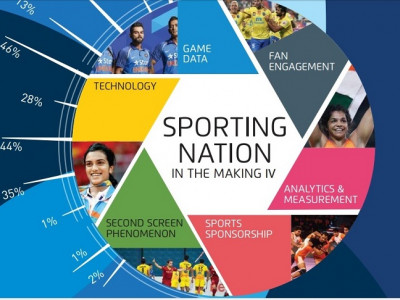

How brands are upping the game for sports sponsorship in India

Sports sponsorship is on the rise in India. As revealed by the ESP Properties-SportzPower annual report, titled ‘Sporting Nation in the Making’, the Indian sports sponsorship industry grew by 14 per cent in 2017, surpassing the $1 billion mark for the first time. Media investments contributed to the largest portion of the pie (55 per cent of overall spends), followed by ground sponsorships. While media spends grew 16 per cent to Rs 4,065 crore, between IPL, ISL, Pro Kabaddi and Fifa Under-17 World Cup, on-ground sponsorship also witnessed a 15 per cent jump to Rs 1,337 crore.

And it’s not just all about cricket, as sponsorship of non-cricketing sports showed growth in 2017. India’s second biggest sport by participation and attendance, football, grew by a considerable 64 per cent.

2017 also saw the birth of five new franchise based leagues – UTT, SBL, SFL, Cue Slam and P1 Power Boating. As per the ‘Sporting Nation in the Making’ report, brands are bullish about investing in emerging sports; 25 per cent increase in franchise fees came from developments in other sports, even as cricket remained unchanged. Thirty-six new franchises were added across all new and existing leagues.

The Sports Surge

Remarking on the growth of sports sponsorship in the country, Mohit Joshi, MD, Havas Media Group, India, noted, “Indian sports sponsorship is on a growth trajectory, with the overall sports sponsorship growing by around 14 per cent in 2017. Sports advertising rose to Rs 7,300 crore in 2017, a substantial leap from Rs 6,400 crore in the previous year. Sponsorship of non-cricketing sports has grown substantially in 2017.”

Sudhanshu Rai, Founder & Chief Strategist, Saints Art, too, feels that the sports sponsorship market is emerging as a favourite destination for brands. According to him, 2017 has been a watershed year with sports sponsorship, garnering 12 per cent of the total ad spends amounting to about Rs 7,000 crore. “The development of sports leagues for Cricket, football, kabaddi and increased audience interest in sports other than cricket are important factors leading to this trend. The market is expected to further grow by 8 per cent this year. The sports sponsorship market is set to see its best days as major brands, including global brands, are getting attracted towards such platforms to gain market momentum,” he added.

N Chandramouli, CEO, TRA Research, pointed out that the sports sponsorship market is about US$1 billion today. At the same time, he observed that this was a small number yet since majority of the sponsorship still went to one sport – cricket. “With the other leagues like Kabaddi, FIFA Junior, etc., taking off and getting higher viewership, you will see the total sponsorship balloon over the next five years,” he added.

Agreeing with this, Mohit Joshi remarked that with cricket as a leading sport and entertainment domain, it is already featuring big time in the marketing campaigns of most brands. There are many brands which have just been built on cricket alone.

He further said, “The good thing is that other sports (besides cricket) are also picking up – both in terms of viewership as well as in terms of client sponsorship interests. We have a lot of our brands, like Tata Motors Commercial Vehicles, TVS, Hyundai, KIA Motors, which look at sports in a very big manner.”

When asked if an event-driven campaign limited the year-round appeal of brands, Joshi replied, “Brands associate with events in line with their brand objectives and priority calendar. Thankfully, today we have enough sports opportunities round the year to keep the overall association alive through the year.”

Sports & Brands – Building the Right Connect

At the same time, Rai stressed that associating with sports should correlate with the brand’s personality. The target audience and product mix has to be taken into consideration as confused positioning can create negative impact and hurt brand image. Mobile, tech, fitness and similar brands have more synergies when associating with sports and thus gain necessary momentum in terms of market reach and equity.

Chandramouli believes that everything in sports sponsorship has to do with audiences. “If the sport is engaging and connects to users, and it has a unique proposition, it is definitely going to get sponsors/ advertisers. Contrary to what many have been imagined, Pro-Kabbadi is a clear example of this. However, if a league is overpriced and the audience takes time to take a liking to it – as in the case of Futsal – it can be a loss-making a proposition and therefore will not have sponsors or league owners supporting it. The key to building a viewership for any sport is to build viewer keenness on the sport. This needs you to look at a sport as a brand, rather than just a sport. We often help analyze such cases, where we help build viewer keenness through our scientific Buying Propensity model.”

Vive la Vivo

In the year 2014, Vivo began to expand into markets in Southeast Asia and other regions. Deploying localised product and marketing strategies, Vivo saw rapid growth, and was strongly embraced by local consumers. The smartphone brand has continued to invest in R&D, and established seven major research centres across China and the United States. Vivo has also used sports marketing to increase brand awareness in international markets.

In 2015, the brand ventured into sponsorship of sports events and its first property was the Indian Premier League (IPL). It was also the title sponsor for Pro Kabaddi that was launched in 2014. In the year 2016, Vivo started a strategic partnership with NBA China as its Official Mobile Handset Sponsor, inviting NBA superstar Stephen Curry to become the product ambassador for Vivo’s flagship Xplay6. As sponsor of the just-concluded FIFA World Cup Russia 2018, Vivo built up significant traction across the world. Vivo has an agreement with International Federation of Association Football (FIFA) to sponsor the FIFA World Cup for six years, covering two tournament cycles. This means Vivo will be the official sponsor of the FIFA World Cup 2022 as well.

Commenting on Vivo’s strategy of building the brand via association with strong sports properties, N Chandramouli said that given the extremely competitive cellphone market in India, it is extremely difficult for a relatively new brand to build stature, recognition and a loyal following. “Vivo’s sports sponsorships, even at such a high premium, have given it a faster route to building a connection and buying propensity (or keenness to buy) with potential users. All these initiatives put together have enhanced Vivo’s Brand Trust and it has even featured in TRA’s Brand Trust Report as the leading trusted brand in the Mobile Phone category this year beating all competition.”

Sharing similar views, Sudhanshu Rai remarked that developing a strong brand value and recall demanded communication campaigns which might fetch cognitive results in the desired market. “Vivo, since its entry in the India market, has been trying to develop differential positioning among its target consumers, and association with sports have not only helped them create the desired positioning but gain maximum eyeballs as well. Sports in India directly relates to aspirational value – whether it is from its brand ambassadors (players) or its popularity with viewers – and Vivo having trying to position itself as the most sought after phone manufacturer directly relates to the concept. Cricket, followed by football, are the two prominent sports in the Indian horizon and attract maximum fans right from urban as well as rural sector, for which Vivo acting as the major sponsor (Title sponsor) can further get cognitive benefit and recall via integration with on-ground as well as several other promotional activities (photographs, promos, etc.). So, while at one arena Vivo has managed to sustain its image of being a brand in the category value for money, it has managed to create familiarity among its audience via multiple appearance, including subconscious registration for brand preference.”

Rai further said, “India boasts of envious demographic profile with about 50 per cent population below the age of 25 and 65 per cent below the age of 35. With sports being the favoured pastime of the youth, and along with burgeoning campaigns stressing on healthy lifestyle, the appeal of sports event is witnessing renewed interests by the audience. Vivo’s strategy is absolutely in sync with this emerging trend as this allows Brands with products specifically targeted towards Youth to establish direct engagement with its target audience and garner necessary eyeballs.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn