audience Report 2021, the size of the OTT audience in India is approximately 353.2 million, making India one of the most lucrative markets for growth in the OTT category.”

HBO Max is following the steps of those American Pay-TV players that have launched standalone SVOD (subscription video on-demand) streaming services. AT&T’s DirecTV Now and Dish’s Sling TV are some examples. Similarly, Sky has launched streaming services in European markets like Germany, the UK, Italy, etc.

Experts believe that HBO Max is likely to take it slow and steady in India. Building a committed subscriber base can be a time-consuming process. How to stand out from the rest in a market inundated with streamers of various kinds, homegrown as well as foreign? HBO obviously will cash in on its strength as a traditional media house and make the best use of the treasure-trove of legacy movies and interesting TV content in its kitty. It will definitely add significant value to its content offering.

An eclectic blend of originals (Hollywood and the like) and local content will be the best bet in a market as diverse as India. (Well, in the modish streaming lexicon, glocal (global+local) has already entered in style.) HBO will have to take this regional factor in mind as it has done in other markets through acquisitions and partnerships to deliver custom content. HBO España, and HBO Nordic are some examples.

Room for more players

Is there room for more players in India? According to Uday Sodhi, Partner, Kurate Digital, the Indian OTT market is close to little over $1 billion and growing at 30% YoY. So, there is enough room for more quality players. “We will see many more OTT platforms in the years ahead,” he said.

HBO Max’s reported basic plan will start at Rs 69, which is cheaper that competing platforms like Disney+ Hotstar and Netflix. But it is unlikely to trigger a price war. As put by Sodhi, “This is probably an entry price and won’t work in the long run. They will increase the price and become much like other premium platforms.”

With regard to the possible content strategy of HBO in India, he said, “They are known for some amazing content and great shows. Hopefully this will be continued in their India journey also. The OTT business is great for creative talent in India. Also, it offers great choices to consumers. This will only get better.”

On the other hand, Shrenik Gandhi, Co-founder and CEO, White Rivers Media, said that there is no doubt that the OTT space is getting crowded. “The content is infinite; however, the audience’s consumption time to watch this content is finite. Hence, it is a classic supply v/s demand game, where the supply is increasing, but the demand is constant. Which means, there will be more marketers bidding for the same consumption time of the audience, making OTT space more competitive and adding to the clutter,” he added.

Regarding the pricing strategy of HBO Max, Gandhi said, “One must be mindful, that it is not about monthly subscription pricing, but the type and quality of content. The audience has been spending a few hundred bucks on movie tickets as well. However, here it is imperative about the brand you build, your brand strategy and most importantly the type of content you offer that shall help break the clutter. For a country like India, these factors will definitely be a bigger differentiator than pricing.”

He, however, is upbeat that the entry of HBO Max will be beneficial for creative talents, brands, and end customers. “For creative talent, there will be more avenues to present the right content. For the brands, there will be more avenues to advertise the right content and for the end customers, there will be a lot more content diversity to choose from and hence it is going to be a win-win scenario,” Gandhi added.

(Edited and Additional Inputs by Shanta Saikia.)

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn