Edelweiss Tokio Life Insurance’s sports associations paying off rich dividends

Edelweiss Financial Services Ltd reported 30 Quarters of consistent growth in profits, with Profit After Tax (PAT) of Rs 272 crore for the second quarter ending September 30, 2018, as against PAT of Rs 185 crore for Q2 FY2018, an increase of 47 per cent.

Total revenue was up 32 per cent at Rs 2,672 crore in Q2 FY2019 from Rs 2,030 crore in the corresponding of the previous fiscal.

Edelweiss’ insurance JV with Tokio Marine Holdings, Edelweiss Tokio Life Insurance is one of the fastest growing life insurance companies in India and continues to scale up its business with the objective of enhancing quality of business and focus on customer. Edelweiss Tokio Life Insurance recently launched a digital campaign for its term plan offering – Zindagi Plus – with industry feature of better half benefit.

The digital campaign showcases the product attributes by capturing a real life conversation on love and life between two achievers like pistol shooter Heena Sidhu and her coach/husband Ronak Pandit, and a couple who understand and complement each other completely.

Guided by customer insights, this product brings a unique benefit – Better half benefit – that enables the policyholder to additionally provide a life cover to the spouse in the event of his/her death without any future premium requirements. This benefit commences after the claim has been paid to the beneficiary following the policyholder’s death.

Elaborating on the Zindagi Plus plan, Abhishek Gupta, Chief Marketing Officer, Edelweiss Tokio Life Insurance, said, “Zindagi Plus is a comprehensive ‘life planner’ which adapts to the customer’s evolving needs and responsibilities. That is the message we have captured through this campaign. Having achievers like Heena Sidhu and Ronak Pandit is an icing on the cake. Their relation, in and out of the shooting range, is a perfect fit to succinctly portray the product attributes.”

Typically the spouse takes on the mantle of managing the household in case of bread winner’s death. In such an event, insurance is the last priority due to which the spouse is likely to remain unprotected. The product with the option of better half benefit has been designed to provide protection to both, husband and wife, in a cost effective manner.

While Edelweiss Tokio Life has enlisted Heena Sidhu and Ronak Pandit, another video showing daily conversations between a couple will also support the campaign. Both these films aim to highlight how Zindagi Plus understands the customer’s existing, emergent and unarticulated needs, much like a spouse.

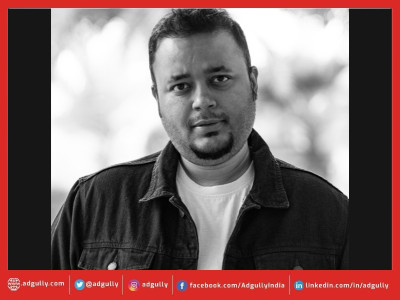

In conversation with Adgully, Abhishek Gupta speaks at length about the latest campaign, on women taking the lead in insurance decisions, Edelweiss Tokio’s marketing strategy and more. Excerpts:

What is the thought behind the ‘Zindagi Plus’ campaign?

It is important to understand the product before we discuss the campaign. We undertook a thorough process of collecting and analysing customer insights to develop this product. Zindagi Plus is a term insurance plan and at the heart of it is customer centricity. It not only addresses customers’ existing and emergent needs, but also the unarticulated ones. It brings a unique proposition, called ‘Better Half Benefit’ that enables our customers to take care of their spouse in their absence.

We wanted to depict an everyday conversation between a real life couple to bring out the importance of securing one’s financial future. Since we have been associated with sports, it was a no-brainer to have high-octave achievers like our brand ambassador Heena Sidhu and her husband/coach Ronak Pandit in this ad film. Additionally, we have also created a series of films that delve into the various aspects of the product and explain them simply to the audience.

These films have seen a spectacular reception so far across all digital platforms. Together, these films have received about 8.1 million views on Facebook, with over 18 million reach. We have garnered more than 65,000 engagements and 8500 shares. We have also experimented with new affiliates, OTT, and apps for this campaign and have seen promising results.

Which were the agencies that had worked on the campaign?

We worked with two creative agencies for this campaign – Humblebrag Advertising and Ravishing Ventures, and sought digital marketing support from Auburn Solutions.

Why the choice of digital as the primary medium for the campaign?

We have been promoting this product across multiple digital channels and would continue doing so. Zindagi Plus has been well-received among our audience, so whether we want to stick to our digital strategy or expand to other media platforms is something we are evaluating currently.

The campaign is primarily live on digital and we have seen exceptional results. We will continue to focus on this medium at least in the immediate term. Currently, we are live across Facebook, YouTube, and select digital affiliates. We have seen promising results also in terms of driving business performance. There is an uptick in website traffic and the number of followers across social media. If you study the online sales in life insurance, term plan takes a majority of the pie. So, it was a logical and conscious choice for us to focus on digital.

The campaign has recently gone live at cinemas and we might continue doing so over the subsequent few weeks. We have received an overwhelming response for the product and the campaign since its launch in early August. Against this context, we are evaluating taking this campaign to the mass market in the last quarter given that it is a crucial period for us.

Another important point to note is that our messaging has graduated from informing people about the product to the product being a part of their lives. You will see a progression in the messaging as we move closer to the end of the financial year.

What was the idea behind showcasing women as advisor?

We have always tried to showcase women as an important partner in the entire insurance buying process – either as a seller or a buyer in our films and there are two reasons behind it. Firstly, if you look at our brand story, we have always supported female athletes and continue to do so. Their stories of grit and courage resonate deeply with us. Therefore, it is a conscious choice to highlight the woman in any story that we tell in our films.

Secondly, in insurance, women typically leave the decision making to the man of the household. Either their father or husband ends up buying the insurance for them. While we have seen a minor shift in the behaviour, we want to promote the thought that women, especially those working, should treat insurance with utmost importance and decide on making that purchase themselves. Buying insurance is every individual’s need, irrespective of the gender and it is not a decision one should leave to another person. It is unlikely that we will deviate from this theme going forward too.

How did Edelweiss grow its strong association with sports?

We have enjoyed a decade-long relationship with sports and we are extremely proud of it. We have had an enviable opportunity of interacting with great athletes and it has been an enriching experience for us as a brand. It is essential that I explain why we chose these so-called alternative sports. In fact, calling them alternate sports in itself is a sign of unfair treatment extended to these athletes. If you are a sports enthusiast in India, you will know as well as I do that cricket occupies a massive mindshare among the audience. While their glory might be well-deserved, we realised that athletes belonging to other sports have not got their fair share of recognition. A large proportion of public support and corporate endorsements tilt in the favour of cricketers. We recognised we had a unique opportunity of galvanising public support for these athletes and also providing whatever support they need – financial or otherwise. This, in turn, would prove beneficial to our brand as well.

This journey started in 2009, when the Olympic Gold Quest was in its inception phase. Edelweiss Group, through its CSR arm EdelGive Foundation, extended financial support to athletes like Mary Kom, Ayonika Paul, and PV Sindhu. Since then, we have made a conscious effort to associate with more and more athletes.

Edelweiss Group sponsored the Indian Contingent at the Rio Olympics in 2016, and Edelweiss Tokio Life insured each athlete for Rs 1 crore. We have continued our association with these sports by inking a long term association with the Indian Olympic Association recently. Edelweiss sponsored Team India at both the Common Wealth Games 2018 and Asian Games 2018. Again, Edelweiss Tokio Life offered life insurance to every player. Our association will continue till 2020 as Edelweiss sponsors Team India at the Tokyo Olympics 2020.

We have also signed on Rani Rampal, Mirabai Chanu, Dipa Karmakar, Hima Das, Manika Batra and Heena Sidhu as our brand ambassadors and are working closely with them. These athletes share a lot of common values with us as a brand – perseverance, grit, tenacity and a winning attitude. This association has helped us create a positive brand aura and pushed up our awareness, visibility and consideration.

How are you panning out the campaign across India, especially the Tier 2 and 3 markets?

Our focus is on creating relevant content and being present on every medium. A customer can consume our brand from any medium – traditional mediums like TV, print, OOH, radio or relatively new mediums like digital and then decide to interact with any of the channels that they are comfortable with.

In the recent years, our focus has been on expanding our geographical reach by adding more branches and acquiring more partners across channels. Last financial year, we added 30 branches and expanded our reach to 121 branches across 93 cities. The focus now is on lending support to our branches for building a robust advisor pool.

We are helping them in terms of on-ground activations and running recruitment campaigns locally. We are also building vernacular content for them and simplifying our customer communication to do away with any insurance jargons.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn