NBA Valuations: From $450 Million to $5.2 Billion

The average NBA franchise is now valued at $2.4 billion — a 2% decline year-over-year — but who are the real winners?

Some key highlights:

- For the first time in more than two decades, the average NBA franchise valuation declined year-over-year — now worth $2.4 billion, a 2% decline.

- Three franchises—the New York Knicks, Golden State Warriors, and Los Angeles Lakers—are each worth more than $5 billion, which is slightly more than the NFL’s most valuable franchise — the Dallas Cowboys

- At $5.42 billion, the New York Knicks are the most valuable franchise in the NBA, despite having the league’s worst record since 2000.

The fair market value of all 30 NBA teams, including ownership’s stakes in real estate, regional sports networks, and additional team-related holdings, is more than $70 billion. That’s more than the GDP of countries like Bulgaria, Croatia, and Uruguay.

Given below are the top 10 most valuable NBA franchises:

Rather than break down each franchise's valuation individually, let’s focus on — the Golden State Warriors.

When a group led by Joe Lacob and Peter Guber paid an NBA record $450 million for the Golden State Warriors in 2010 — outbidding billionaire Larry Ellison in the process — a majority of the sports world was left scratching their head. And today Golden State Warriors is worth more than $5.2 billion.

After drafting Stephen Curry in 2009, the team started winning — making the playoffs for nine straight years, participating in the NBA Finals five straight times, and winning three world championships in the process.

The Warriors now rank among the top of the league in home-game attendance and saw their revenue skyrocket accordingly. At $430 million last year, no team in the NBA brought in more revenue than the Warriors.

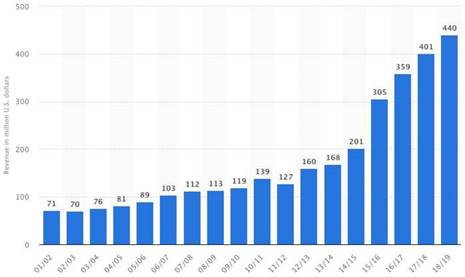

Here’s how the Warriors revenue has trended over time and their financial success afforded them the expansion.

- 2010 Revenue: $139 million

- 2019 Revenue: $430 millionIn 2019, the Warriors opened the Chase Center — a brand new $500 million arena in downtown San Francisco.

Unlike their in-state rival Los Angeles Lakers, the Warriors own, operate, and even act as landlords to corporate partners like Uber on the property. In total, Sportico values the Warriors’ team-related business and real estate assets at $1.5 billion, which is 50% more than any other NBA franchise.Comparing it to other NBA franchises' overall growth rate to see how the Warriors just happened to grow faster.

Here’s an example: The average NBA franchise valuation has grown from $365 million in 2010 to $2.4 billion today — an increase of 557%. And Golden State Warriors have seen their valuation increase more than 1,000% in the same time period, from $450 million to $5.2 billion.

In the end, the Warriors benefited from a unique combination of timing, overall league growth, winning, and real estate. With the team projecting an annual revenue target of $800 million in the next decade — slightly less than 2x their current revenue— the Warriors might just be getting started.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn