BARC’s report reveals key seasonal trends in India’s TV viewership

The seasonality of the television business is well known, and often talked about, especially in the beginning of a financial year when annual plans are laid out by various stakeholders in the media ecosystem. TV viewership is dynamic and changing every day, yet it seems to be cyclical in nature.

BARC’s Seasonality & TV Trends report analyses viewership data over the past two years to find out how the quarter on quarter TV viewership shapes up as well as its implications.

Looking at the ebbs and flows in the viewership trendline, the BARC study reveals that the TV viewing pattern remains consistent quarter on quarter, each year. TV viewership follows similar seasonal fluctuations year-on-year. While Oct-Dec is the strongest quarter of the year, viewership is seen to dip in the peak summer months (Apr-Jun).

As the holiday season ends, viewership starts picking up in Q3 (July-September). The quarter witnessed a growth of 5 per cent in overall TV viewership from 2016 to 2017. This is the highest viewership growth across the four quarters, and may be an ideal time to hook the viewers returning to television after a short hiatus, by debuting new content and programmes.

Weekly viewership spikes occur on weekends and are primarily driven by the Movies genre. Sundays have the highest time spent (ATS) on television as compared to any other day of the week.

Viewership spikes on weekdays can be attributed mainly to festivals and public holidays. Historically, holidays of National significance, that is, Republic Day and Independence Day, witness significantly high TV viewership as viewers tune in to watch the live parade, President’s address, and other special programming such as patriotic movies that are aired to commemorate the occasion.

Interestingly, holidays that fall mid-week tend to see better viewership than those on long weekends. There may be a great opportunity here for broadcasters to hook viewers on long weekends with a cohesive programming strategy spread across 3 days, which would impel the viewers to tune into television to watch the channel/ programme on all days of the long weekend.

Daypart Trends

According to BARC’s report, 5 unique dayparts exist in the average TV viewing day. The late morning (0900-1200) and early afternoon (1200-1500) time bands can be thought of as a single time band due to high similarity in their viewership patterns.

Looking at the historic day-part trends split by 3-hour time bands, it appears that the early Prime Time band (1800-2100 hrs) is the only time band which reflects seasonality in TV viewing, while all other time bands appear immune to it. The late prime time band (2100-2400 hrs) also exhibits seasonality. There is a visible drop in the viewership for this time band during Q2 (April-June) in both years, however the increase in the subsequent quarter is not as high as that of the previous time band.

In fact, it is interesting to note that the early and late Prime Time bands exhibit opposite growth trends, specifically in Q1 (Jan-Mar) and Q4 (Oct-Dec) each year. Since these are also the strongest quarters with respect to Tv viewership, there may be a latent opportunity here to grow viewership by airing compelling content in the late prime time (2100-2400 hrs) time band.

Genre Trends

The GEC genre appears to be the biggest genre on television with the highest share of viewership across the timeline. It is a relatively stable genre, with no major fluctuations across the year. Some of the spikes observed can be attributed to the airing of specific events, such as award shows and finale episodes of popular reality shows.

Next big genre is the Movies genre, which has been driving weekly viewership spikes on weekends, which is also in keeping with the programming strategy of airing blockbuster movies and Premieres/ World TV Premieres on weekends. A distinct viewership peak is observed in this genre on August 15 across both years. This may likely be the impact of patriotic movies that are aired especially on this day to commemorate the Indian Independence Day. A noteworthy rise in viewership in the genre is also observed between April and May 2017. This can be attributed specifically to the airing of a popular T20 cricket tournament on a broadcasting channel in the movie genre.

Most genres exhibit similar seasonal patterns, except the Kids genre. There is a marked increase in viewership of this genre in the summer months (Apr-Jun). This could be a great medium for brands to combat the general viewership drop in this quarter. The viewership for Kids genre lines up perfectly with the school vacation period across all zones, indicating high sensitivity of Kids’ viewership during vacations. Kids channels could potentially be a good platform for brands to capture the attention of the parents and leverage the pester power of the kids at the same time, especially during the summer vacation months.

The Music genre has a similar viewership share as that of Kids genre among the 15+ audience. The genre seems to be growing with an upward linear trend. The Youth and Infotainment genres are relatively smaller in comparison to the rest. While the Youth genre seems to be stable and consistent, the Infotainment genre exhibits a slightly downward trendline.

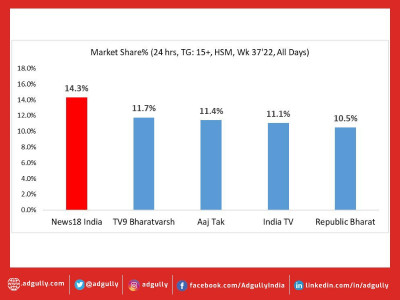

The News genre is a highly event driven and dynamic genre. While it is a small genre, we see some massive spikes across the timeline. All these spikes can be attributed to some major event or story that was being covered by news channels, as indicated in the graph. Some events lead to a higher spike in viewership due to their nature and impact.

For example, the sudden demise of Jayalalitha led to the highest spike in News viewership, across India, over the last 2 years. Though the event was more central to South India, it was covered by most news channels with equal intensity.

Demonetisation was another critical event with a big impact. Politically significant events such as Elections also lead to a noticeable increase in viewership, as is evident across the genre timeline.

The News genre also witnesses improved viewership on Republic Day, across years, as viewers tune in to watch the live feed of the processions. While the Republic Day processions are originally telecast on DD channels, News channels across the country also receive the feed and air them on their respective channels.

Sports is also a very dynamic and property driven genre. Maximum fluctuations can be seen in this genre across the timeline, based on the schedule of major sporting events. During telecast of big ticket properties such as the T20 World Cup and the ICC Champions Trophy, the average viewership of the Sports genre was seen to have surpassed the highest average viewership for GEC genre on a given day during the two-year period.

While the interest in other sports has been on the rise among Indian viewers, with the introduction of new sporting leagues and formats, Cricket still dominates the sports viewership for the average Indian viewer. This is evident from the viewership spikes during all cricket tournaments, especially when Team India is playing.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn