India represents huge sporting opportunity for the 2020s: MIDiA report

With much of the attention of India’s vast mobile audience now being captured by both established traditional sports and newly emerging digitally-native esports and fantasy leagues, a new report by MIDiA Research examines India’s current sports streaming landscape, and the role of premium sports in driving engagement: The roaring sporting 20s | India leads the way in innovation and engagement.

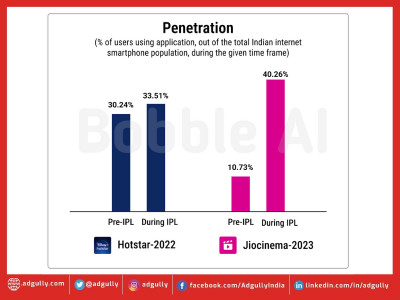

A key message from the report, for developed markets to prioritise reach over revenue, is demonstrated through the case study of OTT service Hotstar, which has used its exclusive domestic and international cricket rights to accelerate engagement with the Hotstar brand.

Rights to a range premium sports such as the Tennis Grand Slams French Open until 2021, the English Premier League (EPL) until 2022 and Pro Kabaddi League till 2024, as well as its uber-affordable pricing strategy, has seen the OTT service become the largest in India, amassing more than 300 million users in 2019.

Compared to competitor SonyLIV, which costs Rs 999 ($13.5) for a year, a subscription to Hotstar costs Rs 365 ($5) for a year, and gives users access to live sports and some Hotstar-produced original content. At Re 1 a day, the price is inexpensive for a rural cricket enthusiast and in 2019 a report by the World Bank estimated that 65% of the Indian population lived in rural areas.

With withering traditional revenue streams from pay-TV and zero-to-little live attendance of fixtures, India’s experience in optimising reach over revenue highlights a roadmap, as D-Day for sports rights becomes a reality for rights holders and broadcasters, and will offer valuable lessons for developed sports markets navigating the current transition.

The opportunity for growth in India is widespread across various sports but there remain some challenges, not the least of which is low monetisation from domestic non-cricket leagues and the perception that limited opportunities exist to pursue a career in sports outside of cricket.

However, the sheer scale of Indian audiences means niche can pay outsized dividends in engagement and fandom for global sports brands seeking to diversify outside of core markets. A niche sport in India can be more popular than major sports in many developed markets. For example, Wrestle Mania 36 was watched by 25 million Indian consumers in March 2020, with broadcasting in Hindi playing a huge role in the growth of WWE in India.

Alongside this, a rapidly growing opportunity in Esports is opening up new audiences for services. The IPL fantasy league Dream11 grew its player base from 0.3 million users in 2015 to over 800 million in 2020, meanwhile Star Sports and Hotstar made a revolutionary addition to the Indian sports viewing market by offering esports tournaments to their coverage.

From Dream11’s digitally-native fantasy sports service, to the blend of subscription and ad-supported streaming distribution of live premium sports, India is busy re-inventing the sports proposition for digital-first twenties and the rest of the world needs to pay attention.

Srishti Das, a MIDiA consultant and one of the report authors said: “India is uniquely positioned with a billion-plus digital consumers all bypassing traditional analogue media distribution behaviours and going straight to streaming. However, this has big implications as to how sports re-invents itself as competitive and cost-effective digital content proposition.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn