First move towards consolidation – the road ahead for the Foodtech Ecosystem

The Foodtech Ecosystem has taken an even more interesting turn with Zomato acquiring the Indian operations of Uber Eats for a reported deal worth $350 million (₹ 2,485).

According to media reports, the deal was done as an all stock transaction, giving Uber 10 per cent shareholding in Zomato. Uber Eats’ users are now redirected to Zomato as its services cease to exist locally. However, Zomato will not be absorbing the Uber Eats India team leaving a few hundred executives either without jobs or relocated to other Uber verticals.

Zomato tastes benefits of First Consolidation move

With the acquisition of Uber Eats, Zomato now corners 50-55 per cent of the market, giving it a definite upper hand over arch competitor, Swiggy. Over this, Zomato also gets the delivery partners of Uber Eats, customer information and order details. Having even more delivery partners will definitely increase the reach of the delivery service and might even reduce cost per delivery. In addition to having 1.5 million restaurant partners across 24 countries and serving 70 million users every month, the Uber Eats delivery partners will raise the total for Zomato to 2 lakh delivery partners, giving it an upper hand over Swiggy.

It is very clear now who the two major players are now in the Foodtech Ecosystem in India. However, does this also mean that they can have a stronger focus on performance marketing?

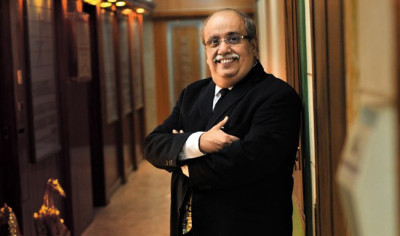

Harish Bijoor, Brand Guru and Founder, Harish Bijoor Consults Inc, opined, “Not really. Now they have focussed eyeball to eyeball competition to contend with. The brand battles will still be on and that’s where the action lies.”

Jagdeep Kapoor, Founder Chairman and MD, Samsika Marketing Consultants, added here, “They have to continue to build their brands with even greater vigour! Brand building is like breathing. It cannot be stopped. Performance marketing is part of brand strategy, because another word for brand is trust. They have to perform to keep the promise they have made to consumers, in terms of customer service along with prompt delivery. They have to upgrade their offering based on higher expectations. Consolidation does not mean complacency.”

What’s next for Foodtech’s David & Goliath?

For both Swiggy and Zomato, the top tier cities have been a huge generator of revenues, contributing to 60-70 per cent of their business. However, the smaller towns still need to be leveraged. Do we see that happening now that we have two undisputed players in the market? Agreeing with this, Bijoor said, “Smaller cities will progressively play a bigger role. Market expansion, penetration and saturation as Zomato satraps or Swiggy satraps will play out in a more involved manner.”

At the end of day, Indians are just used to getting food and groceries delivered to their doorstep. It’s hard to believe why that wouldn’t apply to the smaller cities. Leveraging Tier 2 and Tier 3 cities might be the next route for the Foodtech Ecosystem in India. However, with 54 metros and major cities, there are still a few left to be leveraged.

Where are the smaller players?

While we’ve seen the ecosystem grow tremendously over time and it’s safe to say that it has changed consumer behaviour; and this consolidation sees one less player in the market. So, how much space do the smaller or niche players have in this ecosystem? With food and diet trends being the talk of the market, Bijoor remarked, “There is space for niche players at the bottom. At the very bottom, there is an organic play, a keto play, even an intermittent fasting food play, maybe.”

We have seen players like Food Panda exit the market, whereas on the other hand we’ve seen players like Dunzo creating a niche for themselves. With two giants defined in the ecosystem, it will be interesting to see what the smaller players have in store.

Consolidation ≠ Profits

With a consolidated market, we see Zomato having an upper hand over Swiggy as mentioned above. What does this mean in terms of profit? While we see them changing consumer behaviour and creating a market of their own, both Swiggy and Zomato are still not profitable. In March-end 2019, Swiggy reported losses of ₹ 2,364 crore, while Zomato reported losses of ₹1001.15 crore. Can a consolidated market change this scenario? Bijoor said, “No. Profits are far. Profits come from a clever rejig of operations. Not a mere brand buyout.” Furthermore, Kapoor added to this by saying, “Profitability is the duty of every business. Better productivity, volume and value growth and cost efficiency can definitely bring profitability.”

According to last year’s reports, Swiggy and Zomato had an average order volume of 40-50 million orders a month, which again averages at 500,000 orders a day. These players are really changing the way India eats. With a consolidated market catering to Zomato, it will be interesting to see the steps of both the giants. Can Zomato convert the Uber Eats customers to their own customers? Do we finally see a bigger play in smaller towns by both delivery giants? It’s some delish food for thought.

Also Read:

Zomato Acquires Uber’s Food Delivery Business in India

Zomato-Uber Eats closer to becoming India’s biggest delivery service

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn