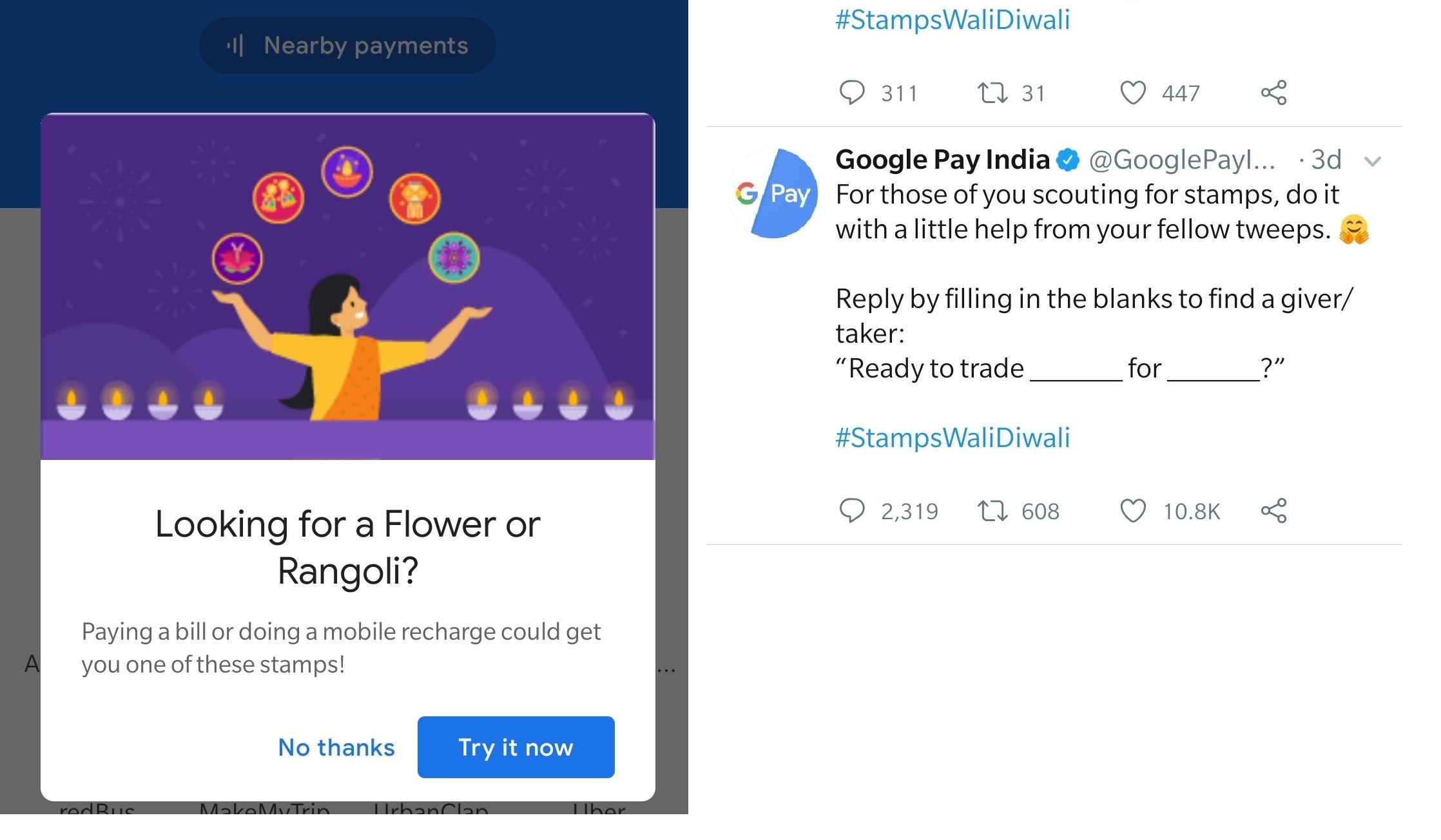

If you’ve updated your Google Pay app to their latest version, you might have noticed their new tab, called ‘Diwali’, next to the Rewards and Offers tab on the app. During the festive season, Google Play offered users an opportunity to win Rs 251 and a chance to make Rs 1 lakh if they collect 5 Diwali themed stamps. All users had to do is use the platform to transact and stand a chance of winning a stamp.

Google Pay generated a lot of word of mouth for their reward system and had users searching high and low for the especially rare Rangoli and Flower stamps. This gave users a chance to bond with others who were facing the same problem.

They also hinted that users could trade stamps with one another. Users took to social media to share hacks and tricks to increase chances of winning stamps, trade with others, and generally announce that they won the prize.

For those of you scouting for stamps, do it with a little help from your fellow tweeps. 🤗

Reply by filling in the blanks to find a giver/taker:

“Ready to trade ______ for ______?â€#StampsWaliDiwali

If anyone wants to trade their Rangoli stamp with mine flower stamp then DM.

Things tried:

1 made first ever Rangoli of my life

2 paid electricity bill,due date was 4th Nov

3 recharged all mobiles.

Next I am gonna go on dark web!! #GooglePaystamps #GooglePay

I'm looking for jhumka, flower, ranjoli stamps, do u have them with u??

DM and gift me â¤â˜º

Thank you so much in advance #StampsWaliDiwali #GooglePay pic.twitter.com/9ujfDitpXA

#StampsWaliDiwali #GooglePay #GooglePayIndia #DiyaStamp #LanternStamp #JhumkaStamp .Get 5 stamps in 5 seconds. Scan any digital diya/candle. LOL. Here's a attached video that I made. Easy to go. Have a try! 😀. Maybe, u get a #RangoliStamp and #FlowerStamp ðŸ˜, I still don't have! pic.twitter.com/oO75kd1mTW

All my life, I ignored the whole concept of Rangoli.

Now, thanks to @GooglePay that's all I can think about.

What a marketing strategy! #GooglePay #DiwaliContest #DiwaliStamps

Since its launch in 2018, Google Pay has introduced a smart system of ‘Variable Rewards’ to increase user affinity to the app. A LinkedIn user while mulling over ‘Why Google Pay offers a scratch card instead of an assured cashback?’ to reward its users, explained, “Every time we receive a reward (for example, cashback), our brain releases a good dose of the happy hormone –  dopamine. In moderate doses, it helps regulate our wellbeing. In large doses, it can lead to addiction. Long story short, our brains crave dopamine. But then there’s a catch.”

Continuing further, the LinkedIn user shared, “Back in the 1950s, BF Skinner, a famed psychologist, ran an experiment where he offered lab rats food pellets if they pressed a lever. Lever A would bring down pellets of the same size every time. Lever B would offer pellets of different sizes, that is, sometimes you’d get a smaller pellet, sometimes a larger one and sometimes none at all. And the rats kept going crazy for the randomised lever. This experiment provided the scientific basis for using ‘Variable Rewards’ to condition human behaviour.

It turns out, our brain releases more dopamine in the anticipation of rewards than the reward itself. When the rewards are fixed and we know what to anticipate, our dopamine levels stay in check. But when the rewards are variable, our brain relentlessly seeks the thrill of unlocking large payouts.”

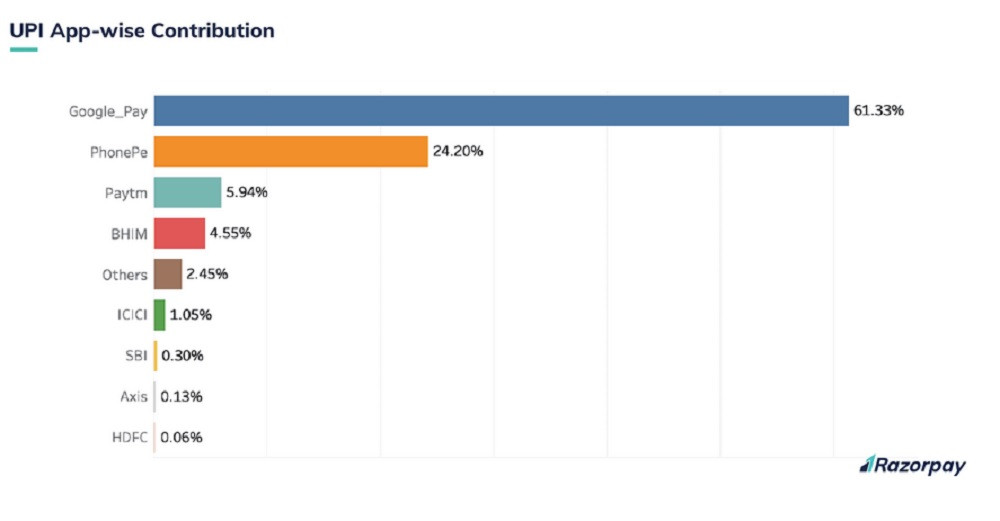

As per data provided by Razorpay, Google Pay contributed to 61.33 per cent of the total UPI transactions carried out on the platform during the month of September. PhonePe is second with 24.2 per cent.

The adoption of Google Pay shows how a well-designed product markets itself. As Apps become integral to accomplishing daily tasks, making those tasks a little bit less mundane and repetitive is a challenge to all developers.

Shortening the user journey used to be marketing 1.1, however gamifying it doesn’t necessarily make it short, but rather more addictive. You can see that Google Pay actually adds a step in the transaction journey by introducing scratch cards instead of instant cashbacks.

Gamifying the user journey can be done by addressing pain points in the user interactions with the app. There can also be task-based gamification on special occasions like Diwali, which we’ve seen with the Google Pay example. Or there can be level-based gamification, which is common in mobile games.

Tanay Kumar, Co-Founder, CEO and CCO of Fractal Ink Design Studio Linked by Isobar posits that, “While designing these, it is important to realise consumer’s state of mind and accordingly push the users to engage.”

He adds, “Design overall provides a lever to elevate your reward programmes through clever use of sentiment modelling and placing them into right contexts.”

Gamification built around existing consumer journey

In this, the users are simply carrying out their tasks and you reward them for just being loyal to you. Most applications in the financial domain such as payment apps, e-commerce apps or banking apps build their gamification around this. Each activity is a need and successful completion can earn the users some benefits, which can, in turn, lead them spend more time in your app. Loyalty programmes are usually built around these kinds of apps or ecosystems.

Task-based gamification

These are usually adopted by domains where virality is a need, usually entertainment and gaming. Users engage in these apps to feel good about themselves. Here, the consumers are ready to give you that extra time and in return the responsibility on you is to gratify them with rewards for the extra time spent. Like listening to a complete song, or completing a level or inviting friends to join you. In this kind of scenario, the quality of rewards and redemption decide whether a user will engage with your app or not.

Level-based gamification

These are models usually adopted by apps in the knowledge or information delivery domains. These nudge the users through a promise of a better app environment with increased usage. The more time spent allows user to qualify for either a new feature or a new exciting piece of content.

Depending on what your users have come for and how much mind space they have to give it to you, you can choose which model to adopt.

Rewards – how do they work?

A reward has to mean something to the user. The video game PUBG monetises by offering players customised gear that looks great in-game, but does not have any functional purpose.

“Digital goods typically have notional value, but cost very minimal to the developer. It is such items that can be offered to the user to limited usage,” says Vaibhav Odhekar, COO, POKKT Video Ads.

That’s why most video games have some form of in-app currency like gold, coins, etc., that have a perceived value within the game, but are worthless outside that system. According to AppAnnie’s ‘State of Mobile’ 2019 report, 74 per cent of consumer spend on app stores went to gaming apps in 2018.

The task for the developer is to generate a high perceived value of the in-app currency in the minds of the user so that they chase after it. This can be accomplished by setting goalposts for the user to chase.

Most video games now offer in-game rewards as they are designed to encourage growth mindsets and facilitate intrinsic motivation, or they can inhibit exploratory play and reinforce a helpless mindset.

Ecosystem Play

The digital ecosystem is extremely competitive. Paytm was a pioneer in the payments ecosystem in India, but has been superseded by late entrants like PhonePe and Google Pay just a few years later. With more than 10 players competing in the same space, in-app experience will be the deciding factor in driving user affinity.

Google Pay’s Diwali contest has been the latest of well-designed rewards programme to generate buzz and goodwill of users. Competitive players like e-commerce, OTT, social and utility app developers are doing gamification to build user engagement.

A new ride hailing start-up called VAOO is subsiding or offering rides at zero cost to customers by earning rewards. Customers can earn these rewards by viewing ads on the VAOO app. Hyperlocal mobile advertising start-up, Batooni, also pays users money to view ads, which they can use to recharge their mobile bill or transact in small amounts.

Other players are only just starting to catch up with video game developers in identifying unique ways to build consumer engagement.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn