Asia OTT Television research report by Brightcove

The future of TV is OTT and fundamentally, it will be defined by what the viewer wants, exerting a strong influence on how media companies package, deliver, and monetise their content. As a leading provider of online video streaming solutions in Asia, Brightcove speaks

to many content owners who are in various stages of their OTT journey.

With the goal of discovering how today’s consumers respond to OTT TV services, Brightcove teamed up with YouGov, an international data and analytics group, and conducted a study that polled 5,000 participants across Hong Kong, India, Indonesia,Singapore, and Thailand about their TV viewing habits. The study investigated how these viewers typically consume TV media, which platforms and devices they prefer,

what factors motivate them to either sign up or unsubscribe, their payment preferences, and their tolerance for ads.

INTERNET & MOBILE USERS BY COUNTRY

Note that these five countries have vastly different internet and mobile users’ base, as well as internet and penetration rates. Both Singapore and Hong Kong are considered mature markets, whereas India, Indonesia and Thailand are emerging and mobile centric markets.

CONSUMPTION TRENDS: HOURS, PLATFORMS, & DEVICES

There are only so many hours in a day or week devoted to TV watching. Up to 40 percent of consumers said they spend one to five hours a week watching content, while up to 27 percent said they spend six to 10 hours. This indicates consumers generally allot a limited number of hours per week to watch movies and TV shows. However, in emerging markets like India, Indonesia, and Thailand, which are mobile-centric, consumers, watches more TV than in mature markets like Singapore and Hong Kong.

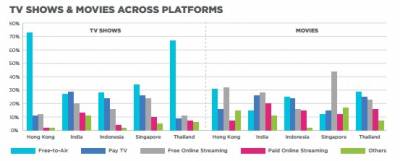

Consumers are accessing TV and movie content across multiple platforms. Among television viewers, up to 73% said they preferred to watch content on free-to-air (FTA) broadcast channels, while some preferred pay TV channels and free online streaming services. Generally in these countries, FTA broadcast channels tend to be the go-to channels for local content, since local content is not readily available on free or paid

online streaming channels.

For content owners, increasing consumer engagement and view duration means their content library should drive a strong stickiness factor and offer a mix of live broadcast and catch-up programming. What is interesting here is that even though FTA broadcast channels are the easiest way to consume TV; a growing number of consumers are watching TV through streaming platforms.

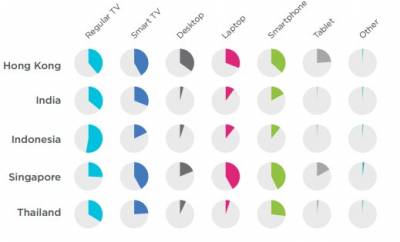

TV content is being accessed across many devices. Across all five countries, the big screen TV isn’t losing its stature in the living room just yet, but it is definitely being complemented by non-traditional TV screens, such as desktops, laptops, smartphones, and tablets.

In Singapore and Hong Kong, laptops, smartphones, and tablets are the most commonly used platforms to watch TV, whereas in Indonesia, India, and Thailand, Smart TVs and smartphones are the strong favourites. Wider wifi coverage in Thailand and Indonesia,

coupled with the Jio effect in India with low data prices, are also fuelling consumer behaviour to access OTT. As consumers increasingly watch videos across many devices and screens, it is critical for content owners to implement a multi-screen OTT strategy.

OTT SERVICE ADOPTION FACTORS & BARRIERS

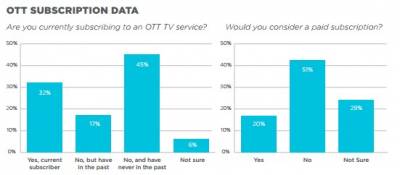

Factors that drive OTT adoption. Thirty-two percent of consumers polled said they were current OTT subscribers, whereas 17 percent said they were past subscribers without an active subscription currently. When looking at the possible factors driving these subscription rates, research shows that free trials and promotions were the top drivers, mainly because the “try-before-buy” strategy is quite effective in lowering sign-up barriers. However, the exception to this was in India, where content libraries and mobile app user experiences were the main drivers

for consumers to sign up for OTT TV services.

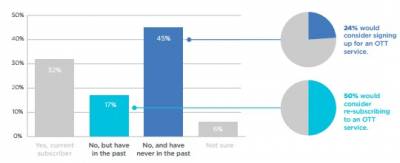

When we asked the 17 percent of lapsers if they would consider re-subscribing to an OTT service, 50 percent said yes. Of the 45 percent who said they have never subscribed, only 24 percent said they would consider signing up. For content owners, this means that once a user tries a service, they are highly likely to return and resubscribe. With 45% of consumers not subscribing yet, this is a sizable opportunity to address. Very few categories have this level of interest or engagement.

Factors that hinder sign-ups. Forty-five percent of respondents stated that they do not currently subscribe, nor have they ever subscribed, to an online streaming service. When asked if these people would consider a paid subscription, 51 percent said no.When asked the reasons for not considering a paid subscription, most of the consumers said they either were satisfied with free streaming services or saw no value, or they

considered the service too expensive.

Factors that drive retention. Once trial users convert to subscribers, four main factors play a role in their retention: Accessibility on mobile, Quality of experience on mobile, Price, and Content library.

MARKETING AN OTT

When it comes to marketing OTT TV services, many content owners tend to focus primarily on their content library offerings, assuming that this is the type of messaging that will drive the most sign-ups. But what’s often overlooked is OTT’s own secondary benefit: accessibility on mobile

devices. Access on mobile devices is one of the prime drivers for consumers to subscribe,and retain their subscription to OTT TV services, mainly because mobile devices are so personal to consumers and offer the ability to curate viewing options to fit consumers’ schedules.

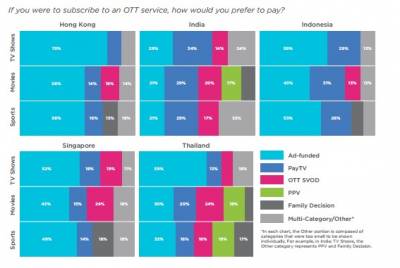

PAYMENT PREFERENCES - TV SHOWS, MOVIES, & SPORTS

Across all five countries, there is a sense of comfort in free, ad-funded and pay TV models because they have existed in these markets for decades. The beauty lies in that these models are familiar and have zero friction when it comes to payments. OTT and payper-view are considered newer services and therefore come with a level of friction, since payment ecosystems differ from country to country. Content owners rolling out OTT TV services need to consider the added complexity of online payments and design offerings that ease the sign-up and subscription process.

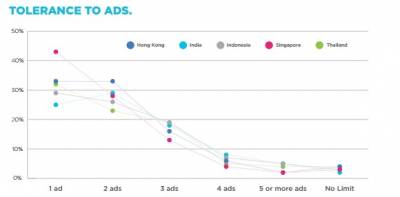

TOLERANCE TO ADS

The rise of video consumption through OTT provides a new source of ad revenue for advertisers. OTT has the power to reach audiences that many advertisers would pay a premium for. But advertisers cannot just replicate the linear TV ad experience to OTT, because across all countries, most consumers stated that they can tolerate one to three ads on OTT TV services, but no more than three ads in a single commercial break.

Consumers are long accustomed to the ad experiences of linear and pay TV, where they are inundated with ads within the programming. But with OTT, consumers' expectation is more content and less ads. This is where addressable TV advertising can thrive in the OTT landscape—where ads can be targeted, agile, and effective.

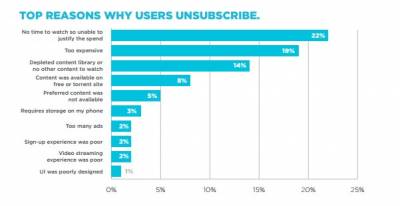

For most subscription-based businesses, churn rate is a crucial metric that determines overall performance, and preventing churn is key to improving revenues. Research shows that the main cause of churn for OTT TV services lies in whether the subscriber has the

time to utilise the service, as a metric to justify the spend.

Consumers are also highly price-sensitive to OTT TV services and are likely to churn if the price point is too expensive. This is because consumers are coming from an era where pay TV packages are often expensive, and need a significantly compelling value

proposition to justify the spend on OTT services. For many in Asia, an OTT TV service is still considered as a premium item.

To keep subscriber churn rates low, OTT service providers need to orchestrate a variety of factors: a robust content catalogue and a multi-screen strategy for consumers to increase their utilisation time on the service, the right price point with frictionless sign-up and payment experiences, and deliver an exceptional video streaming experience at any and every time.

CONCLUSION

One standout finding was that getting consumers to pay for OTT TV services is a major challenge. Consumers today are forcing an unprecedented digital disruption, and it’s changing the way large parts of the population are watching TV content.

For consumers, the switch between TV and mobile devices is straight forward. The implication for service providers is, however, much greater.OTT is an important platform for publishers, distributors, and advertisers to reach quality audiences at scale and generate positive brand outcomes.

Underlying technology of video delivery should be left to organisations like Brightcove. Understanding and navigating the intricacies and challenges of streaming video across the world is what video technology companies like Brightcove do, so that content owners can focus on providing exceptional video content experiences that grow their audiences and generate revenues.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn