HBO content to stop streaming on Disney + Hotstar

Disney+Hotstar will stop showing HBO content by the end of this month. The move may affect its prospects as the SVOD platform recently lost rights for the Indian Premier League. It also didn’t renew the rights for Formula 1 in 2023.

Disney+ Hotstar tweeted: "Starting 31st March, HBO content will be unavailable on Disney+ Hotstar. You can continue enjoying Disney+ Hotstar's vast library of content spanning over 100,000 hours of TV Shows and Movies in 10 languages and coverage of major global sporting events."

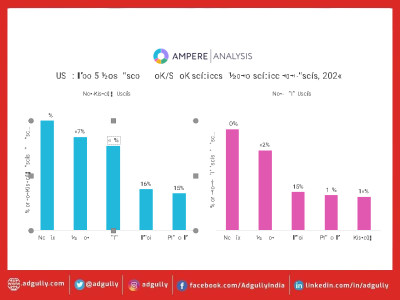

Karan Taurani, senior analyst at Elara Capital, believes that the move will have a significant negative impact on paid subscribers for Hotstar India. “We maintain that the loss of subs will continue to happen towards Jun’23 quarter due to IPL. In terms of the recent HBO content moving out of Hotstar, we estimate the subs loss moving towards the upper end (around 25-30% in total), of the 61.5mn subs at peak.”

“The active paid subs base for Hotstar could settle at 42-45mn subs over the next three quarters, as there is still respite in the form of 1) catch up Tv content (drives a large chunk of broadcaster OTT content- Star is the market leader for Tv content) , 2) upcoming Cricket World Cup (T20) , 3) Disney’s massive global and Indian movie catalogue and 4) other Indian and international cricket content. BCCI is expected to renew its contracts for India matches this year and if Hotstar ends up losing that for CY24 and beyond, then it will be a bigger blow as the active paid subs base can move even below 40mn over the medium term,” he added.

According to him, Netflix too had seen some pressure due to its loss of Disney content in 2019. “However, they invested into building original IP and shows which has paid rich dividend over the last four years. We expect Hotstar to also invest aggressively into fresh and original content which needs to click well with audience in order to ensure subs retention and minimise the negative impact. Investment into original content and new IP takes some time as this requires a transition time (12-18 months).”

He adds that subs revenue growth for OTT platforms in India is slated to converge over the near term due to IPL being offered free - the most premium content which costs INR 50bn in terms of annual content cost. “This is much ahead than even the total content cost for any OTT platform in India, which means that there is very little likelihood of an ARPU growth due to most premium content being offered free; this in turn implies that subscriber growth is the only one driver for overall subscription revenue growth; which too we believe may come under pressure if key content deals are lost in terms of renewals or content costs are curbed due to macro uncertainty globally.”

“We don’t foresee a cut in the ARPUs for OTT platforms as they already are at reasonable levels, except for Disney + which may some cut due to loss of IPL and HBO content; expect many platforms to curb password sharing or move to small ticket subscription packs/promotion offers in order to drive/retain subs base,” Taurani said.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn