M&E Industry in South India to grow at 16% CAGR: Deloitte-FICCI Report

The Media & Entertainment (M&E) industry in South India is poised to grow at a CAGR of 16% to reach INR 43,600 croreby FY 2017 against the current INR 23,900 crore in FY 2013, according to a Deloitte-FICCI report- ‘Media & Entertainment in South India - the Digital March’. This growth will be mainly driven by popularity of vernacular content among the region’s populace and the evolving ecosystem, including endeavors by media vehicles to expand their presence.

While enabling regional media players to reach their target audience, the industry continues to attract national players to explore this growing South market. The market is dominated by television (56%), followed by print (28%) and films (11%). Sectors such as New Media and Radio, though smaller than other mediums, are expected to grow at rates higher than the industry average, given their increasing power of engagement.

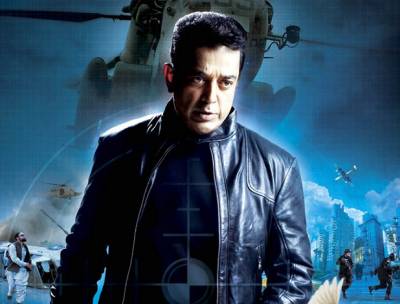

According to Kamal Haasan, Chairman, FICCI Media & Entertainment Forum – South, “All media platforms viz. films, TV, print and radio are pushing content on the digital medium so as to enhance reach. Not only is the digital medium helping industry players reach wider audiences, it is also enabling them to establish a stronger connect with consumers.”

Television constitutes the largest segment of the South Indian M&E industry and is currently estimated at INR 13,470 Crore, accounting for the largest share of the overall market at 56%. The medium is expected to grow at a CAGR of 20% over the next four years due to benefits of digitization being realized. As at the national level, digitization is changing the way consumers view television, with broadcasters also seeing an opportunity in creating and showcasing digital content. While the industry is enabling multi-screen viewership of TV content for viewers who are constantly on the move, the medium is attracting increasing number of local advertisers.

Print is the second largest segment accounting for 28% of the overall market in FY 2013 at INR 6,680 Crore. English players are launching vernacular dailies as advertising revenue from vernacular print in the region is estimated to grow at twice the pace of that of English, largely driven by local advertisers and increasing focus of national advertiser’s beyond Tier 1 cities. Print industry is also trying to identify monetization opportunities online by developing mobile apps and mobile optimized websites. With players identifying innovative ways to reach out to their readers, Print industry is also expected to see a steady CAGR of 8% till FY 2017.

“The print industry in South India, where four states represent about 30% of the Indian market in terms of readership, has been able to maintain its vigor through tough times.” said Neeraj Jain, Senior Director, Deloitte Touche Tohmatsu India Private Limited. “The opportunity will lie in tapping the growth potential of the market through expansion and deeper penetration while simultaneously building additional capabilities to explore alternate sources of revenues.”

Films rule the hearts and minds of the people in South India. The region churns out more films than Bollywood. Buoyed by an ardent fan following in the South, Film is the third largest segment (11%) at INR 2,680 Crore. The industry is adopting technology across the value chain – scouting talent through social media, adopting newer film making technologies in terms of sound and filming, distributing and exhibiting films digitally as well as embracing e-ticketing platforms. The industry is expected to see a healthy CAGR of 12% over the next four years.

Radio, with the upcoming Phase III auction, and New Media, propelled by the consumer’s demand to access content ‘anytime, anywhere’, are expected to grow at a CAGR of 19% and 23% respectively, over the next four years. Increasing presence of radio on the digital medium is also enabling it to reach listeners across the globe. With Phase III of radio frequency auctions, players are gearing up to further their reach and strengthen engagement with the consumers.

As for New Media, mobile phones are expected to emerge as the preferred platform for consuming content, with the increasing popularity of mobile broadband (3G) and the impending launch of 4G LTE services. This shift of users to web and mobile platforms for media consumption is expected to have a direct impact on growth of digital advertising. The success of New Media not only depends on accessibility and devices, but also on the development of a viable online eco-system. South Indian media industry holds great potential in leveraging the availability of quality vernacular content to create this eco-system.

Overall, the South Indian media industry remains the “poster boy” of the thriving regional Media & Entertainment industry, with people in South India demonstrating a penchant for local content. Among the states, Tamil Nadu constitutes over one-third of the South Indian M&E industry. The M&E industry in Tamil Nadu is expected to grow at a slightly higher rate than the other states of the region, with all four media platforms expected to grow faster in the state.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn