Insurance advertising: Of mandatory disclosures, filing of ads & disclaimers

After 2 decades, the IRDAI has proposed a modification to its regulations on Advertising insurance products in India. What are the existing regulations? What are the modifications proposed by IRDAI? What are the Do’s and Don’ts that govern advertising in the Insurance sector? Part 27 of the series of articles on Misleading Ads by Advocate Aazmeen Kasad is the fourth part of a series on Advertising in the Insurance sector in India, and serves to demystify and provide an in-depth understanding of what the law on the same is for mandatory disclosures and filing of ads, disclaimers which should be part of insurance advertisements, advertisements regarding ULIPs, product combination ads, etc., by insurance companies.

The Insurance Regulatory and Development Authority of India (‘IRDAI’) has notified that Insurance Regulatory and Development Authority (Insurance Advertisements and Disclosure) Regulations, 2000 (‘Regulation’), the Master Circular on Insurance Advertisements, the Consumer Protection Act, 2019 and the Advertising Standard Council of India’s Code on Self-Regulation in Advertising, to protect the interests of the public, enhance their level of confidence on the nature of sales material used and ultimately encourage fair business practices.

These provisions are to be complied with by all insurers (life insurers, non-life insurers and health insurers), agents, point of sales persons, motor insurance service providers and insurance intermediaries.

Provisions applicable to published advertisements apply equally to advertising through electronic media, that is, advertisements through a telephonic interactive mode or on the internet.

- Mandatory disclosure as specified by the ‘Advertisement Regulations’ and applicable guidelines/ circulars as may be specified from time to time should be clear, conspicuous and legible and should find at least 10% of the total space utilised for the advertisement in print/visual mode with a minimum print equivalent to font ‘Times New Roman’ No. 7. In case of advertisements via an audio mode, these disclosures should be spelt for at least 10% of the total time slot of the advertisement.

- All the advertisements should carry a unique identifiable reference number.

- Use of taglines by registered insurers/licensed entities:

3.1 All licensed entities soliciting insurance business should mention their identity and contact details. Any person who is found to be guilty of misleading the prospect on any insurance product shall be liable for regulatory actions.

3.2 All the registered insurers and licensed intermediaries shall print the following text (font size should not be less than 9) at the bottom of all their advertisements (both institutional and insurance advertisements) and other publicity material including policy documents, premium receipts, renewal notice, bill boards/ display boards and logos released through print or electronic media:

For Insurers & Intermediaries IRDAI Regn. No. __________

- Where material is filed with the Authority in accordance with the ‘Advertisement Regulations’, in other than English/ Hindi language, true translation of the same in English/ Hindi duly certified by an Authorised officer of the insurer, is to be enclosed.

- Advertisements filed (including Joint Sale Advertisements) should be filed within 7 days of their release or launch into the market place.

- Insurers must file only English and/or Hindi base versions of advertisements on BAP.

6.1 The advertisements which are issued in other languages and other formats, where there is no change in the content, design, image to that of base versions of English and/or Hindi will bear the same URN of the base version. The IRDAI does not treat them as a new advertisement and hence they need not be filed. However, a certificate needs to be filed to the effect that the advertisements released in other languages are true translation of the base versions of English and/or Hindi and there are no changes in the content, design, image etc., of the base version.

- All Insurance Advertisements approved by Insurers for their Insurance Agents (Individual Agents and Corporate Agents) in accordance with the provisions of the IRDA (Insurance Advertisements) Regulations, 2000 and Clause 12 of Guidelines on Licensing of Corporate Agents No. 017I/IRDA/Circular/CA Guidelines/2005 dated 14th July, 2005 shall also comply with all provisions of Advertisement Regulations and the provisions of this Master Circular and shall form part of Advertisement register referred at Regulation 3 (iii) of Insurance Advertisement Regulations. These Advertisements shall also be filed within 7 days.

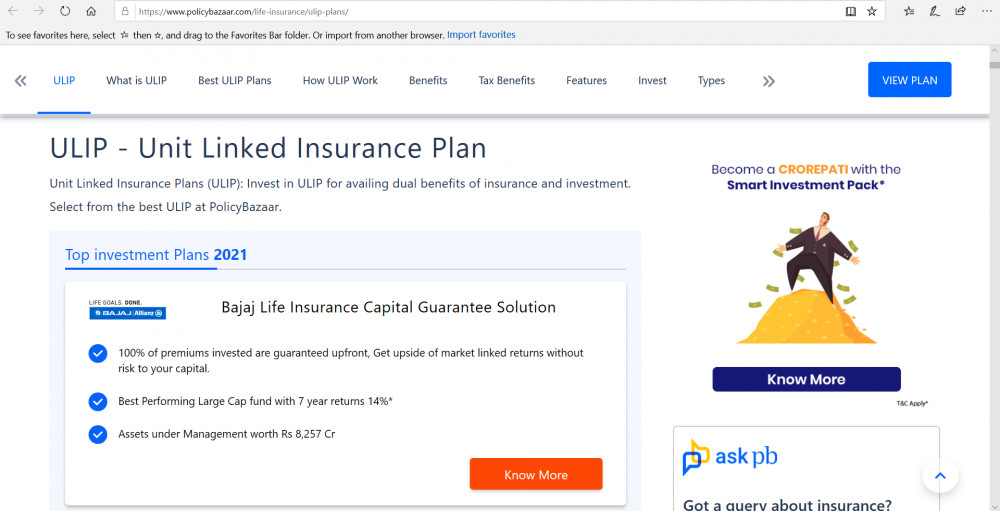

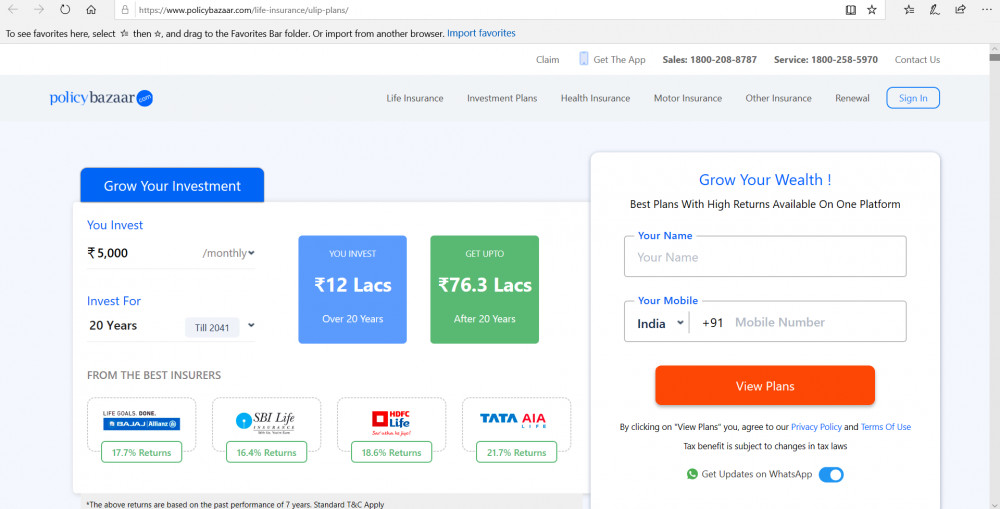

- In case of Unit linked products, the advertisements issued by Life Insurers should also adhere to the other norms prescribed in IRDAI (Unit Linked Insurance Products) Regulations, 2019.

- ULIP Products with 0% charges and 100% allocation

9.1.1 In the case of100% (or more) allocation

a.The Company must not issue specific advertisements or sales literature or any other marketing material (print or electronic or any other form) positioning the product as offering 100% (or more) allocation of premium in first policy year.

b.The benefit illustration should carry a declaration in capital and bold letters. This declaration is “I ALSO UNDERSTAND THAT WHILST ___% OF MY FIRST YEAR PREMIUM WILL BE INVESTED IN UNIT LINKED INVESTMENT FUNDS THERE ARE CHARGES DURING THE FIRST POLICY YEAR AS GIVEN IN THE BENEFIT ILLUSTRATION”.

- Norms while promoting the Product Combinations

10.1 Where more than one product and combination of their benefits are promoted in a single advertisement, there shall be a complete disclosure of all the related particulars of Individual Products, inter alia, a reference to the respective product names and UIN, a caveat advising the prospect to refer the detailed sales literature of the respective individual products, segregated premium particulars of each product.

10.2 Such advertisements should contain a specific declaration as “Advertisement Disclaimer” on Top in BOLD [not less than Font size 7].

This advertisement is designed for combination of Benefits of two or more individual and separate products named (1) ____ (2) ____ (3) ____ (as applicable) etc. These products are also available for sale individually without the combination offered / suggested. This benefit illustration is the arithmetic combination and chronological listing of combined benefits of individual products. The customer is advised to refer to the detailed sales brochure of respective individual products mentioned herein before concluding the sale.”

10.3 A certificate by the appointed Actuary must be enclosed at the time of filing of advertisements with the IRDAI which must state –

i)The benefit illustration shown by combining the benefits of more than one products is nothing but the arithmetical combination of all the individual product benefit illustrations (state product names and UIN) as approved by the Authority and is a proper chronological and combined listing of the benefits of two or more individual products.

ii)The benefit illustration shown in the advertisements truly and fairly represents the combined benefits of individual products and does not in any way exaggerate the same.

10.4 IRDAI (Unit Linked Insurance Products) Regulations, 2019 & IRDAI (Non-Linked Insurance Products) Regulations 2019, as applicable to Linked/ Non-Linked Products being part of the Combination, need to be complied with.

Under the Consumer Protection Act, the Central Consumer Protection Authority will regulate matters relating to violation of rights of consumers, unfair trade practices and false or misleading advertisements which are prejudicial to the interests of public and consumers to promote, protect and enforce the rights of consumers. This Authority is headquartered in the National Capital Region of Delhi and may have regional and other offices across India.

A complaint relating to any false or misleading advertisements may be forwarded either in writing or in electronic mode, to any one of the authorities, namely, the District Collector or the Commissioner of regional office or the Central Authority. After a preliminary enquiry is made, if the Central Authority is satisfied that a prima facie case exists, an investigation shall be conducted.

Where the Central Authority is satisfied after conducting the investigation that the advertisement for which a complaint is received is false or misleading and is prejudicial to the interest of any consumer or is in contravention of consumer rights, it may, by order, issue directions to the concerned trader or manufacturer or endorser or advertiser or publisher, as the case may be, to discontinue such advertisement or to modify the same in such manner and within such time as may be specified in that order. If the Central Authority is of the opinion that it is necessary to impose a penalty in respect of such false or misleading advertisement, by a manufacturer or an endorser, it may, by order, impose on manufacturer or celebrity endorser a penalty which may extend to Rs 10 lakh: Provided that the Central Authority may, for every subsequent contravention by a manufacturer or endorser, impose a penalty, which may extend to Rs 50 lakh. Additionally, where the Central Authority deems it necessary, it may, by order, prohibit the celebrity endorser of a false or misleading advertisement from making endorsement of any product or service for a period which may extend to one year: For every subsequent contravention, prohibit such endorser from making endorsement in respect of any product or service for a period which may extend to three years. Where the Central Authority is satisfied after conducting an investigation, that any person is found to publish, or is a party to the publication of a misleading advertisement, except in the ordinary course of his business,it may impose on such person a penalty which may extend to Rs 10 lakh. The defence that the false or misleading advertisement was published in the ordinary course of business shall not be available to such person if he had previous knowledge of the order passed by the Central Authority for withdrawal or modification of such advertisement.

In light of the newly introduced provisions under the Act, which came into force from July 20, 2020, it is advisable for both the advertisers and the endorsers to exercise caution in the claims that form part of the advertisement of the goods/ services. The ensuing Parts of the series will pertain to various aspects of what constitutes Misleading Advertising and key judicial precedents on the same.

Advocate Aazmeen Kasad is a practicing corporate advocate with over 20 years of experience, with a focus on the Media, Technology and Telecom industries. She is also a professor of law since 14 years. She is a member of the Consumer Complaints Council of the Advertising Standards Council of India. She is a speaker at several forums.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn