Castrol India Q1 net up 1%, at Rs. 124.3 Cr!

Castrol India Limited today announced its first quarter results for the period January – March 2013. The Company delivered improved performance with Profit After Tax growing by 1% at Rs.124.3 crores as against Rs.122.9 crores during the same period in the previous year.

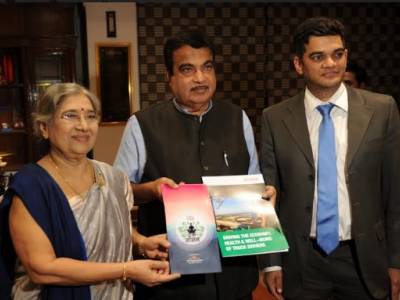

The Board of Directors at its meeting held today, also announced the appointment of Ravi Kirpalani, currently Automotive Director and Chief Operating Officer, as Managing Director of the company with effect from 27th April 2013.

The Board of Directors also expressed their support for a scheme of capital reduction to return to the shareholders of the Company, a sum of Rs. 5/- per share, and thereby reducing the nominal / face value of the share from Rs.10/- to Rs. 5/- per share. This proposal is subject to the approval of the stock exchanges, Regulatory body viz Securities & Exchange Board of India, Castrol India's shareholders and the High Court of Judicature of Bombay.

Commenting on the results, Ravi Kirpalani said: “The first quarter results reflect improved gross margin on account of better realisations and softening base oil prices. Furthermore, managing and controlling cost helped deliver a growth in Profit from operations before other income and finance charges by 7% during the period under review”.

According to Kirpalani, “Castrol India continues to grow and has delivered a strong underlying performance especially in its core retail automotive business, despite the extremely challenging external environment. This growth has been led by the two wheeler and passenger car segments where we have increased volumes significantly. The growth in the retail automotive part of the business was partially offset by the Industrial, Marine and Building & Construction segments which were severely impacted due to the extremely difficult external environment. As a result of this, our sales in these segments were also impacted”.

Outlook: The next few quarters will continue to be challenging. Whilst base oil prices have been soft on the back of weak demand, given the increase in crude prices, base oil prices have hardened again. Moreover, the sluggish economy, and slow automotive and industrial growth will continue to dampen lubricant demand. This may put our margins under pressure.

In the longer run however, we remain optimistic about the prospect for lubricant market growth in India. Castrol India is in a strong position to participate in this growth owing to its strong brands, enduring relationships with key stakeholders and continued commitment of its staff.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn