India on track to become 10th advertising market: GroupM forecast report

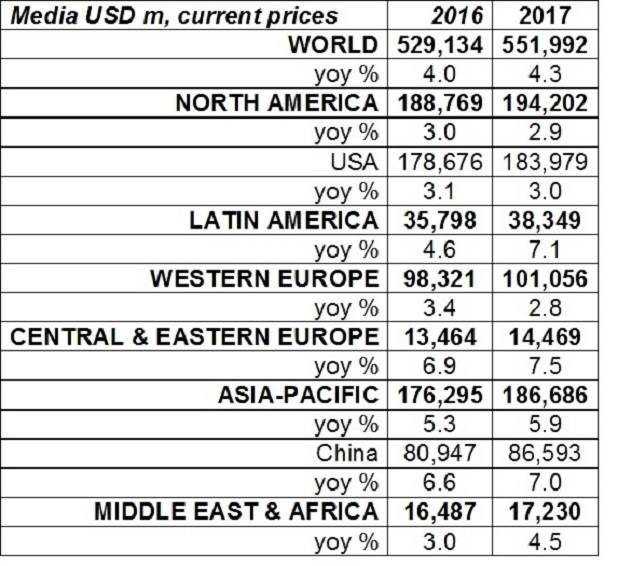

WPP’s GroupM has trimmed its 2016 global ad expenditure forecast and shared its initial outlook for 2017. The 2017 ad volume prediction of $552 billion (+4.3 per cent), when combined with other marketing services, pushes total marketing services expenditures worldwide past the $1 trillion threshold for the first time. However, slowing growth in China and Brazil this year drive GroupM to revise down their 2016 growth estimate to 4.0 per cent from the 4.5 per cent earlier predicted, (net new investment of $22 billion trimmed to $20.5 billion).

Supported by stable finances, sustained urban demand and important reforms, India remains the fastest-growing larger economy at a forecast annual run rate of 14 per cent to 15 per cent in 2016 and 2017. By GroupM’s estimates, India is on track to become the 10th advertising market with greater than $10 billion in annual investment in 2018.

Globally, the growth of digital continues to be high, but it is moderating from 18 per cent in 2015 to 14 per cent in 2016 and 12 per cent in 2017. This is to be expected as markets like China see the medium surpass 50 per cent of media investment. Still, digital will account for 99 per cent of all net ad growth in 2016, and comprise 31 per cent of investment this year and precisely one-third next year. Print media continues to lose the most share to online, while TV remains resilient.

GroupM China reports a ‘new normal’; 2016 growth is now forecast at 6.6 per cent, revised downward from 9.1 per cent as the slowdown in fixed investment and profits affects consumer demand. The initial advertising growth estimate for China in 2017 is 7.0 per cent. These estimates keep China among the top growing large markets, with ample fundamental support tied to growing urbanization and consumer confidence, though China no longer boasts the double-digit growth rates of recent years.

With the slowing of China, GroupM believes that the US will again be the leading contributor of global ad growth this year, assuming a mantle China has held since 2007. GroupM’s US advertising growth estimate for 2016 is revised up from 2.7 per cent to 3.1 per cent, driven primarily by a healthier TV marketplace that will grow 3.4 per cent in 2016 instead of the 2.3 per cent earlier predicted. Political, CPG and Pharmaceutical categories are key contributors to TV’s strength.

After a slow growth 2015, the communications market in Brazil is feeling the effects of economic crisis in 2016, but is still hopeful of ending the year positive for growth at 1 per cent. Prior optimism for 7 per cent growth in 2016 was dashed by Brazil’s continuing economic recession, increasing unemployment (topping 10 per cent), and political turmoil.

Meanwhile in Russia, fourth of the BRIC markets, where the economy and media investment shrank 3.7 per cent and 10 per cent, respectively in 2015, very rapid recovery in the first quarter this year is probably not sustainable given the lack of evidence that the GDP or consumer income is improving, but GroupM still thinks 2016’s ad investment will grow 7.8 per cent, with 9.4 per cent to follow in 2017.

These predications and more are published in GroupM’s biannual worldwide media and marketing forecast report, ‘This Year, Next Year’. The intelligence is drawn from data supplied by WPP’s worldwide resources in advertising, public relations, market research and specialist communications by GroupM’s Futures Director, Adam Smith.

The new ‘This Year, Next Year’ report also includes a discussion of perspectives on measuring the success of online video and developments with online ad networks (inventory aggregators and sellers); this continues conversation from GroupM’s last digitally-focused report, ‘Interaction’, published in April.

In his update to the 2016 forecast, Smith paid particular attention to the impact of the UK’s vote to exit the European Union. “At this time, there is no tangible evidence of a Brexit effect in macro indicators nor budgeting decisions. However, in the next six months to a year, it is likely companies will invest less. Job creation, wage growth and productivity will be lower than it otherwise might have been. This is a difference of degree, not magnitude,” said Smith. “There is no evidence of a Brexit-driven recession at the time of this writing, and though some have deferred 2016 advertising investments, worst-case we still see that UK advertising growth will reach 4.5 per cent this year, propelled exclusively by the growth of digital. Our base case remains 6.3 per cent, which we will revise as usual in November.”

“The impact of media consumption migrating to digital platforms, and the flow of advertising investment with it, must not be underestimated by advertising clients,” said Dominic Proctor, President, GroupM Global. “This fragmentation of billions of consumer impressions across thousands of platforms demands the use of data and technology to create bespoke and meaningful targeted audiences for brands. This is the transition from media planning to audience planning and the reason why GroupM continues to focus investment in talent and technology around data and analytics. We see this as crucial to creating sustainable marketplace advantage for our clients, and it’s an important dialogue we’re having which is increasingly and appropriately focused on performance versus the commodity pricing of media.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn