Nielsen’s global framework helps put COVID-19 impact on business in perspective

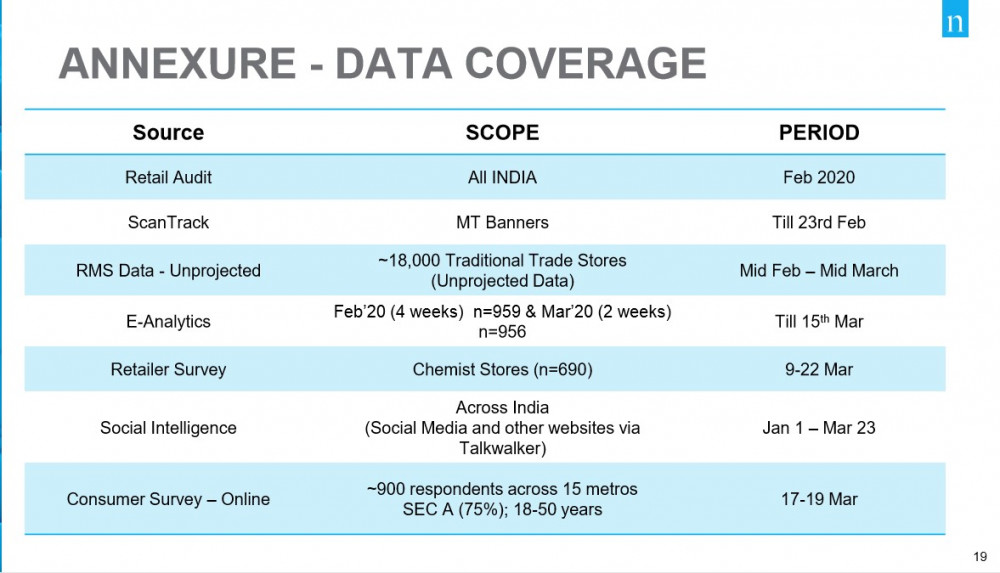

Market research and analysis firm, Nielsen, which has access to a treasure trove of retail audit data, modern trade stores, consumer surveys, e-commerce analytics and social intelligence has created a global strategic framework for businesses in FMCG and Retail to sharpen in their approach to the epidemic.

In the past, India has been successful in eradicating small pox and polio, a feat commended by the World Health Organization (WHO). Now faced with the COVID-19 pandemic, India has been taking several measures, including a country-wide lockdown.

Rising up to the occasion, India Inc, too, has joined the fightback against COVID-19. FMCG majors like Hindustan Unilever, Dabur, ITC and United Spirits, among others, have bulked up production of hand sanitisers. Auto manufacturers and mobile handset makers are being urged to manufacture ventilators on a war footing.

At the same time, the economic implications of COVID-19 is huge, and, as declared by the IMF chief, the global economy has entered recession. Industry experts believe that recession arising out of the current crisis could be far more severe that 2009.

Prasun Basu, President, Nielsen South Asia and Sameer Shukla, West Market Leader, Nielsen South Asia, guided us through the global strategic framework and how it applies to the Indian market.

In 2003, when the SARS (Severe Acute Respiratory Syndrome) virus inflicted China, the country had to shut down its schools, shops and factories, much like today. E-commerce giants Alibaba Group and JD.com were up and comers in China’s then fledgling e-commerce market. As consumers stopped shopping offline and shut themselves at home, a new behaviour pattern emerged that only facilitated e-commerce growth in the country. Most importantly, even after the virus was contained and people could once again move openly, the tendency to order online did not revert to what it was before the epidemic struck.

Similarly, the COVID-19 outbreak will irreversibly alter consumer attitudes and purchasing behavior in India.

Read More: GSK Consumer Healthcare merges with HUL

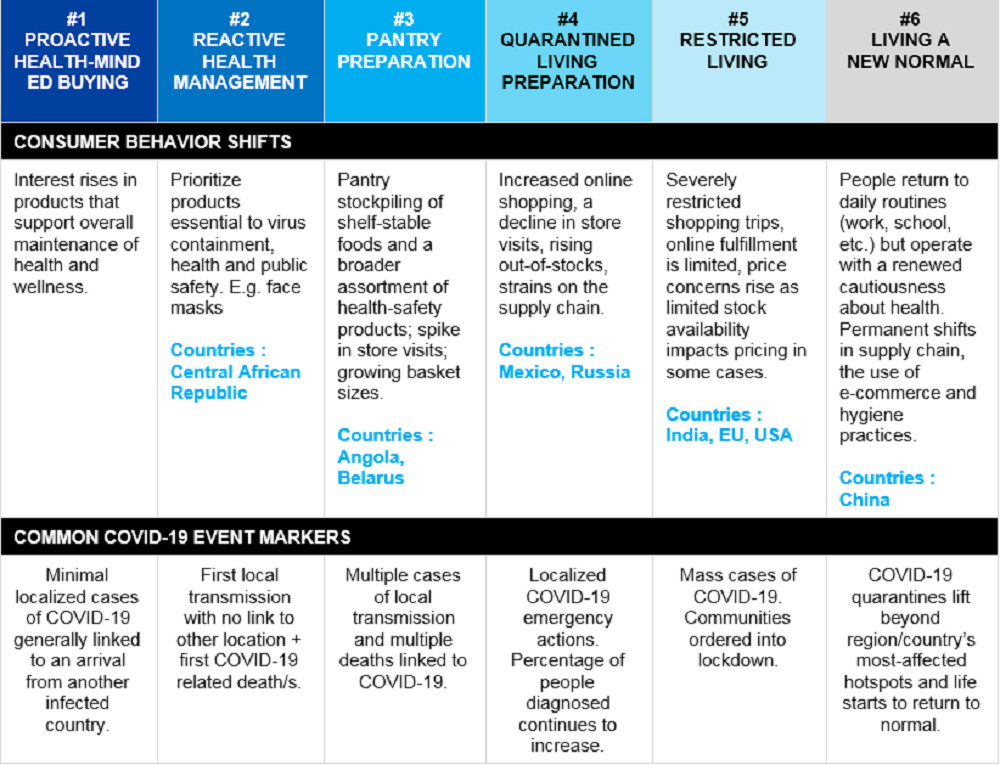

After investigating consumer behavior in a dozen or so markets, Nielsen identified consumer spending patterns as their countries transitioned through each threshold of the outbreak. Nielsen has categorised 6 thresholds based on observations on the basis of news media coverage and Government action mapped across different countries.

Interestingly, before the Government enforced lockdown came into effect, each region of India was in different phases of their COVID-19 journey. Consumers in Kerala, the state in which the first case was reported, exhibited purchasing behaviours in response to the crisis far earlier than the other states.

Right now, the entire country could be considered in Phase 5 or restricted living phase of the lockdown. This phase is characterised by severely restricted shopping trips, limited online fulfillment, and price concerns due to limited stock availability, and communities ordered into shutdown. Globally, India, EU and the US are tackling this phase. Considering that US and EU have a far higher case count than India and far lesser population, we can give some credit to the State and Central Government in handling this crisis.

In fact, by tracking social media conversations through listening tools, Nielsen found out that consumer compliance to Government directives was the highest during period with volume of trending hashtags such as #JantaCurfew #CoronavirusLockdown #SocialDistancing #COVIDIOTS #IndiaFightsCoronavirus #BreakTheChain #StayHomeStaySafe. (Data provided to Nielsen by Talkwalker)

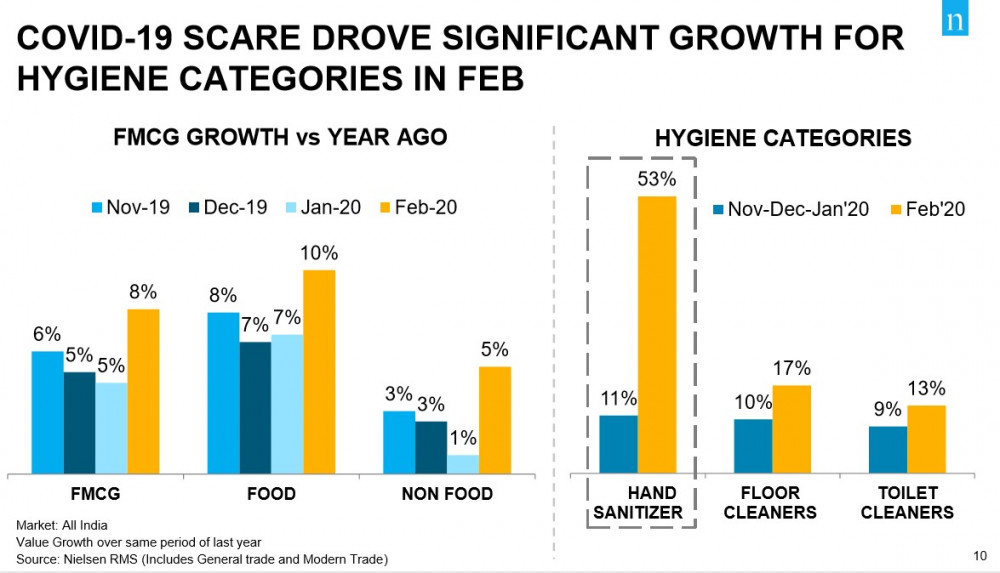

Nielsen reports that FMCG growth rates for February 2020 compared to the same period last year have jump from 5-6% to 8% on account of it being a leap year. The virus scare drove significant growth for hygiene categories in the same period compared to previous year. The States that had the highest severity of COVID-19 equally saw highest sales of hand sanitizers with 11 out of 21 with reported cases seeing a >40% growth over the same period last year.

Through consumer surveys, Nielsen found that top of mind awareness levels about safe practices to protect from infection among metropolitan citizens was greater than 80%. However, after studying their behaviour, the company found that little more than 50% of the respondents actually regularly followed through on the habits.

That means there is enormous potential for companies and brands to inculcate new behaviors among consumers to drive consumption of hygiene categories.

Read More: COVID-19 effect: 2020 estimates for M&E all askew; drop could be as high as 20-25%

Purchasing Trends

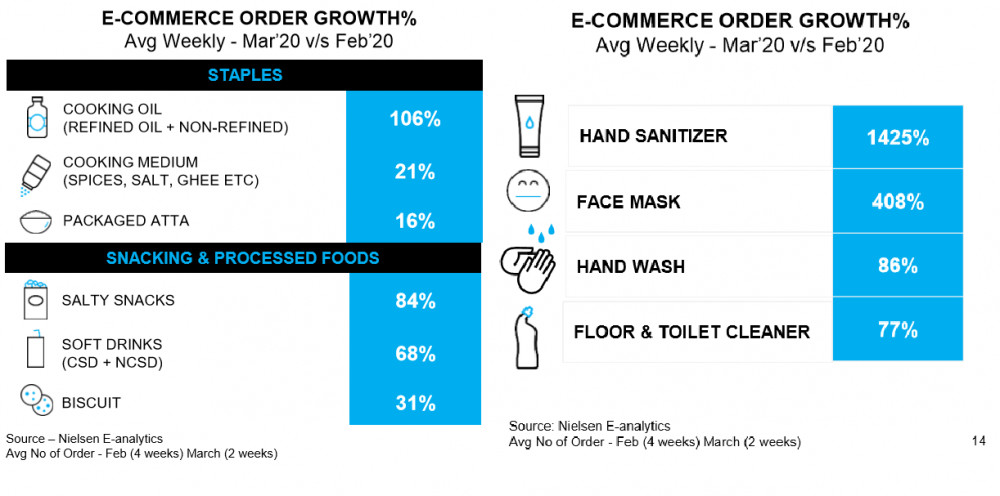

Before the lockdown came into effect, Nielsen tracked the purchasing behavior of consumers across 18000 retail stores between the period of mid-February to mid-March to learn what consumers were buying. Hygiene products obviously saw a growth with products like hand sanitizer (144%), liquid handwash (42%), antiseptic liquids (39%), antiseptic liquids (39%), and toilet soaps (8%) registering the highest growth compared to the same period last year. The hand sanitizer categories doubled in growth compared to the same period last year while the antiseptic liquid category grew 6X.

A tendency to hoard was also seen among consumers with branded pulses growing by 72% almost 5X growth compared to the same period last year and packaged atta growing by 25%. Nielsen’s consumer survey revealed that the items in most demand were personal hygiene products, cleaning products, grocery essentials, grocery essentials, fruits/vegetables, personal care, biscuits, chocolates, packages snacks, and OTC medicines (in that order).

However, the really interesting trend was how average weekly order volumes picked up on e-commerce.

Through a retailer survey, Nielsen found that chemists were anticipating a demand surge of 50% for items like masks, gloves and cough syrups, but were inadequately stocked and hence were anticipating a price surge where prices of these products could more than double. This presents another opportunity for healthcare and pharmaceutical players to ramp up production of these items.

Ground Reality

In the second week of lockdown, local kirana stores are witnessing higher foot traffic as consumers scramble for essential supplies. Both trust in these outlets for essential goods and less friction in the purchasing journey have made them heroes in the crisis.

The Government lockdown has disrupted the e-commerce supply chain as unclear guidelines have led to authorities barring the on-ground operations of these players.

This has resulted in a scenario where most e-commerce apps are not accepting orders and accepted orders are being delivered with 5-6-day delay.

E-commerce in India accounts for less that 5% of the overall retail market. Most products sold by e-tailers include consumer electronics, consumer durables and handsets and not essential groceries. This means that the e-commerce players who do deliver essential supplies are eclipsed by the 11 million kirana stores that are present in the country.

If Indian e-commerce players want to go the China route, there is an urgent need to innovate on the distribution front.

Also Read:

Global business leaders join the fight against COVID-19

COVID-19 effect: 2020 estimates for M&E all askew; drop could be as high as 20-25%

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn