Total TV viewership in India up by 12%; TV homes grow 7.5%: BARC’s BI report

TV homes in the country have seen a 7.5 per cent jump, outpacing the growth of homes in India which grew at 4.5 per cent, as per the Broadcast India (BI) 2018 Survey released by BARC India today. India currently boasts of 298 million homes, of which 197 million have a TV set, having an opportunity of almost 100mn more TV homes in the country.

The BI 2018 Survey is based on a sample study of 3 lakh homes in India and offers data and insights that go beyond TV ownership and viewing habits. The Survey also contains a wealth of granular insights on consumer profiles and behaviour, making it a valuable ready reckoner for marketers and advertisers. This year, except field-work/data collection, all the other major parts of the study like sample & instrument design, data quality check, weighting and the software etc has been conducted by BARC themselves.

Two big takeaways from BI 2018 Survey is the rise of the middle class and the increase in the number of Flat TV screens. As per the Survey, with 123 million TV homes belonging to the middle class, NCCS B & C accounts for 63 per cent of TV homes in India. Together, NCCS ABC or the affluent TV owning homes form 84 per cent of TV homes in the country. The fact that homes falling under the low-socio economic class (NCCS D/E) have seen a 13 per cent drop, highlights the improving disposable income of an Indian home and is in line with the rising economic growth and prosperity.

Some interesting trends that have emerged with BI 2018 Survey are:

- Number of TV viewing individuals grew by 7.2 per cent to 836 million from the previous 780 million. However, viewership increase in Week 29 vs previous 4 weeks is 12 per cent.

- TV homes in Urban and Rural India grew by 4 per cent and 10 per cent, respectively. Viewership uptake in Urban India is 10 per cent, while that in Rural India is 13 per cent.

- The Average Time Spent by TV viewing individuals too has seen a 3 per cent growth and currently stands at 3 hours and 44 minutes. This is driven by Urban, which has seen an increase of 5 per cent in ATS (4 hour 06 min), ATS in Rural India has grown by 2 per cent and stands at 3 hours and 27 minutes.

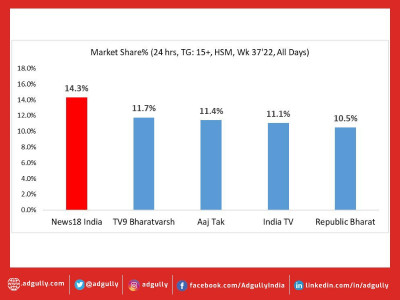

- Both HSM and South markets have seen a spike in viewership. HSM saw an increase of 12 per cent, while South grew by 10 per cent in Week 29.

- The Male-Female split of TV owning individuals as per BI 2018 is: 429 million-407 million. Male viewers grew by 6.9 per cent, while female viewers saw a growth of 7.5 per cent over BI 2016.

- In terms of viewership, in Week 29, Male viewership has seen an 11 per cent growth, while Female viewership has increased by 12 per cent.

- Viewership contribution of the affluent class (NCCS AB) grew by 15 per cent.

- The daily TV tune-ins in Week 29 saw a healthy growth of 8 per cent and currently stands at 614 million viewers. The previous 4 week average was 569 million viewers.

Partho Dasgupta, CEO, BARC India, commented, “With BI 2018, we have been able to showcase the changing face of India. However, what hasn’t changed is the fact that TV remains the most effective platform for both content creators and advertisers to reach their audiences. This year’s Survey is also special to us since we have been able to bring it in-house. We have been investing heavily on technology and talent and moving this almost entirely in-house is a proof of our capabilities. As for the trends, BARC India has maintained that India is a country which is driven by family viewing and this shows in the increase in the number of TV households. With a penetration of just 66 per cent, there is still a huge scope of growth in the space.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn