Penetration of smartphones has surpassed laptops in India: Deloitte survey

A recent Mobile Consumer study in India conducted by Deloitte reveals that a considerable 53 per cent of Indians bought their smartphones online, while 39 per cent of smartphone owners still bought their phones in-store.

The study further elaborates that for most smartphone owners in India, the reliance on WiFi has reduced considerably because of higher penetration of mobile data. The report says that 4G adoption is expected to grow strongly over the next year to become the predominant data network. About 45 per cent of the respondents said that they would subscribe to 4G or LTE in the next 12 months.

The Deloitte Global Mobile Consumer Survey, 2016 analyses the mobile usage habits of over 2,000 Indian consumers as part of a global survey of 53,000 respondents across five continents and 31 countries. India data comprises representatives from eight urban cities with internet access and adults aging between 18 and 54 years.

The Smartphone behaviour: According to the research, for most smartphone owners, checking their phones is among the first and last things they do in a day. 61 per cent of respondents look at their devices in less than 5 minutes after waking up. The number swells to 88 per cent comprising people who take less than 30 minutes and 96 per cent of the respondents take about less than an hour to peep into their handsets. Interestingly, 74 per cent respondents look into their mobile phones about 15 minutes before preparing to sleep.

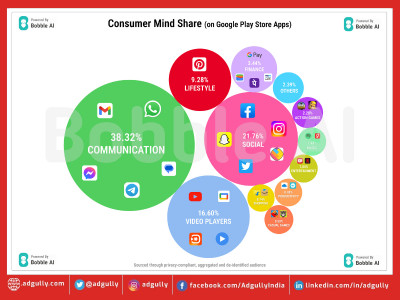

The research found that communication services, namely social networks and Instant Messaging, are the two things consumers check on their smartphones first thing in the morning. These are followed by personal emails and text messages.

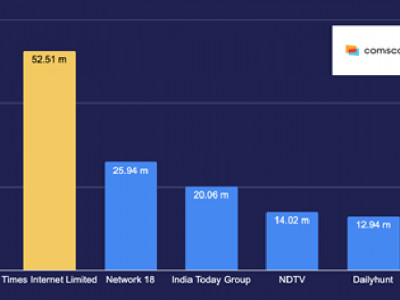

Device Ownership: The report indicates that the penetration of smartphones has surpassed laptops. Moreover, interest of people in buying tablets has softened as compared to previous two years.

The research also found that Indians have developed an addiction to their smartphones and use the same throughout the day to monitor various activities and remain updated. “This study reveals that smartphone usage has increased considerably. It has been identified as a disruptor in many common daily activities. After waking up in the morning, 88 per cent consumers check their phones in the first 30 minutes itself, while 94 per cent of them repeat the exercise in the last waking hour of the day. This says a lot about the way mobile phone usage has intruded in consumers’ personal space and life,” remarked Neeraj Jain, Partner, Deloitte Touche Tohmatsu India LLP.

He further said, “Also, in the post-demonetisation era, where we are expected to rely more on digital platforms for our commercial transactions, it is observed that more people upgrading from feature phones to smartphones in future. With internet becoming cheaper and higher mobile data penetration, consumers are becoming extremely data hungry. Thus, usage of smartphone is only expected to grow from here onwards.”

Communication Services: This research shows that the usage frequency has also increased for most data communications services. Instant Messaging (74 per cent), Social network (64 per cent) and Email (63 per cent) saw the highest growth in usage frequency.

Another trend that has come to light is that whilst almost 80 per cent of respondents use instant messaging at least once a week, it is the social networking and calling apps that are gaining momentum.

Jain also added, “With the higher penetration of mobile date, especially 3G and 4G, there has been a noticeable change in the way consumers are connecting to internet now. 59 per cent of the respondents said they were using Mobile Network to connect to the internet. This is a clear indication that their reliance on WiFi is moving southwards.”

Mobile Banking / e-Commerce on the rise: According to the research, e-commerce websites and mobile phone shops are the No.1 choices for online and in-store smartphone purchases, respectively. Further, the consumer survey reflects that the better part of smartphone users wield their devices to check bank balances (54 per cent), pay utility bills (54 per cent) and services bill (53 per cent) the most. This is followed by transferring money within the country (38 per cent) and abroad (31 per cent).

However, when it comes to using phone for making in-store payments, it is the fear about security and lack of understanding of potential benefits that prove to be the key barriers. The most common reason given for not using phone to make a payment was fear about security, cited by 29 per cent of respondents. This was followed by “I don’t see any benefits from using this” (19 per cent); and “I get rewards if I use my credit card instead” (15 per cent).

Among people who have an estimate, the majority of respondents have installed 20 apps or less. This is in addition to all the pre-installed apps.

The Indian data cut is part of Deloitte’s Global Mobile Consumer Survey, a multi-country online study of mobile phone users around the world. The 2016 study comprises 53,000 respondents across five continents and 31 countries. Data cited in this press release is based on a sample of high earning urban professional aged 18-54. Fieldwork took place during May-June 2016 and was carried out through online polling.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn