How Govt’s move on FDI will increase insurance penetration in India

In any country, the financial services sector is typically made up of banks, trust and loan companies, credit unions, life and health insurance companies, property and casualty insurance companies, securities traders and exchanges, investment fund companies, pension funds, finance and leasing companies, insurance agents and brokers, and a myriad of auxiliary service providers, such as independent financial advisors, actuaries, and intermediaries. Opening up of the sector was a part of GAT (WTO).

The announcement in the Union Budget 2021 to increase FDI in insurance companies is a welcome move for the insurance sector. Insurance is a long-term offering with built-in assurance, leading to a need for high capital investment, especially in the initial years of the business. However, though it is an important constituent for the country’s growth and risk mitigation, insurance penetration is by far the lowest in India. While the sector has several players, only a few have been able to find a firm foothold and market penetration.

Equity infusion will help larger and global brands to explore the Indian market. Companies like Berkshire Hathaway have always wanted to explore a higher FDI in the insurance sector to explore the business opportunity in India. While the opportunity for the business is great, it’s a game where a large balance sheet and having a lead market share has an advantage. At present, local players have an edge.

The sector is currently under-penetrated and needs some help and boost to expand to smaller towns. India needs to make insurance not only affordable, but also accessible and attractive to the lower strata of the society. Especially in the post-pandemic world, where people have become more alert and cautious about their health and well-being, on the one hand, and want to strengthen their financial health, on the other hand. Therefore, health checkups and preventive care measures have taken a top priority and people are more eager to insure and protect themselves even in the Tier 2 and 3 towns.

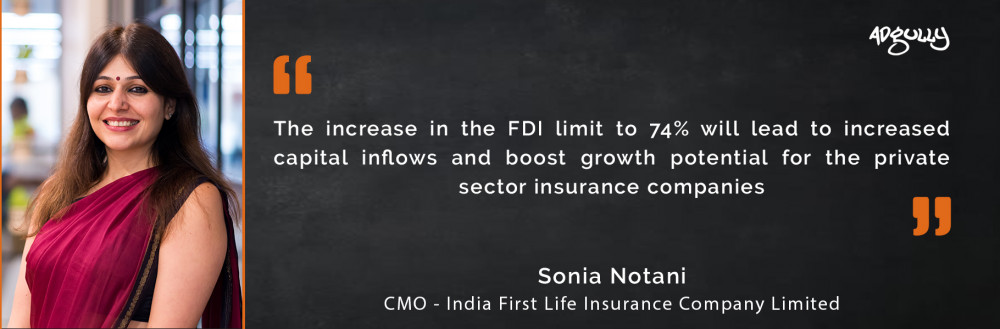

Speaking to Adgully, Sonia Notani, CMO, IndiaFirst Life Insurance Company, noted, “This is quite encouraging and will help the insurance industry in several ways. The increase in the FDI limit to 74% will lead to increased capital inflows and boost growth potential for the private sector insurance companies. The additional infusion of capital will be deployed not only for managing solvency requirements, but will also lead to funding growth and enabling deeper penetration of the private sector insurers across the country. This will also lead to enhanced employment generation in the sector. Increased FDI limit will also help attract more foreign insurance companies to set-up in India, thus bringing in diverse global expertise and healthy competition.”

Notani further said that the life insurance penetration rate in India continues to be one of the lowest across the globe at 2.74%, as per the annual report by the Insurance Regulatory and Development Authority of India (IRDAI). The industry requires adequate capital infusion to manage solvency and boost growth. The additional capital can provide stimulus to scale up the technology and digital infrastructure to enable cost-effective customer acquisition and servicing capabilities; thus, leading to widespread reach and subsequent penetration across customer segments.

Sharing his views on the announcement of the hike in FDI in the insurance sector by the Government, Suresh Agarwal, Chief Distribution officer, Kotak Mahindra Life Insurance Co, said, “We see the increase in FDI limit from 49% to 74% as a positive development as this will attract more capital to the industry. This move shows the Government’s confidence in the insurance industry and companies will certainly work towards significantly increasing the insurance penetration in the country.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn