COVID-19 impact: EBITDA margin of print media to shrink 10% yoy in FY21 - Ind-Ra

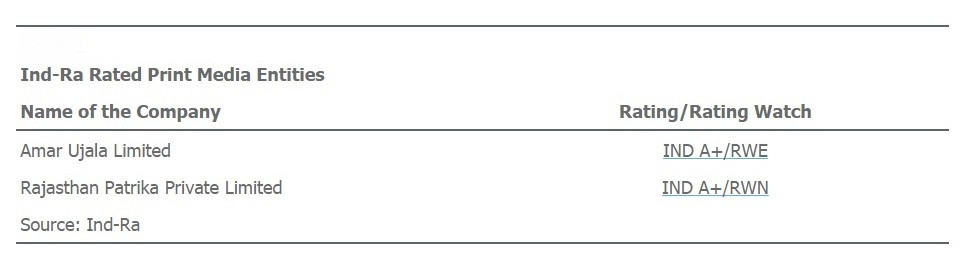

India Ratings and Research (Ind-Ra) has opined that the overall EBITDA margin of print media players are likely to shrink 10 per cent yoy in FY21, amid a substantial revenue contraction, led by a plunge in advertisement income. The analysis is based on the assessment/ estimates of major companies by circulation, accounting for about 58 per cent of the overall print media sector.

Also read: New Print Media Ad Policy: Why print media is resisting Govt’s strong-arm tactics

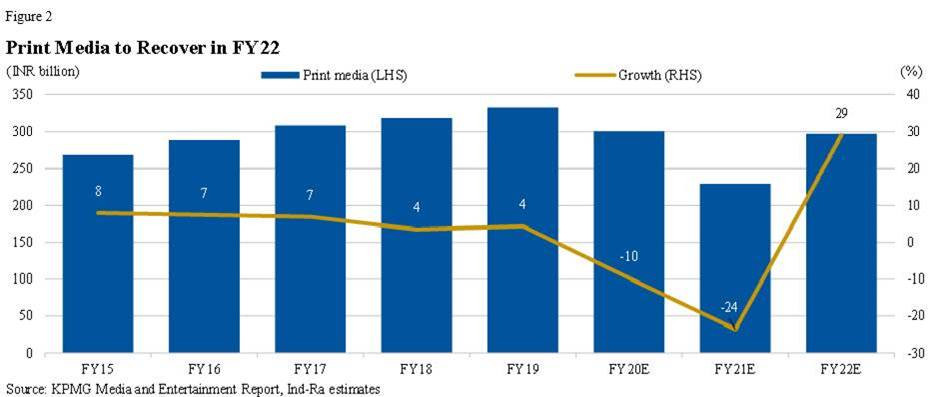

Print media players derive more than two-thirds of their revenue from advertisement income, which is directly linked to economic activities and growth. Ind-Ra expects a significant GDP contraction in FY21, which could lead to a substantial drop in advertisement revenue for the print media; however, much of this contraction is likely to be restored with the bounce back in the GDP in FY22.

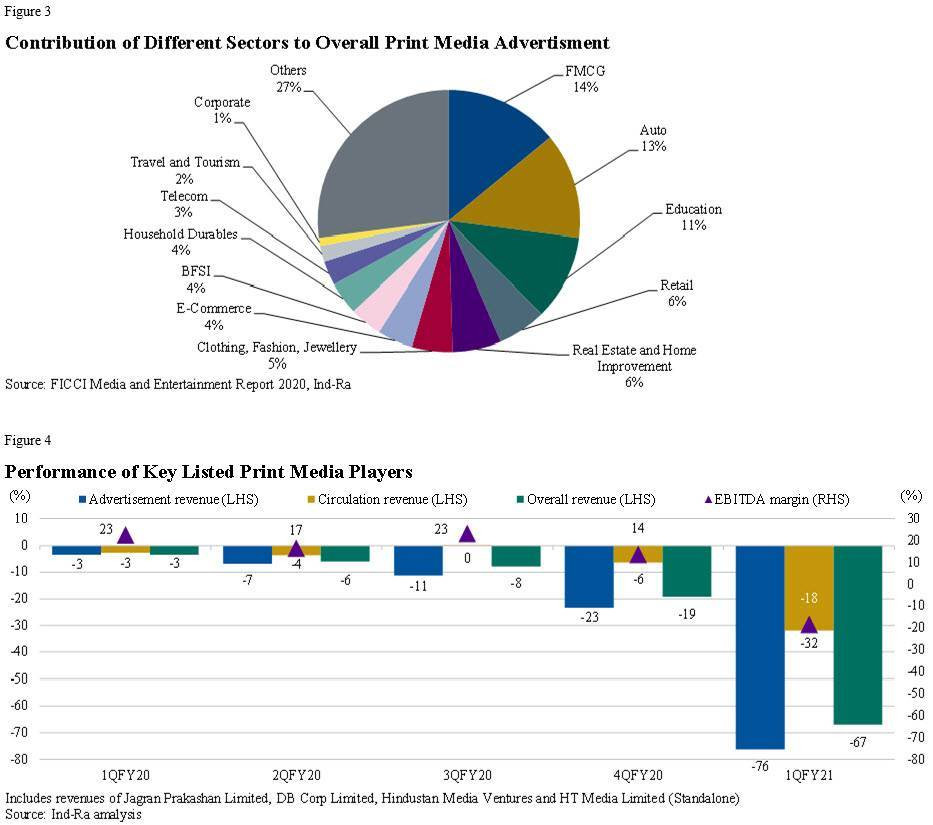

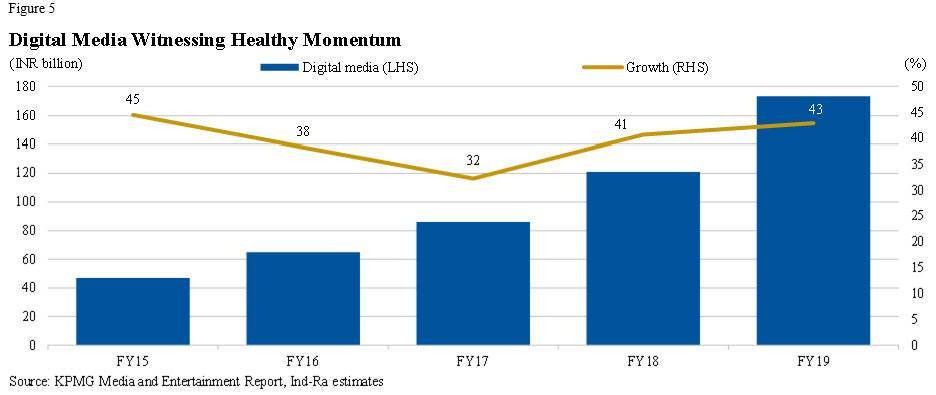

The print media sector had already been reeling under the weight of structural changes, including demonetisation, implementation of Goods and Services Tax, Real Estate Regulations Act, along with proliferation and adoption of digital media over the past few years. Subdued advertisement spending by key advertisers had restricted the growth rate in the advertisement revenue. Even the increase in government advertisement rates by 25 per cent as directed by the Directorate of Advertising and Visual Publicity ahead of the General Elections in 2019 could not augment sector revenues as ad volumes remained lower. For instance, the companies analysed reported an increase of around 3 per cent yoy in its overall revenue compared to the growth of about 13 per cent witnessed during FY14, ahead of the 2014 General Elections.

Sharp Revenue Decline during Q1FY21

The sector now faces yet another formidable challenge of COVID-19. The strict enforcement of lockdown initially with the complete closure of business activities, prompting cut back on the discretionary expenses by corporates and other agencies to conserve cash, resulted in a substantial decline in advertisement revenue, especially during April-May 2020. Additionally, supply-side disruption impacted the circulation levels. Major print media players during 1QFY21 witnessed a substantial revenue decline of over 67 per cent yoy, led by a substantial fall of over 76 per cent yoy in the advertisement revenue and 32 per cent yoy drop in circulation revenue. The decline was higher for English print media players than Hindi print media players. Given that advertising revenue remains a key profitability driver, the players reported EBITDA losses during this period.

Unlocking in phases and thereby, gradual resumption of business activities have led to a month-on-month improvement in the advertisement revenue stream and circulation levels for the sector.

Considering normalcy of operations around October-November, the sector revenue could dwindle by about 24 per cent yoy in FY21, led by about 26 per cent yoy fall in advertisement revenue that would be partially offset by a lower decline of about 10 per cent yoy in the circulation revenue.

Lesser number of elections in 2020 than 2019 and subdued outlook of key advertisers such as automobiles, real estate and construction, travel, tourism among others (about 25 per cent of the overall print advertisement revenue) will impact the overall advertisement revenue in FY21. This decline in revenue is on top of about 10 per cent yoy decline in FY20.

The successive fall during FY20 and FY21 is likely to cut the print media size to the level similar to that of FY12. This is likely to shrink the EBITDA margin of sector by about 10 per cent yoy, which will result in players reporting the lowest EBITDA margin in the past 10 years. While players have initiated cost rationalisation measures such as reducing the size of papers to contain the cost, decline in the advertisement income will drive such a substantial decline in the EBITDA margin as it remains a key profitability driver. The impact though would be different; while Hindi print media players are likely to witness a decline of EBITDA margin of about 7 per cent yoy, English print media players are likely to be the most affected, in view of higher circulation in urban areas and higher adoption of digital medium for news consumption.

Recovery in FY22

With the likely bounce back of the GDP in FY22, the revenue loss of FY21 could be recouped in FY22 with growth of about 29 per cent. The growth percentage will remain better in view of the base effect. Notwithstanding such improvement, the overall revenue of the sector could still remain lower than FY20. Besides, such a growth for the industry hinges on the continued adoption of print media for advertisement. Structural changes such as focus towards digital mode of advertisement by corporates could restrict the recoverability and growth, and the same remains a key monitorable for the sector.

Credit Profile to Remain Healthy

The credit profile, despite the expectations of decline in the EBITDA margin, draws support from the healthy liquidity profile and strong financial flexibility emanating from the strong balance sheets which would enable the players to raise funds in case of requirement. Also, the EBITDA margin is likely to witness a turnaround in FY22 as the players recoup their revenue. However, sway towards the digital platform could restrict the full restoration of profitability.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn