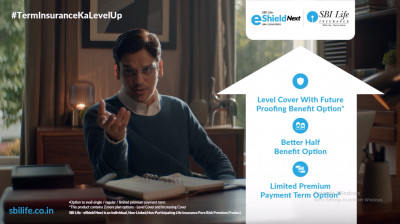

SBI Life’s new TVC highlights the importance of cherishing life’s prominent moments

When it comes to life’s prominent ‘level-up’ moments be it getting a new job, getting married, becoming a parent or buying a house, we often overlook the need to ‘level-up’ our financial protection as we are busy living in that moment and rightfully so. SBI Life Insurance today released a new TVC #TermInsuranceKaLevelUp, that showcases the prevalent consumer insight, wherein with evolving priorities and altering lifestyles there is an inherent need for a term insurance that ‘levels-up’ as one progress through life’s prominent moments.

Conceptualized by Mullen Lintas, the TVC leverages the versatility of critically acclaimed artist Vijay Verma, who engages with consumers by enacting life’s prominent moments that one often experiences. The film opens up with Vijay narrating life’s journey and changing responsibilities with every prominent ‘level-up’ moment. Transitioning from being a student to an office going professional, then buying a house as he progresses in life and finally starting a family. The TVC focuses on the continuous ‘level-ups’ in life and the inherent need to level-up one’s term insurance / financial protection. The film aptly displays the significance of every evolving transition in a person’s life, and how important it is to have a term insurance that levels up as one progresses through the journey of life.

Mr. Ravindra Sharma, Chief of Brand, Corporate Communication & CSR, SBI Life, said, “The #TermInsuranceKaLevelUp film is an attempt to let consumers relive the ‘level-up’ moments of their life and subtly remind them of the intrinsic need to also ‘level-up’ their financial safeguards, as they achieve life’s prominent moments. With a deeper understanding of today’s consumers, who believe in living-in-the-moment as they progress in life, we’ve been able to identify the need to prioritise financial safeguards as life goes along. The film subtly highlights the unique features of SBI Life eShield Next plan, which is designed to let consumer cherish life’s significant milestones, while providing customized options to ‘level-up’ one’s insurance coverage simultaneously.”

He further added, “The ever so versatile Vijay Verma connects with audience across the board, by seamlessly fitting into life’s prominent scenarios. With Vijay’s wide appeal across the country and his ability to connect with audience, one instantly relates to the storyline, realising the need for ‘levelling-up’ of financial safeguards as life progresses. We humbly hope that the film helps consumers identify the need to have a future ready protection cover that ensures adequate insurance coverage as they level-up in life.”

Ms. Garima Khandelwal, Chief Creative Officer, Mullen Lintas, said, “SBI Life’s eShield Next is an adaptable term insurance that enables customers Level Up their financial security to match with their life milestones. This resonates with the need of today’s individuals who place family goals at par with their own personal success. The narrative starring Vijay Verma traces a beautiful journey of a man reflecting on his material achievements and starting a family. These Level Ups would be challenging if not for the ease of adjusting the eShield Next plan to their new level of life, easing their journey onwards and upwards.

About SBI Life-eShield Next Plan:

An individual, non-linked, non-participating, life insurance pure risk premium product, is designed to let consumers enjoy the finer moments in life, by ‘levelling up’ the required insurance protection, through an increase in sum assured linked to the significant ‘level-up’ milestones in one’s life, like getting married, becoming a parent or buying a new house.

Key features of SBI Life ‘eShield Next’:

Choice of 3 Plan Options: Level Cover, Increasing Cover and Level Cover with Future-Proofing Benefit to suit variable protection needs

Life Cover up to 100 years (Whole Life) or 85 years (other than Whole Life)

Customizable Plan to meet different requirements: Through Better Half Benefit Option and death benefit payment modes

Pay premium as per your convenience: Only Once, For Limited Period or Entire Policy Term

Additional Coverage through Riders

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn