Disney leaps ahead in North America scripted commissioning

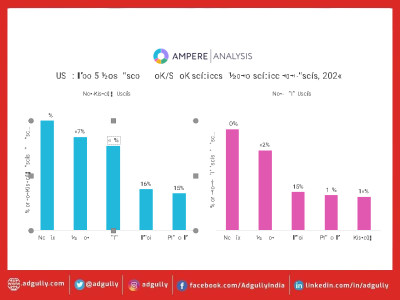

The latest research from Ampere Analysis shows that Disney has taken a firm lead for scripted content in North America, having ordered more new scripted content by the end of September than it took in the whole of 2021. Netflix has focused more on international with its scripted output falling by 15% in North America across the first three quarters, vs Disney’s growth of 61%. Warner Bros. Discovery and Paramount have also reduced US commissioning, with Warner Bros reducing its scripted outlay from 44 to 28 new series orders in the first three quarters (-30%), and Paramount reduced from 54 series orders to just 29 (-46%). Mid-size players have shown the greatest development in North America in 2022. One example in this group is Apple, which is steadily evolving into a serious scripted playerthis year to date it is the fourth largest commissioner of scripted content in North America with 32 new series ordered, making it one of the global top 10 commissioners of scripted for the first time.

Global trend: Disney’s scripted commissions race ahead of Netflix Disney’s global scripted Original output will vastly surpass Netflix this year, having just slightly edged ahead last year. Back in 2020, it had been nearly 70 shows behind. Both Netflix and Disney will far outstrip the competition in terms of scripted output. Disney’s scripted commissions this year are up 28% compared to the end of Q3 last year to 181.. Amazon has recorded the strongest growth among all platforms and surpassed the major studios’ commissioning with some 76 titles to date (+33%). As a result, WarnerMedia has dropped out the top three scripted content commissioners ranking. Its strategy shift post-merger with Discovery means it is likely to be overtaken by Paramount and Comcast. Regional trends: Netflix stakes a claim in Western Europe In Western Europe, traditionally led by public service broadcasters, France TV is currently the largest commissioner of new scripted content with 40 titles so far this year, roughly level with output at this stage last year. Netflix has risen to match this also with 40, four more titles than this time last year. The biggest reduction in scripted commissioning has come from the BBC, which has fallen to third having been the biggest commissioner in 2021, with a reduction in scripted output of 20 titles compared to this stage in 2021 (-37%). A change of hands is occurring between the major studios active in Europe too. Warner Bros. Discovery has reduced its scripted output in Europe by -29% to date this year (15 titles this year to 21 last), while Paramount has more than quadrupled its commissioning (27 commissions compared to 6 at this stage last year). Fred Black, Research Manager at Ampere Analysis says: “With public service broadcasters increasingly pulling back due to budget constraints, Subscription Video on Demand (SVoD) platforms and studios are ramping up scripted output. At the top of the tree, Netflix is pivoting its Originals strategy even further towards international commissions as it searches for subscriber growth, allowing Disney to catapult its way to the top of the scripted content commissioning via its base in the US, leaning on that volume for global content superiority. If Disney can successfully position its global portfolio of streaming services and cable channels in a way that suits consumers, it can claim Original content supremacy over incumbent market leader Netflix.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn