Urban Indian offline shoppers rely on digital for final purchase: Google Study

A new study conducted by Google to understand the impact of growing Internet penetration and changes in buying behaviour of shoppers in India, revealed that the lines between online and offline shoppers behaviours are blurring. Urban offline shoppers are using the Internet in varied ways for all their product purchases, including researching online, when they are at an offline store, influencing their final purchase decision.

The new Google study, titled ‘Shopper Path-2-Purchase’ and compiled by IPSOS, was conducted across seven different product categories including, Accessories, Skin Care, Baby Care, Make Up, Home Decor and Computers. The study decodes the influence of digital across different stages of an urban offline shopper’s journey.

In the pre-purchase phase, the report highlights that the Internet is now established as a natural go to place for any kind of information needs of the users. And this behaviour is now also consistent for offline shoppers even for smaller value product categories, a distinct shift from research online and buy offline behaviour that was seen for high value product categories just a few years ago. The report underlines that the online habit has been already created, even for the offline shopper and they are now going online to find information even when they are in store before making the final purchase.

Commenting on the report, Vikas Agnihotri Country Director - Sales, Google India, said, “With over 460 million Indians online, on-the-go search is now an established habit that is resulting in shoppers to be on a constant lookout for information and satiate their need to make an informed decision before buying a product even when they are in a store. While online shopping users were considered as more digitally savvy, the report reveals that urban offline shoppers are equally adept and engage with digital touch points throughout their purchase journey. The propensity to explore, assess, validate and assimilate information at convenience has made digital a default destination for the urban offline shopper. Irrespective of the gender or product category, the Indian shoppers are very comfortable navigating through the numerous touch points (physical as well as digital) available to deftly derive the best overall value.”

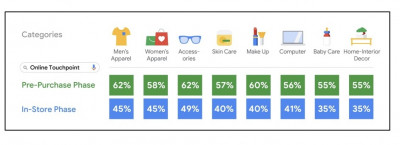

Breaking down the purchase journey of offline shoppers, the report highlights the role of digital touchpoints in the shopper’s decision making process across phases of pre-purchase and in-store journeys. In the pre-purchase phase, 55 per cent of urban offline shoppers turn to digital in the case of Home Decor or Baby Care, and 62 per cent in the case of Men’s Apparel.

The report highlights that the in-store purchase phase is an extension of the exploration pre-purchase phase, where offline shoppers engage with different touchpoints for further verification and validation. In-store cues like visual merchandising, point of sales material and promotion definitely have an impact on offline purchase decision, but shoppers continue to compare prices, explore discounts and promotional offers for their chosen product via online touchpoints while in-store. The Internet is also leveraged to gain further information or validate for new inputs received at the store.

Pre-Purchase and In-Store Stage online touchpoints:

The report also studied the triggers and post purchase behaviour, revealing that the engagement with the online touchpoints does not cease even after the purchase has been made. Shoppers are still indulging with the category post the actual purchase with 1 in every 3 shoppers was observed to be engaging with the category online after the purchase. Shoppers are either using social media to post pictures, their experience or share reviews. Another interesting category which is on the rise is “How to Use” for the recently purchased products.

The report presents rich insights for offline retailers and brands to engage and influence offline shoppers and leverage new viable opportunities to upsell and cross-sell products/ services even after the purchase.

Methodology

The report was compiled by IPSOS after speaking to a total of 6,600 recent shoppers covering 4 metro and 4 non-metro cities, NCCS A to C, Men and Women of various age groups to have an adequate representation of the Indian urban shopper.

Path to purchase journey of a wide variety of categories, ranging from a very frequently bought category of Apparel to a Computer which is bought once in a couple of years, were covered. Apparel (Men and Women separately), Accessories (Watches, Sunglasses and Jewellery), Skin Care, Baby Care, Make Up, Home Decor and Computer were covered. This helped IPSOS to arrive at larger mega trends that shoppers in India exhibit as they deftly navigate and leverage offline as well as online mediums/ touchpoints with increasing ease. The qualitative research came up with 4 main stages of the shopper’s journey. The first stage is Needs/ Triggers, which is stage 0, followed by Pre-Purchase, In Store and Post Purchase.

Also Read:

ET NOW Leaders of Tomorrow Season 8 introduces Winning Pitch

Storytelling is intrinsic to India: Amarjit Batra of Spotify

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn