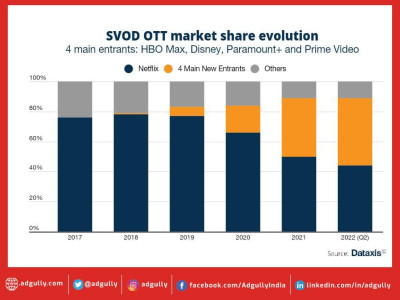

The SVOD market exhibits strong concentration. As of Q2 2022, the five main players concentrated 89% of the accounts in service. The three new entrants captured 35% of market share in just four quarters. Since mid-2020 when Prime Video increased its commercial aggressiveness, Netflix exhibits a slow evolution. This slowdown of the leading operator could indicate the market's limit. From this perspective, the gain of new players is attributable to Netflix's smaller footprint, hence the growth of the average number of accounts per household. Since 2020, Netflix has lost more than 30 points of market share. The company tried unsuccessfully to force the formalization of the huge reserve army of customers that shared accounts represent. Although it implemented a penalty for those who share the resource, the measure failed to increase metrics. The constraint was only applied in a handful of countries and in some of it Netflix already reversed the measure.

OTTs' strategic alliances with well-established companies from different industries have multiplied. These partnerships allow them to meet several strategic objectives: gaining visibility (key to standing out among multiple offers) and, in some cases, resolving subscription billing (the region has low banking penetration rates). New entrants have expanded the universe of possible pacts. In general, the partners were telecommunications or Pay TV operators and now the list includes banks, credit cards, airlines, and retailers. OTT no longer only adds value to a telecommunications product but is also offered as a powerful element in the loyalty programs of other industries. According to Dataxis, the big five players have established ties with 81 regional companies. HBO Max and Disney have been the most active with 85 and 81 active commercial actions as of Q2 2022. Although several Pay TV operators have been aspiring for years to organize the OTT offering under a scheme that puts in one place and orders the offers to make recommendations, the first cases have just appeared: Claro Box TV (Brazil) and MVS Hub (Mexico), among others.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn