Permanent changes in consumer behaviour once the COVID-19 dust settles: Nielsen

Nielsen has released the 2nd edition of their COVID-19: Impact of FMCG and Retail report, which gives us a framework to put the epidemic in perspective and gauge its effects.

In our previous story on the report, Adgully had examined how pre-COVID-19 demand for FMCG categories such as personal hygiene, staples and pharmaceuticals surged. Before the lockdown enforced by the Government demand for these products was high across e-commerce, modern trade stores and general trade stores but post the lockdown only general trade stores were able to serve the customer faithfully.

In India, general stores account for 80% of the retail sector, modern trade banners account for 10% and ecommerce accounts for 3%, thus, while each category will see a growth post COVID-19, kirana stores will always be better positioned to serve the customer, according to Prasun Basu, President – South Asia Zone, Nielsen Global Connect.

In the last decade, the share of kirana stores has dropped from 94% to 88% with increase in modern retail outlets and e-commerce. So, while online commerce will see a growth at its own pace it is not going to replace traditional retail anytime soon.

According to Nielsen’s threshold framework, the Indian consumer is at the #5 phase of behaviour characterised by restricted shopping trips, limited online fulfillment, and rising price concerns.

A majority of the public began stockpiling evolved hygiene and food items before the lockdown which has led to a significant degrowth in certain categories once the restricted living phase began.

Products such as hand sanitizer (-1228%), floor cleaner (-69%), packaged atta (-45%), packaged rice (-67%), breakfast cereal (66%), and cheese (-66%) saw degrowth because retailers are unable to meet the consumer demand. Hand wash was the only product category that grew 199%). (Value Gr % Vs. YA) (The week defines the start of restricted living phase) (Note that Nielsen’s retail audit data is released on a monthly basis and this is just a snapshot of the lockdown period)

After seeing a surge in social media chatter in the early days of the lockdown, the conversation on online platforms has plateaued as Indian consumers come to terms with the ‘New Normal’ even as COVID-19 cases continue to surge.

According to data sourced from social media data platform Talkwalker, the chatter indicates that consumers are building their resilience and resolving to fight the crisis as a community.

By far the most used hashtags are:

#IndiaFightsCoronavirus, #IndiaFightsCorona, #COVIDIOTS, #CoronavirusLockdown, #StayHomeStaySafe, #BreakTheChain, #JantaCurfew, #CoronaOutbreak, #SocialDistancing, #SafeHandsChallenge, #CoronaFighters

All retail channels saw a sharp decline in volume of orders once the lockdown came into effect. Traditional trade showed a degrowth of 8%, e-commerce by 64%, and cash and carry saw a 44% drop. Modern trade saw a drop in demand but still grew by 6%.

Growth in demand for FMCG categories (Food and non-Food) accelerated until the lockdown came into effect and saw a sharp drop. In food category, lifestyle foods and chocolates and confectionery saw the sharpest decline post the lockdown and in non-food category evolved hygiene and other personal care products saw the most decline.

From a supply chain perspective, retailers are facing enormous pressures. Salesperson visits to restock supplies had dropped by 80%, 8 out of 10 retailers ran out of stock of essential supplies, and grocers and chemist were sourcing goods from manufacturers at higher rates.The most common out of stock items were hand sanitizers followed by face masks and gloves, salty snacks and ready to eat products.

1 in 4 retailers in urban India faced the challenge of staff not showing up for work due to COVID-19 concerns.

Supply chain disruption has emerged as the No. 1 concern of industry leaders during this crisis. The opportunity for marketers during this disruptive period is to intersect consumer behavior trends is by deploying better quality and efficacy of services/product, improve local distribution and supply, and leverage technology catalysts to be more agile in response to consumer expectations.

For example, Government initiative to empanel 2 million retail outlets (suraksha stores) in partnership with FMCG companies, as sanitizedoutlets adhering to safety norms.

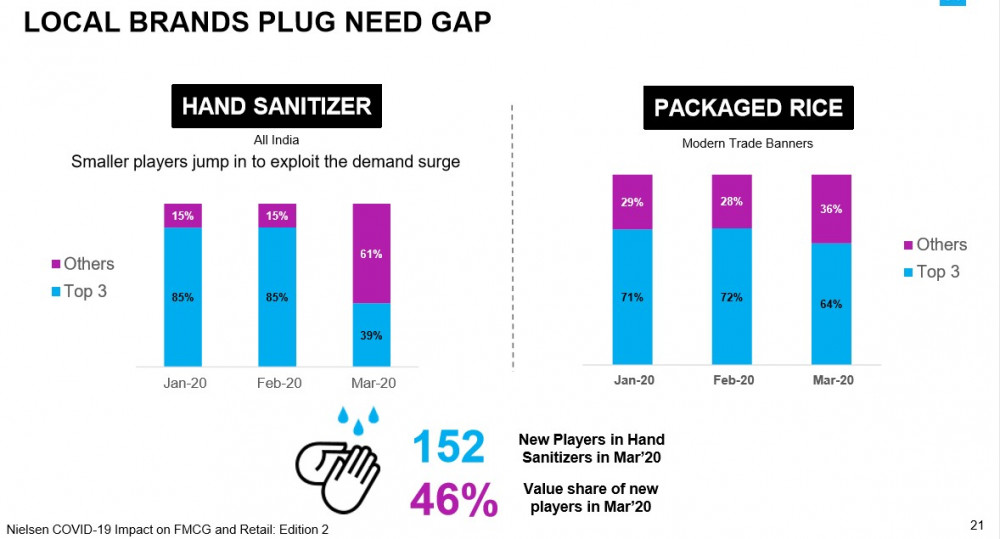

A lot of local brands have entered the fray to plug the need gap for essential products/services. There were 152 new players in hand sanitizer category during the month of March 2020. Value share of new players increased to 46% in March 2020 pushing back incumbents in the category.

Technology catalysts such as use of WhatsApp for product ordering and delivery, use of mobile apps to track and create awareness on COVID-19 (AarogyaSetu), companies partnering with delivery agents for last mile delivery, and online aggregators diversifying to meet current consumer needs.

While the volume of orders online is relatively low, delivery platforms such as Zomato, Swiggy, Box8, and Dunzo are making a most of the situation by sourcing groceries and other essentials and delivering them to the consumers doorstep or at their gate.

In fact, Dunzo also shared this infographic on their Twitter to indicate which items were most in demand in different cities.

Some Indian cities med the most of it during the lockdown, this March. Delivering from pharmacies is clearly no child's play.ðŸ¥#Contraceptives #Condoms #PregancyKits #HandWash #IPill #Pharmacies #Medicines #Lockdown2020 #quarantinelife #quarantineandchill pic.twitter.com/6fEvKMJniC

According to media reports, online delivery platform, Zomato is in talks to buyout e-commerce platform Grofers and enable last mile delivery for its partner grocery stores.

Glimpse of a post-crisis scenario

Nielsen study the recovery pattern of Asian markets are 3 crises that were similar to COVID-19 outbreak – SARS outbreak, Fukushima disaster, and MERS outbreak. Good news is that Japan, South Korea and China which were the epicenter of the previous epidemics saw a recovery in the market conditions within a year’s time and even lesser. In each of the cases, the lockdown situation did not persist longer than 4 months.

India has barely completed the first month of the lockdown. An online survey of 1,330 respondents in 23 metros and cities conducted by Nielsen showed that consumers are gearing up for cut back spending on restaurant and movie theatre visits, luxury goods, automobiles, personal grooming items, and tobacco and alcohol products. They are a general trend towards healthier lifestyle and products associated with it. Home entertainment sees a huge increase in demand with many consumers considering increasing spending on Apps, OTT, DTH and WIFI. 64% respondents stated that they couldn’t make it through the lockdown period with OTT platforms or WIFI connection. Online shopping is also expected to see a boost.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn