We reside in the pockets of our customers through mobile phones: Sonia Notani

Life Insurance as a category has been showing growth. While it is a low involvement category, the pandemic time and the increasing focus on protecting life has stepped up the urgency for getting oneself insured – both from the life and the health sides. Insurance has always been a recommended instrument in financial planning. However, with the ensuing global pandemic the importance of insurance is even more pronounced.

The digital transformation and search for insurance products has increased rapidly as more and more people are looking for information on the various insurance products. Today, even the insurance companies have beefed up their online offerings and are engaging more intensely with their prospects by educating and making the purchase of insurance easier and simpler through online. Widespread digital adoption, deep regional penetration of telecom, access to the internet; are all factors that have led to new mediums of outreach and is helping Insurance brands to connect in smaller towns.

In an exclusive interview with Adgully, Sonia Notani, Chief Marketing Officer, IndiaFirst Life Insurance Company Limited, speaks in depth about how they have navigated during these times and what are some of the new marketing initiatives and campaigns that they have planned to closely engage with their audience.

Insurance as a category has very low involvement. You need a lot of effort to push and educate the insurance seekers to come forward as the market is crowded. How do you nudge your potential customers through a well-thought-out marketing and communication strategy?

Insurance, as a category, is one that allows for peace of mind. It is like a parachute, useless until critical – yet it has your back. Hence, while it is low involvement, it does need definite attention, basic understanding, and a nudge to decision a purchase.

In recent times, digital adoption has peaked and customers have embarked on the curve of online information, access, and engagement, accelerating their learning tremendously. We have moved from information to decision making, choosing to buying, checking to servicing. It is imperative to keep this momentum on all future process adoptions and what we are offering to our customers. For instance, at IndiaFirst Life, we went multi-lingual on our website and our communication to cater to customers across the length and breadth of our country. Our single version of truth enables our distribution partners to leverage our assets and cater to their customers. We enabled a self-service portal and did proactive engagement and outreach that was customised to customer profiles. Our innovative integrated campaigns, such as Ghar Baithe Insurance and e-Sampark, have been instrumental in acquire new customers and servicing the existing ones in this unprecedented year.

We will continue to strengthen and cultivate our regional capabilities on digital platforms – be it website or voice.

How much research is needed and what is the role of research to cull out insights for the campaign? What kind of campaign approach works in this category?

We have to start with the objective of the campaign – is it awareness, education, re-assurance, engagement, or purchase. We need to also cull out our prospective customer segment at a broad level basis demographic, life stage, etc., and plot needs. Once we have frozen on the ‘why’ and the ‘who’ is when we start exploring the ‘what’ and the ‘how’.

I believe the latter two can be strengthened by secondary research, A / B testing, content, and context validation amongst other things. Also, given the hyperconnected and omnichannel environment, an integrated marketing campaign tailored to add value with tweaks across access points enabled better awareness, recall, direction and even purchase.

For example, in Digital and Performance based campaigns, we usually use a two-fold approach, one is on communications for intent-based channels the other one is interest-based marketing.

Communication for Intent based channels like Google, Bing and Yahoo search is where the user is looking for a brand or insurance product. For these channels, the strategy is to simply focus on key benefits and price points and then re-target non-converted users’ basis their behaviour and demographic data.

On the other hand, Interest Based Marketing uses channels like Facebook, Google Display, Native Advertising, Affiliate, where we need to pull users with the help of a good banner, gif or video ad. Our focus is to attract users with a catchy tagline, along with price points and offer details.

However, if the above is bolstered with good brand presence and engagement across other social and digital properties, we see better outcome on targeted campaigns as well.

In the last year have you seen any major shift in people buying insurance online?

We are suddenly more aware of risk and uncertainty. Be it our own morbidity and mortality risks or financial risk. Assurance is now critical. Customers are looking for protection and guaranteed plans in the ensuing uncertainty. They are also willing to trying new mediums of connect, whether B2C or B2C, with a greater advent of video calls, digitised journeys, electronic payments, and the like.

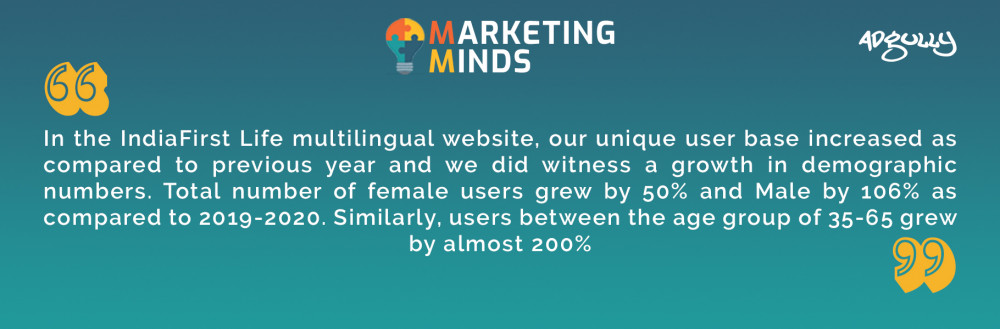

If we simply consider the IndiaFirst Life multilingual website, our unique user base increased as compared to previous year and we did witness a growth in demographic numbers. Total number of female users grew by 50% and Male users by 106% as compared to 2019-2020. Similarly, users between age group of 35-65 grew by almost 200%.

Have you seen a considerable shift here and how has IndiaFirst Life Insurance managed the new trend?

In recent times, we have witnessed a paradigm shift in social behaviour, where people are maintaining social distance, even with their loved ones. However, this has reduced our digital distance.

The challenging times also demand innovation in offerings. IndiaFirst Life has come up with products that offer benefits on diagnosis of Covid-19 apart from regular life insurance payable in case of death related to Covid-19. We also enhanced our portfolio with guaranteed assurance plans. As insurers, it is our responsibility to offer need-based products, which are available when the customers need them the most. We saw the protection policies go up 3x to 7.5% of our portfolio in the last year, versus FY20.

Over the years, how have you embraced technology and how that has influenced your marketing approach?

Widespread digital adoption, deep regional penetration of telecom, access to the internet are all factors that have led to new mediums of outreach and connect.

At IndiaFirst Life, we launched the Ghar Baithe Insurance initiative for our customers to secure the lives of their loved ones from the comfort of their home, through end-to-end digital processes and our multilingual website. This online process enables our sales teams and partners while ensuring ‘zero physical contact’ with customers.

Further, we have launched a more robust self-service portal that we encourage customers to use for online renewal payments and many other services easily available and accessible on their mobile devices.

To promote education and awareness, we recently launched ‘Financially Speaking’, a podcast series to connect with a diverse audience on personal finance. We have also enabled video collaboration in Hindi, such as our integration on Netflix through the movie ‘Pagglait’, to bring out the essential role of Insurance in the journey of life.

Most importantly, we have enabled regular and customised engagement with our customers proactively. We are creating smart, multi-lingual content and building responsiveness into the communication, making it more interactive and effective with the support of data analytics and MarTech tools.

Given the constant flux in consumer behaviour, especially in pandemic times, what is your go-to strategy to understand your customers’ unique wants and needs?

#CustomerFirst is at the core of our business commitments. While we inform customers through our campaigns, enable them through processes and are accessible across touch points; we also focus on personalising and listening to our customers. With our goal to hyper-personalise, we created a matrix of 8 Personas with distinct demographic and psychographic attributes, which further enabled us to create a differentiated communication, share calculator links based on profile and have an engagement strategy for different segments of our customer base. We have also enabled a robust Voice of Customer (VoC) program for targeted feedback and real time service recovery at 11 customer touchpoints across the lifecycle. We work towards enhancing customer experience through personalised, targeted communication, information, and feedback to enable customer delight, loyalty, and testimony.

Digital has transformed every sector. How much emphasis do you give to digital to your overall media strategy? Where does mass media stand for you in today’s scenario?

Virtual is now reality. Today, often our first touch point is digitally enabled. We reside in the pockets of our customers through mobile phones. We are transcending literacy barriers through voice and video technology. Every individual has been nudged to expedite his digital adoption curve. We can divide our audience basis their digital literacy and comfort.

We would re-define digital itself. The scope has visibly enhanced to many more avenues – whether digitised, phy-gital or pure digital. The question we ask is whether the customer is getting equally efficient information, solutions, and services seamlessly across physical to digital spectrum based on their preference?

Our socio-cultural-economic fabric does involve a lot of personal validation and comfort. Our ability to adapt to phy-gital demands in an increasingly digital world is imperative for immediate customer satisfaction. At IndiaFirst Life, we have been ensuring remote assistance, digital enablement, and instant gratification to build confidence and certainty in all our customers.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn