Our strong 2021 performance positions us to deliver on our 2023 goals: Parag Agrawal

Twitter has reported a growth of 37% year-on-year in its 2021 revenues at $5.08 billion. Operating loss of $493 million in 2021, or an operating margin of -10%, includes a one-time litigation-related net charge of $766 million, as well as ongoing investments. 2021 adjusted operating income, which excludes the one-time litigation-related net charge, was $273 million, reflecting an adjusted operating margin of 5%. Operating income in 2020 stood at $27 million, which includes a $150 million non-recurring expense related to an ongoing FTC matter in Q2 of 2020, representing an operating margin of 1%.

Twitter reported a net loss of $221 million in 2021, representing a net margin of -4% and diluted EPS of ($0.28). The net loss in 2020 stood at $1.14 billion, which included a deferred tax asset valuation allowance of $1.10 billion and corresponding non-cash income tax expense based primarily on cumulative taxable losses driven primarily by COVID-19, representing a net margin of -31% and diluted EPS of ($1.44).

Q4 2021 Operational & Financial Highlights

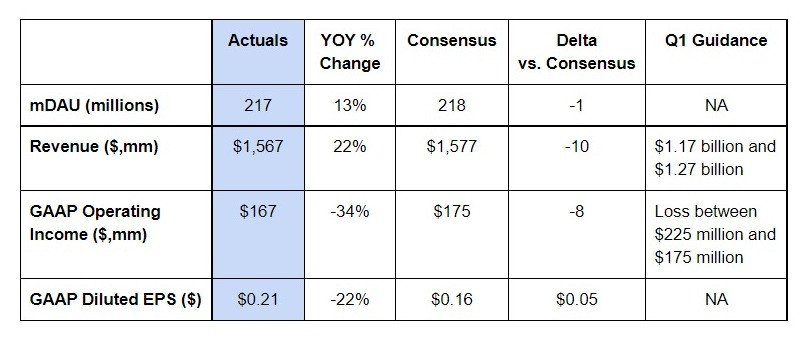

Twitter’s Q4 revenue totalled $1.57 billion in Q4 of 2021, an increase of 22% year over year or 23% on a constant currency basis. Advertising revenue totalled $1.41 billion, up 22% year over year or 24% on a constant currency basis.

- Total ad engagements decreased 12% year over year

- Cost per engagement (CPE) increased 39% year over year

Data licensing and other revenue totalled $154 million, an increase of 15% year over year. US revenue totalled $885 million, an increase of 21% year over year, while International revenue totalled $683 million, an increase of 23% year over year or 26% on a constant currency basis.

Netflix’s Q4 2021 net income stood at $182 million, representing a net margin of 12% and diluted EPS of $0.21. This compares to net income of $222 million, a net margin of 17%, and diluted EPS of $0.27 in the same period of the previous year.

Average mDAU for Q4 2021 was 217 million, compared to 192 million in the same period of the previous year and compared to 211 million in the previous quarter.

- Average US mDAU was 38 million for Q4, compared to 37 million in the same period of the previous year and compared to 37 million in the previous quarter.

- Average international mDAU was 179 million for Q4, compared to 155 million in the same period of the previous year and compared to 174 million in the previous quarter

Outlook

For Q1 of 2022, Twitter expects:

- Total revenue to be between $1.17 billion and $1.27 billion.

- GAAP operating loss to be between $225 million and $175 million.

For FY2022, Twitter expects:

- Stock-based compensation expense to be between $900 million and $925 million.

- Capital expenditures to be between $900 million and $950 million.

Commenting on Twitter’s performance, its CEO Parag Agrawal said, “Our strong 2021 performance positions us to improve execution and deliver on our 2023 goals. We are more focused and better organised to deliver improved personalisation and selection for our audience, partners, and advertisers.”

Ned Segal, CFO, Twitter, added here, “Twitter had a solid fourth quarter to finish 2021, with over $5 billion in annual revenue, up 37% for the year. There are no changes to our goals of 315 million average mDAU in Q4 2023 and $7.5 billion or more revenue in 2023. Our increased focus on performance ads and the SMB opportunity after the sale of MoPub positions us even better for 2022 and beyond.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn