FMCG industry moves into a positive growth space post lockdown: Nielsen

Nielsen outlook for the FMCG industry growth for 2020 has been revised to the range of -1 to -3%. Using proprietary Nielsen Retail Audit data, the report delves into the trends of Q3’20 and the outlook for 2020. The report states that after a dismal performance in Q2 (April-May-June ’20), the FMCG industry has moved into a positive growth space.

With the pandemic achieving stability and markets and economy opening up, green shoots were visible in the July-August-September quarter for the year. There was an appreciable improvement in the performance of manufacturing, witnessed with an arrest of the declining Index of Industrial Production (IIP) from 57.3% in April’20 to +0.2% in September’20. The unemployment rate dropped from 23.7% at its peak in April’20 to 6.7% in September’20.

Also read: 46% of FMCG Cos to spend up to 50% on social media influencers post-COVID

Some of the macro variables still reflect the overall economic scenario with inflation rate continuing to rise and the Consumer Confidence Index (RBI) dropping to a low 49.9 in September’20 from a 85.6 in March’20.

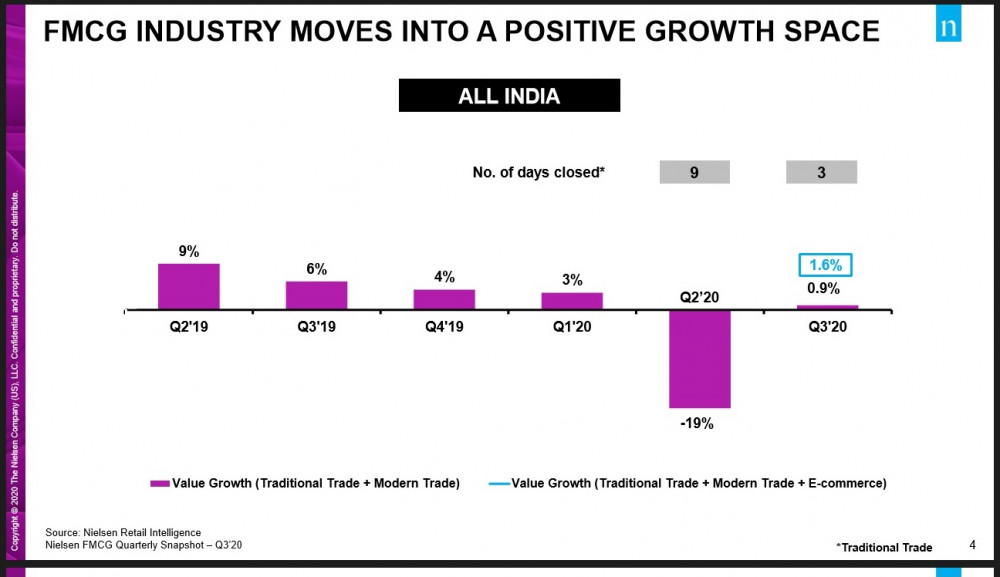

The above-mentioned positivity was reflected in the FMCG industry too. After an unprecedented decline of -19% in the Jan-Mar quarter, FMCG industry displayed signs of recovery in Q3’20 with a 1.6% growth (versus Q3 ‘19).

FMCG industry moves into a positive growth space

The FMCG slowdown in Q2’20 saw a value decline of 19% as compared to the same period of 2019. This was fueled by massive disruptions in the production and supply chain, and low consumer confidence.

The unlock from Q3’20 saw a revival in the industry with a growth of 1.6% versus a year ago. The revival was aided by businesses opening up with the pandemic reaching stable levels. Markets started opening up in a phase-wise manner and store closures came down to an average of 3 days a month in Q3’20 from an average of 9 days a month in Q2’20. After being cooped at home for a long time, consumers also started looking at resuming normal consumption levels.

Product Dynamics – Staples continue to drive growth

Personal care and home care move towards revival – With the opening of the economy all baskets showed signs of recovery, albeit with some clear changes reflecting consumers’ product preferences. Consumers prioritised spending on essential foods during the locked down quarter and with the unlock quarter this accelerated to double digit growth.

An interesting trend was see in the non-food (Home care & Personal care) categories too. The segment registered a movement towards revival with Unlock in Q3’20, indicating a need to move towards normalcy. With heightened consciousness around health and wellness, the ‘health & hygiene’ categories have become an integral part of the new normal of the consumers and continued to boom in Q3’20 as well.

Market Dynamics – Rural continues to drive growth

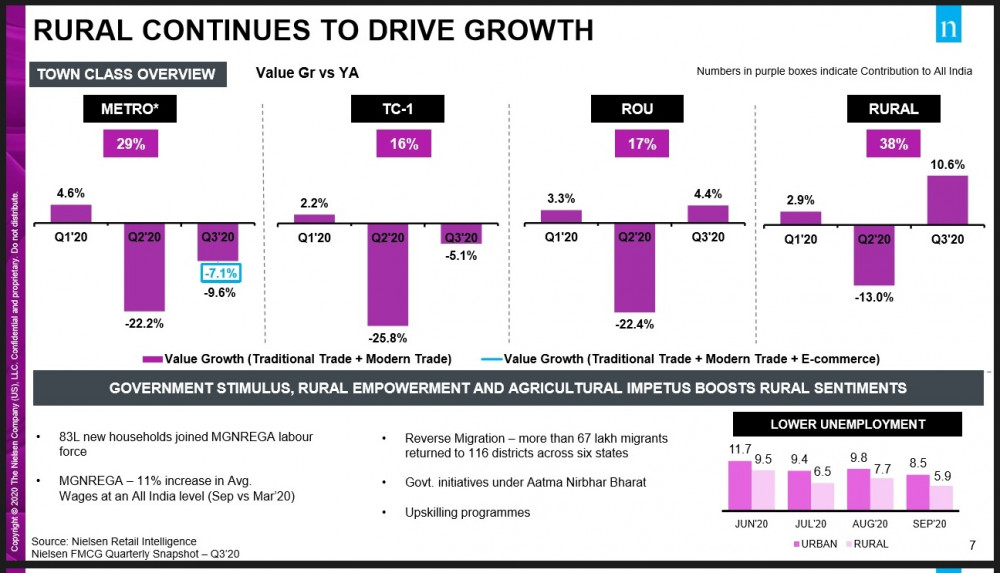

With easing of pandemic and markets unlocking in various phases in the third quarter of the year, recovery was seen across town classes, with the rural and Rest of Urban (ROU) regions continuing to lead growth. FMCG witnessed a double digit growth of 10.6% in Q3’20 in Rural India, while the bigger cities (>1 Lakh population, including metros and Town Class 1) played catch-up.

The rural markets have bounced back handsomely on the back of support provided by the Government as well as good agriculture, reverse migration and a lower unemployment rate.

Various favorable macro-environment factors have helped drive rural revival in Q3’20. Government dialing up on rural stimulus in the form of increased MGNREGA allocation – 11% increase in average wages at an All India level (September vs March’20). 83 lakh new households joined the MGNREGA labour force.

The ‘Garib Kalyan Rojgar Abhiyan’ initiative gave support to agriculture and upskilling programs for migrant workers who had returned to their villages. A bountiful monsoon also brought cheer to farmers with a record output in the kharif crop season.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn