Rural India creating new fulcrum of opportunities for e-comm: Study

The advent of the ‘internet’ era in India has brought about a lot of pleasant changes. On one hand where India has become the 2nd largest consumer of the internet in the world, on the other hand, sales of consumer durables and finance schemes have rocketed in the country.

72 Networks, which is a pan-India distribution house specialising in last-mile delivery with particular focus on rural areas, has come up with their year-end survey on the rise of spending in rural areas across different sectors.

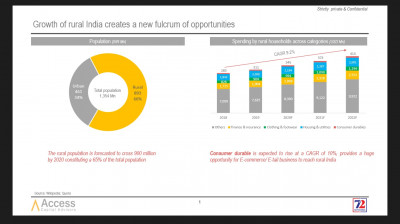

According to the research, the rural population is forecasted to cross 900 million by 2020, constituting 65 per cent of the total population, that is, 1,354 million. The urban population comprises of only 35 per cent of the cherry, with a combined population of 461 million.

The study also indicates that the spending of rural households across sectors has grown dramatically over the years. Housing & Utilities is the segment in which the rural population have shown their maximum interest, with a combined investment of $2,610 million, followed by the Finance & Insurance segment, with a combined investment of $2,553 million. The other sectors to support this suit are the Clothing & Footwear segment with $1,194 million and Consumer Durables with $414 million.

This is the era where OEM’s like Samsung, Xiaomi, Nokia, etc., have entered a steep competition in a billion-dollar Indian market, where the average middle-class consumer is growing day by day. They are investing a lot of money in their distribution channels as they want to reach out to the remotest corners of India. The complexity of the situation can be judged from the fact that e-commerce giants like Amazon, Flipkart, etc., are spending millions to enhance their last-mile delivery process, but still are far away from it.

72 Networks has access to a consumer base of around 150 million through microfinance companies like BFIL, Spandana, Fusion, etc., and till date, they have made over 200,000 individual rural deliveries across the country. They have closed the FY2018-19 with a positive topline of Rs 70 crore. They have also tied up with OEMs like Samsung, MI, Nokia, Singer, Delight, etc., and are providing alternate sales channels for their first sales. This is not only providing the OEMs with an extensive reach to rural India, but is also opening up multiple avenues for market growth.

Also Read:

Urban Indian offline shoppers rely on digital for final purchase: Google Study

MIB draft Bill seeks registration of e-papers, digital news media

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn