Beyond COVID-19: Embracing the ‘New Normal’

KPMG’s thought leadership, ‘Potential impact of COVID-19 on the Indian Economy’, reveals the key sectoral impacts of COVID-19 on the Indian economy. The report also foresees several ways in which the business landscape is likely to evolve in the days to come.

India’s real GDP decelerated to its lowest in over six years in 3Q 2019-2020, and the outbreak of the COVID-19 posed fresh challenges. The three major contributors to GDP – private consumption, investment and external trade – will get affected. Additionally, the report predicts current and potential impact of COVID-19 on various sectors.

It goes without saying that the lockdown is likely to have a sizeable impact on the economy, most significantly on consumption, which is the biggest component of the GDP. The report envisages significant reduction in urban transactions, which could lead to a steep fall in consumption of non-essential goods. The impact would be even more severe if domestic supply chain disruption caused by the 21-day lockdown were to affect the availability of essential commodities.

While a disruption in output in China could impact some Indian industries, the economy at large may be relatively insulated given its low reliance on intermediate goods from China as well as the common practice in Indian firms of stockpiling inventory. Headwinds are more likely on account of demand rather than supply -shocks from countries affected by COVID-19.

Another challenge is the disruption of domestic supply chains caused by the lockdown, which may create a shortage of inputs for Indian firms when they restart their operations.

Key highlights of the impact on the retail and FMCG industry:

Consumer, Retail and internet business

- The existing uncertainty around how the pandemic shapes up may result in an uptick in spend by consumers in categories like rice, flour and lentils

- The e-commerce sector will face challenges due to COVID-19 due to the increased pressure on supply chain for deliveries of product. There will be increased pressure on supply chain for deliveries of products and another challenge for e-commerce companies is that they will need to equip their employees with the appropriate resources to manage operations remotely with little or no disruption

- Going forward we can expect companies to explore newer distribution channels focused on a ‘direct to consumer route’

Key policy recommendations:

- Easing manufacturing rules for essential commodities – faster clearance

- Adequate insurance coverage against extreme business disruptions

Apparel and textiles

- The textile and apparel sector production is expected to decline by 10-12% in the April-June quarter

- Cotton prices have been reduced by 3% and are expected to be further impacted in the next few months

Key policy recommendations:

- Tax compliances deadline needs to be extended considering the nationwide lockdown and taxes need to be reviewed to minimize the impact of decline in demand

- Credit ratings based loan facilitation for MSME players need to be reviewed in order to make the sector competitive/lucrative

- Provide an adhoc reimbursement/ concession of 5-10 per cent against the recently approved Remission of Duties or Taxes on Export Product (RoDTEP) scheme to compensate for the hitherto unreimbursed levies and taxes to the exporters

Beyond COVID-19: Embracing the ‘New Normal’

The increasing spread of COVID-19 has radically disrupted traditional patterns and networks of economic interaction and behaviour, and post this crisis, a new normal has to emerge. The collective experience of going through this common crisis will lead to a fundamental re-evaluation of assumptions and priorities, which will be both a challenge and an opportunity.

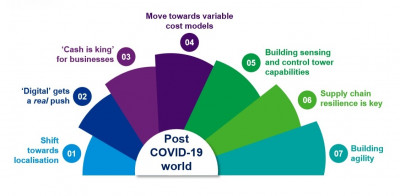

7 ways in which the business landscape could shift:

The shift towards localisation: The supply chain disruption has brought to light the immediate and tangible impact of black swan events. That, along with the ongoing geopolitical environment and a globally recessionary climate is likely to lead to greater protectionism and risk aversion. This is expected to lead to greater localisation of supply chains, especially of essential commodities as well as for sectors that are perceived to be strategically important.

‘Digital’ gets a real push: Most companies have opted to work remotely and their employees are now ‘online’ and working from home. While these trends were already ‘in-motion’, they have now hit the fast-forward button. Even the most traditional brick and mortar organisations have been forced to experiment with digital channels. This presents a real and immediate opportunity to drive efficiencies through digital media. At the same time, this crisis has highlighted the importance of investment in enabling technologies like cloud, data and cyber security. This will change the way we work with far reaching implications on B2B, B2C, B2G services, commercial real estate, e-commerce, e-governance, cyber security, process automation, data analytics, self-service capabilities, etc.

‘Cash is king’ for businesses: This situation has proven, once again, that cash is king – companies that are over-leveraged and ‘living on the edge’ are the most vulnerable. The crisis has reiterated that it is important to be financially prudent and conserve cash.

Move towards variable cost models: One of the biggest lessons, amongst others, is the importance of reducing overall business costs. One significant way to accomplish this is to convert fixed costs to variable costs wherever feasible. For instance, businesses will now determine what they must keep in-house, and explore outsourcing the rest so that fixed costs can be lowered. As with other trends, this will further impact the labour force and ‘how they work’, contract manufacturing, supply chain considerations, etc.

Building sensing and control tower capabilities: Alternate data can offer quick insights that traditional approaches and tools may not offer. This is especially pertinent for areas where information is scarce or erratic. The downside to this are also challenges such as short histories, collection systems that are prone to change etc. Nevertheless, governments and companies have realised the importance of sensing capabilities, building transparency through ‘digital control towers’, ‘digital twins’ and the ability to process both structured and unstructured data. For instance, analytics companies are now mining alternative data such as traffic jams, food orders etc. to track COVID-19 shock. This trend is only expected to pick-up.

Supply chain resilience is key: While localisation is a trend we covered earlier, individual companies will want to ensure their supply chains are resilient to remain competitive. Risks to supply chains are numerous and continuously evolving. Hence, it is imperative that resilience capabilities are developed in order to respond to repercussions of unexpected events and either quickly return to original state of business or move to a new and better state after being affected by the risk and continue business operations as efficiently as possible. Achieving this will require initiatives from both internal business as well as from the wider network.

Building agility: The ongoing pandemic is forcing countries and companies to take quick actions in the absence of perfect data, while remaining customer-centric, addressing employee needs and reinforcing stable team dynamics. It has also made them ponder upon the enabling mechanisms that need to be put in place to respond to any unexpected events in the future. Going forward, policies will need to evolve faster than the market and policymakers will need to be more responsive, inclusive and agile.

Also Read:

ZEE says #HumAndarCoronaBahar with a unique take on social distancing

PepsiCo India commits over 5 million meals and 25,000 COVID-19 testing kits

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn