M&E to rebound by FY22 to reach Rs 1.86 tr; but faces loss of 2 yrs growth due to COVID-19

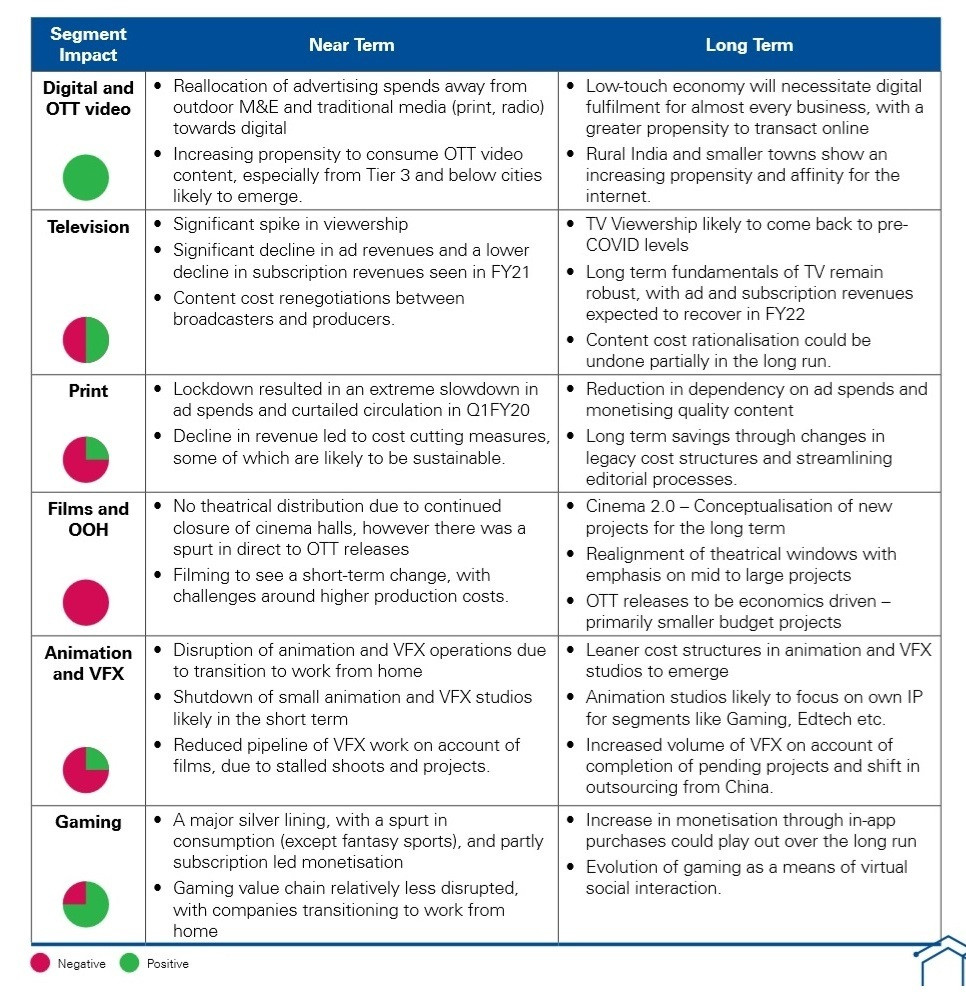

India was already experiencing a slowdown in economic activity even prior to the outbreak of COVID-19 in March, and the onset of the global pandemic and ensuing lockdown dealt a severe blow to the Indian economy. The M&E sector has been affected, but to varying degrees: outdoor entertainment formats (films and events) and traditional media (print and TV to some extent) have been badly impacted as people stayed indoors and advertising spends dried up. Digital advertising, OTT and gaming fared much better, with massive spikes in digital consumption during the lockdown across geographies and socio-economic classes. Digital advertising spends are now set to overtake those on TV by FY21, which is an important milestone and turning point in the evolution of M&E in India.

This was revealed in the 12th edition of the report titled, ‘A year off script: Time for resilience’, by KPMG in India. The report examines the performance of the media and entertainment sector during a particularly challenging period.

As per the report, the tepid economic growth combined with slowdown in domestic consumption had a material adverse impact on the Indian M&E sector, which grew at slower rate of 7.4 per cent in FY20, to reach a size of Rs 1.75 trillion, at a CAGR of 10.3 per cent over FY16-20. While the slowdown negatively impacted print and to an extent, TV advertising, digital and gaming segments continued to grow at a rapid pace and positively contributed to the performance of the sector.

March 2020 also saw the country start to see the impact of COVID-19 and head into a long phase of lockdown. This has had an ongoing adverse impact on the economy across sectors with supply chains, manufacturing, consumption, income levels all getting impacted. The country witnessed a steep decline of 23.9 per cent in GDP in Q1FY21 as consumer spending and investments contracted due to COVID-19.

The M&E sector has also been significantly impacted, particularly with all forms of outdoor entertainment coming to a standstill, a significant slowdown in advertising spend and content supply chains breaking down. As a result, the M&E sector is expected to contract by a significant 20 percentage points in FY21, with major segments like TV, Films and Print all seeing major declines.

On the other hand, extended lockdown is accelerating digital consumption and segments such as Digital and Gaming are seeing rapidly growing user penetration and engagement levels. The M&E sector is expected to bounce back in FY22 with a growth of 33.1 per cent over FY21 to reach a size of Rs 1.86 trillion, at a CAGR of 3.2 per cent over FY20-22,7 with gaming and digital being the fastest growing segments.

Satya Easwaran, Partner and Head, Technology, Media and Telecom, KPMG in India, remarked, “The distinction among segments of M&E has become more pronounced with the experience of the lockdown. Marketing spend has moved perceptibly towards digital media and away from traditional segments like print, radio and to some extent TV. A greater reliance on subscription and other paid options as well as the development of a credible digital business model is going to be inevitable for these traditional media segments.”

Organisations face a multitude of challenges and competing priorities, but based on a survey of CXOs conducted by KPMG in India, customer focus and revenue growth are expected to drive digital-first initiatives over the near term within organisations, with cost reduction also emerging as important to traditional media segments.

Girish Menon, Partner and Head, Media and Entertainment, added here, “There will be a deeper integration of digital technology across the M&E value chain – from content production to distribution. Technology adoption could, however, face some challenges in terms of skill development and the shift to a digital-first mindset, but will result in operational cost savings and potentially lower lead times over the longer term.”

Finally, the M&E sector should recover to its current levels and post a 33 per cent growth in FY22 (following a contraction of 20 per cent in FY21), which still implies a loss of around two years of growth. The two areas that offer encouragement are the continued economic growth of Bharat and the universal acceleration of digital adoption among users across geographies and SECs. As per our revised estimates, India could be home to a billion digital users by 2028 rather than the earlier projected 2030 timeline. There have been several structural changes to digital behaviour on account of the experience of the lockdown resulting in a new homogeneity among users, and it is our belief that many of these changes will translate into a more democratic and sophisticated digital citizenry within the country.

M&E in the COVID-19 era

The M&E sector faced significant disruption with the ongoing lockdown forcing all forms of outdoor entertainment, particularly cinemas and events to shut down and content supply chains to dry up. Additionally, advertising spends also declined as all major advertisement spend sectors were witnessing their own business continuity challenges.

With lockdowns easing, the content supply appears to be restarting, albeit with baby steps. Cinemas and events, however, continue to be shut and face significant uncertainty regarding return to normalcy in the near term (In unlock 5.0 cinema halls have been allowed to open from October 15, 2020 in a graded manner with 50 per cent capacity). Advertisement spends appear to be recovering and with a strong festive quarter expected in Q3FY21, there is likely to be a quicker recovery in marketing budgets once we start moving towards normalcy. The overall reduction in advertising expenditure therefore may turn out to be lower than the contraction in economic activity.

M&E sector – projected performance

- The M&E sector in India is projected to see a significant decline of 20 per cent in total revenues in FY21, with deep cuts in Print and Films, followed by Television, on account of COVID-19 disruption

- The digital consumption segments i.e. Digital (including OTT video) and Online gaming are expected to be silver linings, with digital consumption across the board having seen a significant upswing owing to people working from home. While advertising revenues on digital have been impacted from last year’s hypercharged growth, the subscription revenues have seen an upswing and could end up at an accelerated new normal once the pandemic subsides.

- Digital media advertising revenues are projected to overtake TV advertising revenues for the first time in FY21 and will establish new leaderboard rankings.

- Assuming the pandemic is under some form of control by the end of FY21 and businesses learn to operate in the new normal, FY22 will likely be a bounce-back year for the sector, with a 33 per cent growth projected over FY21.

- Digital and gaming are projected to continue their strong growth in FY22 as well, with the habit formation around consumption translating into greater monetisation.

- Underlying core themes will continue to play their part with Television subscription revenues being constrained due to implementation of NTO 2.0, while Print (particularly English) facing readership and advertisement spend pressures.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn