TRAI’s NTO 2.0 directive impacting an industry hugely dependent on ad revenues

The Telecom Regulatory Authority of India (TRAI) has directed all the broadcasters to report to the Authority, the name, nature, language, maximum retail prices per month of channels and maximum retail price per month of bouquets of channels, or composition of bouquets. TRAI has also amended Reference Interconnected Offer (RIO) in compliance with the provisions of the Telecommunication (Broadcasting & Cable) Services (Eighth) (Addressable Systems) Tariff (Second Amendment) Order, 2020 and the Telecommunication (Broadcasting & Cable) Services Interconnection (Addressable Systems) (Second Amendment) Regulations, 2020, dated January 1, 2020 and simultaneously publish such information on their websites.

Also read: TRAI directs broadcasters to implement Tariff Amendment Order 2020 by Aug 10

TRAI stated that it had received a large number of complaints about consumers being denied the benefits of the amended Regulations and Tariff Order (more commonly referred to as NTO 2.0) by some broadcasters. The Authority also noted that despite being under legal obligation to implement the new regulatory regime notified on January 1, 2020, some broadcasters have failed to not only implement the provisions of the regulations and the tariff orders notified by the Authority, but have also started violating the provisions of the Principal Tariff Order 2017, particularly the clause related to reporting requirement and are also disturbing the status quo by modifying the composition as well as discontinuation of their existing bouquets in a manner that is beneficial to them, but adversely affects interests of the consumers.

Calling TRAI’s directive to implement NTO 2.0 by August 10 as “ill-timed”, Shailesh Kapoor, CEO, Ormax Media, said that, “It does not recognise the unprecedented pandemic situation we are in currently, and how it is impacting an industry that is hugely dependent on advertising revenues. As it is, broadcasters are facing headwinds related to content production and economic slowdown.”

According to Kapoor, NTO 2.0 has been a controversial move to begin with, as it came across as ad hoc when first announced. “TRAI should wait for another few months and open up a dialogue with IBF, than be in a hurry to implement,” he suggested.

Karan Taurani, VP – Research Analyst (Media), Elara Securities India, saw a two-fold impact on broadcasters: 1) it will lead to a reduced ARPU as people may move to further selective viewing towards ala carte offerings, and 2) negative impact on domestic subs revenue.

He felt that TRAI should have waited till the market conditions improved. “We believe as NTO 1.0 saw a transition period, NTO 2.0, too, will see a few months of lower ad spends until clarity emerges on the viewership impact. In current COVID times, when ad spends are at a low and trying to recover during the festive season in the coming months, it will have a negative standing on the ad prospects for CY20, which may be further weakened,” he observed.

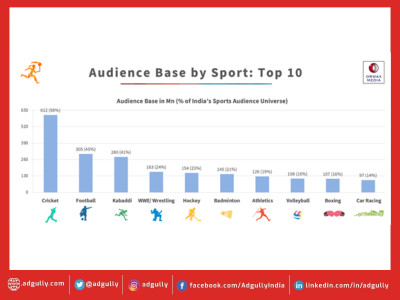

According to Taurani, the most contentious point is the capping on channel pricing at Rs 12 if not a part of a bouquet. “Primarily, the sports genre does heavy investments in content, hence this capping is bound to be a big negative,” he added.

“Further, capping on NCF fee is a negative for distributors who are already struggling due to a lower revenue share arrangement post NTO 1.0,” Taurani concluded.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn