How companies are creating the ‘window shopping’ experience for online commerce?

Social commerce is an experiment. It is an attempt by social media platforms to monetise their existing audience even further and bring the window shopping experience to e-commerce. But as we Indians know all too well, converting window shoppers to buyers is a tough task and this trend hasn’t quite caught on. The problem is complex, but several innovative companies are trying to solve the challenges and create a seamless end to end social commerce experience.

Adgully’s latest #TwitterChat series was a discussion around the topic ‘Is Social Media the next Shopper’s Stop’, which was joined by spokespersons from agencies, start-ups and brands who are involved in the business of selling online.

Anjali Malthankar, National Strategy Director, Tonic Worldwide

Ankur Arora, Co-Founder, ShopG

Bharat Sethi, Founder, Rage Coffee

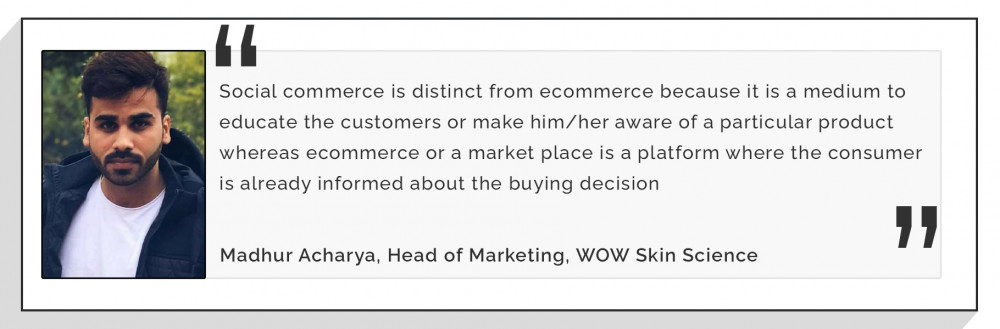

Madhur Acharya, Head of Marketing, WOW Skin Science

Sujay Kar, Group Director and Lead – Commerce, VMLYR, SEA and India

Meghna Krishna, Chief Revenue Officer, Toch

The experiment on social commerce began more than a decade ago by Facebook in 2007. By 2014, it introduced the Buy button so that users could purchase products directly and launched Shoppable Ads in 2015. In 2018, it launched the Facebook Marketplace, which enabled commerce via the platform. But it wasn’t until Instagram Shopping was launched in 2020 that truly enabled a social commerce experience.

“Social helps drive impulse that was missing from e-commerce,” said Toch’s Meghna Krishna. Instagram reported that 70% of users turn to it for product discovery. This impulse is driven via community advocacy, confirmation of choice and peer engagement, she added.

VMLY&R’s Sujoy Kar said, “Social has been driving shopping traffic for years, but major transition happened with Instagram Shopping tags, where users could see and select products within the platform, and with Facebook Marketplace, where SMEs listed products for sale for local shopper communities.”

Resellers and micro entrepreneurs leveraged social commerce to influence those within their social network and buy online, noted Ankur Arora, founder of social ecommerce platform, ShopG. He further said, “Internet users based in Tier 2 and 3 cities prefer assisted buying from someone they trust, like a local shop owner. Enabled by lowest ever data tariffs, these customers spend two to three hours a day on social platforms.”

“Social commerce is handholding this audience through digital and e-commerce,” said Tonic Worldwide’s Anjali Malthankar.

Innovation in Social Commerce

“Companies like Dunzo, Swiggy (Genie), PhonePe, and Meesho have been able to bridge the two ends of the ecosystem swiftly with their innovative strategies,” pointed out Madhur Acharya. These companies are solving problems like logistics, payments, inventory and connecting sellers and buyers.

According to Krishna, “A dynamic eco-system must exist to support social commerce. The inventory management has to be real-time and delivery networks expanded to meet the impulse that social commerce demands.”

Even Facebook, which experts agreed was a leader in this space, had to partner with Shopify, WooCommerce and Big Commerce to launch Instagram Shops. “The content needs to be friendly, transaction seamless and emphasis on users to ‘Buy Now’, remarked Kar.

“All social media platforms have been doing great with collaborations. Shoppable video is where things seem to heading. Apart from this, mini-games, interactive challenges and group buying deals are interesting ways to experience commerce on social media,” observed Malthakar.

While Krishna felt that video content is difficult to manage, he also added that with new-age AI based technologies coming into edit and making videos interactive, video shopping will definitely see a big growth in the near future.

Market for Social Commerce

As ShopG’s Arora noted earlier, social commerce has the potential to unlock consumers in Tier 2 and 3 markets, where trust is an absolute factor when it comes to buying. He explained, “While shopping online, these users have low average order values (less than Rs 250), given their limited household income in the range of 20-25K per month. This makes it impossible for e-commerce 1.0 players (like Amazon, Flipkart) to serve them, given high customer acquisition cost and supply chain cost.”

Madhur Acharya pointed out, “Social commerce is distinct from e-commerce, because it is a medium to educate the customers or make him/her aware of a particular product, whereas e-commerce or a market place is a platform where the consumer is already informed about the buying decision.”

According to Malthankar, the key difference between social commerce and e-commerce destinations is ‘discovery’ versus ‘intent’ and ‘window shopping’ versus ‘planned purchase’.

“Social as marketplace helps acquiring highly informed users, especially in categories that see higher user involvement across education, aspiration, and loyalty funnels,” added Kar.

Brands take the leap

Continuing further, Kar said, “Categories that see a higher user involvement are keen to be part of the social commerce trend. This includes fashion, beauty, personal care, home care, home décor, food, and consumer electronics brands. Incidentally these are also the same categories that are driving millions of views for influencers.”

It is all about “brands building product storytelling using visuals, influencers, connected content and loyal consumer tribes. Brands which focus on a range of choices”, he added.

Madhur Acharya and Anjali Malthankar observed that brands like boAt, Plum Goodness, H&M and Burberry have all taken the leap to social commerce. Visual formats like video and image definitely get more engagement and hence, play an important part in the strategy.

Future of Online Shopping

ShopG’s Arora said, “There are a few ‘Flipkarts’ of social commerce in the making. As per a Bain and Company report, “India’s social commerce sector will be double the size of the current e-commerce market within 10 years. Social commerce is worth $2 billion gross merchandise value (GMV) market today and will hit $60 billion by 2030.”

Adding further, he said, “Globally, social commerce models in countries like China, with similar demographics as India, have demonstrated significant success in the household needs category for Tier 2 and 3 users. In China, social commerce is already a $250 billion market, which is nearly 12% of retail.”

The pandemic has contributed to this growth story, according to Madhur Acharya, who said, “The consumption hours of a user on social media platforms has significantly increased due to the pandemic. Brands leveraged this to get more exposure hence making social media a necessary platform to touch base.”

“Social commerce will only rise as better ecosystems forms around it. Customer-to-customer selling will continue to grow,” predicted Krishna. “Social will emerge as a key shopping medium as other touch points are nearing a saturation point with respect to conversion,” concluded Kar.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn