Count of advertisers & brands fell by 3% & 9% in first 22 matches of IPL 14: TAM AdEx

The BCCI today announced that it has decided to suspend indefinitely the remainder of IPL 2021 as several players and staff have tested positive for COVID-19, breaking through the bio bubble.

The announcement, though not entirely unexpected given the current situation in the country, has raised several questions as to the fallout for the advertisers who are invested in the tournament, the ad inventory already sold and more.

In its comparison for the first 22 matches of IPL Season 14 and IPL Season 13, TAM AdEx data states that the count of advertisers and brands decreased by 3% and 9%, respectively in IPL 14, compared to IPL 13, whereas the tally of categories grew by 10%.

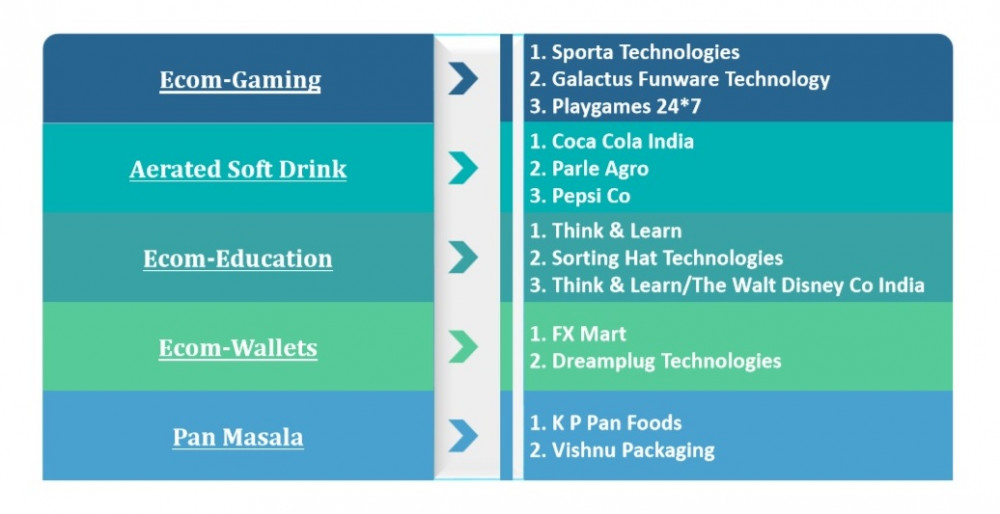

The average Ad Volumes per match per channel during the first 22 matches of IPL 14 grew by 2%, compared to IPL 13. During the first 22 matches of the IPL 14, the top five categories collectively contributed more than 30% of the overall ad volumes.

The Top 5 advertisers contributed 21% share of ad volumes during first 22 matches of IPL 14.

The Top 5 brands contributed 20% share of ad volumes during first 22 matches of IPL 14. Sporta Technologies and FX Mart among the Top 5 advertisers were common between IPL 14 and IPL 13.

Over 30 new categories appeared in the first 22 matches of IPL 14 relative to IPL 13. Among the new categories, Securities/Sharebroking Organization topped the list followed by Fans category.

Ecom-Gaming was on top in both IPL Seasons. Dream11.com and Phonepe among the Top 5 brands were common between IPL 14 and IPL 13.

10-20 seconds ads were utilised the most during commercial breaks, followed by 21-30 seconds ads.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn