What Do Global Investors want from India?

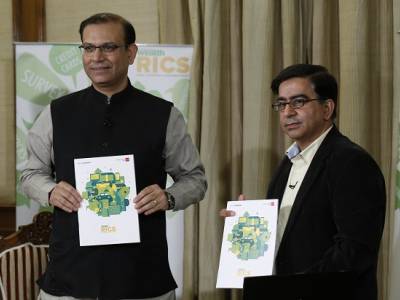

Mr. Siddharth Zarabi, Executive Editor, Bloomberg TV India finds out through an exclusive conversation with Minister of State, Finance, Mr.Jayant Sinha and 9 leading market movers and FIIs from five global locations.

Detailed Transcript

Siddharth Zarabi: In his 8 months in office PM Narendra Modi has travelled the world with one message: "Invest in India". The Bloomberg global network has a one of its kind initiative for you. We are bringing together the most well known investors and India watchers around the world for a conversation with India's dynamic Minister of State for Finance - Jayant Sinha. Mr. Sinha is no stranger in the investing world, having spent decades at the highest levels there himself. Today, Jayant Sinha is on the other side of the fence and will make the case for why India should be seen as the most compelling investment destination in the world. We have luminaries from 5 countries joining us to talk to Jayant Sinha. From Singapore, Sameer Arora of Helios Capital, Jahangir Aziz of JPMorgan and Taimur Baig of Deutsche Bank, From Hong Kong, Michael Every of Rabobank and Richard Harris of Port Shelter Investment. From London - Bloomberg View Columnist and Former Chairman of Goldman Sachs Asset Management Jim O’Neill as well as Arnab Das of Trusted Sources. From New York, Arvind Sanger, of Geosphere Capital. Back here in India, Neelkanth Mishra of Credit Suisse joins us from Mumbai. On the subject of Investing In India, the Government Of India under Narendra Modi's leadership is very clear; we have seen a build up to this in the manner in which you have reached out to the whole world, the promises that have been made, and more importantly the actions and steps that have already been taken.

Jahangir Aziz: What was the government's thinking in pushing for manufacturing through the make in India program because the timing seems a bit odd? If you look globally there is massive excess capacity in almost every country, manufacturing prices have been in disinflation for at least 2-3 years. In China the excess capacity is so much that producer prices have been deflating for almost 35-36 months now. So I would like to understand the reason behind pushing manufacturing because the alternative was to take a very agnostic view, to say that we want employment, we want growth, but we are agnostic between the services sector and the manufacturing sector and that we will level the playfield where-ever growth happens and where- ever employment manages to increase, we will be happy with it. So just wanted to get a sense of what the government was thinking?

Jayant Sinha To Jahangir Aziz: You have to look at make in India in two ways. First, in terms of what it means for the overall economy and really there we talk about the productive capacity of India both in terms of hard as well as soft assets, and then specifically manufacturing. So let me talk about both. First, with respect to India's productive capacity we have seen under the UPA regime an economic philosophy or an economic approach that tended to favour the demand side more than the supply side and we ended up with slowing growth, less investment and actually pretty high inflation which was quite sticky and did not go away for quite a while.

So if we really need to get to 7-8% sustainable growth and continue that for 10 or 12 years we have to build up India's productive capacity, and that has to be both in terms of the hard assets- infrastructure, construction, housing, all of the hard assets and the soft assets which include skill development, talent, our legal system and so on. It really represents in a sense an umbrella theme which looks at India's supply side more so than the demand side. That’s if you look at it as an economy wide term, then we get to the questions of manufacturing. Now as you know well there is in fact excess manufacturing capacity around the world. But our thinking on make in India is that if we are able to manufacture for India's own domestic market where the demand is likely to grow, we are going to be able to absorb whatever manufacturing capacity we had in India simply from the domestic demand that we are likely to see in India. In addition to that our sense is that the manufacturing that we are going to do in India which is suited to Indian conditions is also going to result in products and services that will be of great use to the next 5 billion. If you look at China's manufacturing, you will find that while it is intended for China, but a lot of it is for export as well and it is exporting into the top 1 billion. In India on the other hand, they are manufacturing smaller cars, more affordable motorcycles, solar lanterns that are designed more for India's population, then that is an entirely a new set of markets that we can expand into and that will enable us to be an exporter for those products as well. And then finally with respect to manufacturing, we have a situation where if you look at our GDP, it is quite lopsided. Services is quite large but manufacturing is only about 22% or so, which if we want to have a balanced economy going forward, we want to have the technology, the production techniques and so on, that will enable us to be an economic super power over the next few years, we really have to strengthen manufacturing as well. And so it's for all of those reasons, (1) the overall economy, (2) the important role of manufacturing particularly if we manufacture for our own population and then to make sure that our economic growth itself tends to be much more balanced that we pushed make in India and I would say that it is starting to show great results already.

Samir Arora: My question is more like a recommendation, you may not comment on it, but I would like to suggest that Short Term Capital Gains Tax in India should be completely scrapped. It would take away from having India-Mauritius treaties and India-Singapore treaties for at least 90% of the potential beneficiaries of this. And it will also bring equalization between Indian investors and foreign investors who anyway don't pay and if needed you can always charge a higher STT to make up. It will also take away the discretion from the Indian income tax officials hounding people on whether these are capital gains taxes or business incomes, so that is the big picture. The other question that I had is what is the hesitation in selling SUUTI shares more aggressively? We have these 3 shares which India did not buy as a part of some strategy, they came to us as a bailout of UTI, one of them is a cigarette company and the country or the government should not be seen as benefitting from owning cigarette stocks, so what has been the hesitation?

Jayant Sinha To Samir Arora: Thank you, Samir, for that recommendation. You can be assured that we fully understand all the issues regarding GAAR and regarding SUUTI as well. Those are all under advisement right now, they are all under consideration and we understand all the issues surrounding those matters.

Arnab Das: I have been a long time India watcher and something of a sceptic and I am becoming at least relatively speaking quite bullish, relative to India's own past and relative to other countries, not least because the macro forces in the world are becoming somewhat supportive for India with commodity prices that are down, oil prices that have collapsed, inflation on the way down, and so on. So when I look at this environment I see a government with a strong majority in the lower house but that seems to face some constraints in pushing the reform agenda in the upper house and with the states. And I wondered if you could give us a sense of those constraints would be dealt with and what reforms are most likely to proceed the fastest and have the most impact - the biggest bang for the buck in expending political capital in the reform process?

Jayant Sinha To Arnab Das: Thank you very much Arnab for turning bullish on India. I think your thoughts on that are exactly right. India is in fact going to be one of the more exciting investment destinations globally. In fact one of the figures that I often like to quote is that if we are able to achieve 7-8% GDP growth on a sustainable basis over the next 10 or 12 years, we will have an economy that will go from 2 trillion dollars to 4 maybe even 5 trillion dollars and because GDP to market gap tends to go hand in hand and has been 1:1, we could have a situation in the next 10-12 years where we could add 2 or 3 trillion dollars to India's market capitalization, listed and unlisted securities. And in the last decade we have gone from 1 - 2 trillion dollars of market cap so we have added a trillion dollars of wealth, but over the next 10 or 12 years we could have 2-3 trillion dollars of wealth creation, which makes India a very exciting investment destination and that is why we are out telling people to invest in India and I think for good reason. Now coming to your question about the political scenario in India and what might be possible with respect to the Rajya Sabha, that is the upper house as well as what is possible with the states, let me answer that very specifically. It is absolutely a given that ultimately anything that is blocked in the Rajya Sabha is eventually going to get passed, it is just a question of when. It's simply a delaying tactic that the obstructionist opposition has been engaging in. But ultimately if there is an up- down vote in the Rajya Sabha on any bill that enables us to have a joint session, and the moment we have a joint session of parliament, we have a majority and we can pass those bills. Now what the opposition did in the winter session of the parliament which was quite unfortunate is that they did not even allow an up-down vote. In fact by creating a ruckus in the well of the house of Rajya Sabha, they did not even allow the house to function and as a result we could not have a vote either. I don't think that’s sustainable much further particularly not in the budget session of the parliament which is a very important session with much business to be transacted. So it is not going to be possible for them to use these delaying tactics to prevent a vote. In fact, if they do have a vote and we lose the vote so that we then go into a joint session, they know they will lose there. So the end game is very clear which is that the ordinances that we have had around insurance, around coal, around mining, are going to get passed one way or the other. As I’ve spoken to my colleagues in the opposition, it is quite clear that they recognize what the end game is also. So our expectation is that when it comes to some of the very important legislation that's pending right now, particularly with insurance, mining and coal that we should be able to get it passed in the budget session of parliament.

Then, we come to something which is going to be the biggest change to taxes in India since independence which is GST. It requires constitutional amendments that are it has to be passed by a two-thirds majority in the Lok Sabha and the Rajya Sabha and then it has to be passed by 50% of the states as well. That's a very complicated legislative process but we are quite hopeful we will get that done as well. And then, once we're through the constitutional amendment, we actually have to have GST bills that are passed in parliament as well as in the state assemblies. So that whole process, we think is going to take us sometime, maybe a year or so, but then our expectation is by April 1 2016, we'll be in a position to get GST implemented. All of the other work - the information networks, the thinking on what the rate should be and so on is very well developed already. It's just simply this legislative aspect that we have to get through and that along with the ordinances and obviously the budget will be the very important pieces of legislation that we'll be dealing with over the next few months.

Michael Every: I would like to ask a question about the exchange rates. We can all see that supply side reforms are now taking place in India which is very positive and macroeconomic stability is beginning to take route which is also very positive. But what about the exchange rate? We have a global economic backdrop of competitive currency devaluations and yet ironically, the rupee is currently an island of stability. Of course if India wants to be a manufacturing powerhouse going forward it to bear in mind it's going to be increasingly uncompetitive, relative to other countries around it, I wonder what the view is on that front please.

Jayant Sinha To Michael Every: That's an excellent question. I was just with the RBI governor yesterday meeting with investors, and this was a matter that was discussed at length. It is in fact something we're keeping a very close eye on. You're exactly right to say that the rupee has been a very stable currency and in fact has appreciated against every other currency except the dollar, which means from a manufacturing competitiveness perspective that certainly is something that is causing us concern. We're going to have to see how all of this develops. Obviously currency markets are very volatile and things can change very quickly. But as of now, we do have to find a zone for the rupee that prevents obviously inflation, etc in India, which is one of the things that we are concerned about of course but at the same time does not push us out of the zone of competitiveness as well. Of course the RBI is very vigilant in these matters and you can be assured that the governor is keeping a very close eye on this. We have to find a zone that enables us to be globally competitive and that in some ways is almost dynamic because things keep changing with the other currencies. As of now, somewhere in that 62-65 range I think is a good zone to be in, but again, as I said, it is something that we will have to keep monitoring.

Arvind Sanger: My first question is, oil industry is one I know particularly well and it's been disappointing to be unable to invest in the oil industry with any confidence of any visibility. So is there a plan to put in place a structure where the subsidy sharing, the receipts for different parts of the oil industry whether they are upstream like ONGC or downstream like HP, BP, amongst the government controlled entities that there will be some clarity on that. And frankly we keep hearing that there's been decontrol of pricing and yet, on the same day when the government announces an increase in excise duty, all the PSU refiners announce simultaneous equal amounts of prices being lowered at the pump. If that's not collusion, I’m not sure what is. But I’m hoping there is genuine decontrol coming where each company sets its own prices without coordination. So what is the outlook for the oil and gas industry is it going to be investable?

Jayant Sinha To Arvind Sanger: Whether it's investable or not Arvind is a decision that you, as investors, have to make obviously. I can tell you in general terms where we are headed as far as the energy industry and oil and gas in particular, are concerned. Obviously we want to move to fewer distortions, fewer subsidies in that industry for sure. We've inherited as you know, a very difficult situation in that industry for a variety of reasons in terms of the regime that existed as far as price controls were concerned, in terms of how the various different oil marketing companies operate and then of course in India's overall situation as an energy importer which is very subject to the vicissitudes of the oil markets. So we have inherited a difficult situation and we are working step by step to actually reduce some of these distortions. As you know, we have decontrolled diesel and the parity that we've achieved now with respect to global prices as well as prices in India is now quite close. Obviously we've added excise taxes to it but that's simply because we find that this is a good way for us to not only generate revenue for India but also be able to buffer volatility and that is something we've done in terms of excise taxes for oil and gas. But again, as I was saying at the outset, the idea is to move towards less distortion. Kerosene, for example, is another area where there are quite significant distortions and obviously we had to take all of that into account. Even as I say all of this, and this is of course group of investors and you tend to look at the economics of these matters and look at prices and profits and that's really what you should be looking at, but from a political perspective, and this is perhaps the element of the conversation that typically in these discussions doesn't get full hearing, is also very important. And I can tell you when I’m on a campaign trail to be able to say that oil prices are coming down or oil prices are being kept under control, that diesel prices are under control - these things mean a lot to people. And if we have incredible volatility in these prices, it affects our farmers and our common people quite a bit. And so because of that sensitivity, because of those challenges that we have in terms of managing those expectations, we have to move very carefully and delicately when it comes to these commodities which are very integral to the life of a farmer or common person.

So that is part of the reason why whatever steps we have taken, we've taken very carefully. I'll close by telling you a little about what we're trying to do with LPG. As you know, the number of LPG gas cylinders you can get on subsidy has been a matter of very contentious debate. If you remember, it had been brought down to 9 and then raised to 12, and then there was some discussion of doing it at 6. So there has always been this push and pull about how much subsidy should you get for LPG cylinders. What we have done as a government is that we have made sure that when you buy an LPG gas cylinder you are paying market price. And it is only by having the direct benefit transfer that you can actually get that subsidy back and that's another way of making sure that market forces are working, people understand what the actual price of an LPG gas cylinder is. And then by removing the leakage in the corruption that happens if you were to have subsidized prices. So, we are, as I said, moving towards reducing the distortions and the wrong prices that are across this entire industry. But because of the political sensitivities and all the balancing things that you have to do in terms of how you affect these reforms, it is a gradual process.

Siddharth Zarabi: I want to ask you about the sudden change we have seen in the crude oil prices. Could you comment about the crude oil prices globally and we have also seen the Indian basket sort of make this steep jump virtually overnight, over the last 24-48 hours.

Jayant Sinha To Siddharth Zarabi: No, I think there again we are trying to respond to market signals and that is in fact a manifestation of that. I would like to come back to another point which is that all of us have an understanding of economics and recognize that prices are the way you signal scarcity and the way you signal the relative value of a good or a service. So we should take a lot of comfort from the fact that when PM Modi was CM of Gujarat, he put in place, particularly in a sensitive sector like electricity market linked prices. And that in fact made a huge difference in Gujarat. Of course he set up a separate feeder for electricity for farmers so that they could get subsidized and 24x7 electricity. But as far as the commercial, industrial and residential customers were concerned, there was effectively no subsidy as far electricity was concerned. But they got reliable 24x7 electricity supply and they were very happy with that. So that is very much part of the makeup, the DNA of our government and the way the PM thinks about this.

Neelkanth Mishra: Drilling down from Make In India, actually one of the most important challenges for India, and a part of the BJP manifesto, is also 'Housing For All By 2022'. If I may really over-simplify what happened in the US between 2001 and 2006; and then in China in the last 5 years - almost the entire boom came from construction in real estate, better quality houses for people. In India we have 7.6 crore houses in villages that are semi-pakka or kachcha, 1.4 crore houses in urban areas which are in slums. It is part of your manifesto. There are 7 years left. So if I just add the two, we're talking about 9 crore houses in 7 years. Given that it is a state subject, it is an urban subject but not a central subject... What can the central government do to accelerate the construction of better quality houses? It seems to be a win-win - the activity created by this, will boost the GDP; will help Make India and everything as well.

Jayant Sinha To Neelkanth Mishra: That's an excellent question and it is very much part of our manifesto, part of what the PM has communicated through many of his speeches which is, providing housing for all by 2022; 75 years after we gained independence. We think that there are 3-4 ways of doing it which will enable us to do it in a way hopefully that will prevent the kind of housing bubbles that we've seen in other countries. You only have to go back to the NDA Government from 1998-2004 to see how this can actually be done. During that period what we were able to do was we were able to bring down real interest rates dramatically, there was that tax deduction as well for mortgage interest that made things a lot cheaper. We did work as far as land acquisition, and the Land Ceiling Act in the urban areas so that made a lot more supply possible and then the third thing that we did was really opened up and liberalized the capital markets and made it possible for housing finance companies to be a lot more successful in terms of what they were doing. So our sense is when we try and get to this very ambitious target, which is building almost 75 million homes over the next 5-7 years that we will have to have a combination of such measures. Which is interest rates have to come down, we have to strengthen our housing finance institutions which we are working on, we'll have to come up with the right technologies that will enable us to able to build houses very quickly and in a pre-fabricated way so that we can put it in every village, can do it in slums. We also have to do a lot as far are land acquisition and land reforms are concerned. There you see that we've already said in the land acquisition ordinance that when it comes to public housing, it will be considered a part of public purpose and eminent domain can apply there, so we can get tracks of land which we can then use for building homes very quickly. So again it's a combination of things that we have to do, definitely it will be something that we will be tackling soon on a mission mode. That's why we have confidence that we can do it. Just to give you all some comfort on our ability to execute things on a mission mode, I will direct you towards what we've been able to do on the Jan Dhan Yojana. PM Modi had said on Aug 15, 2014, that by January 26 2015, he wanted to ensure through Jan Dhan Yojana that every household in India had a bank account. Between Aug 15 and Jan 20 - before the deadline that he had given us - we were able to ensure that 99.74% of households in India had a bank account. So we took this on in mission mode, we really worked at it. The PM was talking about it yesterday when I was at a dinner with him, and he said that he really has this execution mindset. He wrote to every single bank chairman personally and asked them to really put all their efforts behind making this happen. Once we take something on in mission mode, the PM puts his weight and energy behind it and you can be rest assured that we will get it done.

Taimur Baig: Let me switch gears a bit towards human capital & education. India's education attainments lag that of ASEAN countries, of Sri Lanka and even Bangladesh had more or less caught up with India - in the quality of education and literacy. So one key question is how India, especially with Make In India in mind does, enhance human capital and related to that is will India allow FDI in education?

Jayant Sinha To Taimur Baig: Obviously this is a very large subject Taimur and your question of course covers the waterfront so it is hard to understand how to kind of pick this off and get going on it. But of course as you know Skill Development is a very important priority for us, and we in fact have a ministry on for skill development and entrepreneurship that is specifically made for ensuring that our young force, workforce has the skill to be employable and to be able to join the workforce in a productive manner and get good, high quality jobs. So skill development is of extraordinary importance to us and again in something which is so vast and so expansive, you have to come at it in 3-4 different ways. One is this ministry that I am talking about, skill development; the other area that we are looking at is the vocational training, strengthening vocational training institutes, putting in place an apprenticeship program like you have in Germany so the whole area of vocational training is something that we are focussing on as well. The third area we are focusing on is just education as such... whether it is elementary education, secondary education or even university education, we have to do tremendous amount of work we have to do. The latest Annual Status Of Education Report has been quite gloomy as far as India is concerned. So all in all, education is going to be a very important priority for us, as I said. To build India's productive capacities, in terms of both hard and soft assets, building up human capital is of extraordinary importance for us. But again it is not something that you are going to turn around very quickly; we have something like 700-800 million people under the age of 35 who are in need of skill development, vocational training, and education of various kinds. We have to put in place an entire infrastructure, ecosystem of institutes, private sector trainers and educators and so on to be able to do this. So it is a major effort and we are engaged in it but of course as I said it is going to take quite a while. Now let me come back to your question about FDI in education. As you know, there was a bill that was introduced in parliament about FDI in education. I know the HRD Ministry is considering this right now. So let us see what further action they take in terms of FDI is concerned.

Richard Harris: Sitting in Hong Kong as I am, a question about China. I am struck by the fact that next year analysts are looking at GDP growth in both China and India being the same at around 6.5%. So China is starting to slow and India looks as if it is speeding up. How do you look at China in terms of the overall effect on the market especially with regards to attracting FDI into India that might otherwise go into China?

Jayant Sinha To Richard Harris: Well I think as far as the GDP growth rates are concerned, it may very well be that India's GDP growth is understated and China's is over stated. I have read reports which suggest that China's GDP rate is quite a bit slower than what is officially reported. So it is very hard to tell what numbers one should be using. India has a very large informal unreported economy. So it is quite a high likelihood that our growth rate is actually higher than what is actually reported. With respect to our own economic discussions and our own positioning related to China, there are many aspects to that relationship. We are a large importer from China, of Chinese manufactured goods and services. China imports in turn imports a number Indian raw materials, but less so of Indian finished goods and services. As far as terms of trade are concerned, they are in China's favour and not in India's favour. We have to ensure that the terms of trade are a lot more balanced than what they are right now, so that is one set of issues. There is another set of issues that relate to China's export led growth. You see a variety of industries whether is steel, plastic and so on; China is looking for growth in these areas where they have significant excess capacities - to expand into markets like India. It is difficult for our domestic industries to be able to absorb the Chinese production and excess capacity that is coming our way. So that is the second area that we have to consider closely. The third sense of issues with China is about natural resources, and how both India and China need resources which do not exist in the country. Oil is a good example of that where we are competing with each other. Ultimately, what President Obama and PM Modi said, we are looking to establish rules based order. We would all countries to play by certain rules so that all could prosper. So if we come in a situation which is kind of counterproductive with one country versus country, we have to make sure that everybody is following this rules based architecture.

Jim O'Neill: I want to ask so many questions, but what I am intrigued to hear you response to is... Do you sometimes feel a little bit, not intimidated, but anxious? At the moment there is this very positive mood about India from the world's financial markets. The perception of a virtual circle with your government improving investor sentiment and the drop in the oil prices, there is a lot of goodwill about India around the world at the moment. Is it something you regard as intimidating? How can you satisfy markets in a positive way against this kind of very supportive environment?

Jayant Sinha To Jim O’Neill: That is a great question Jim, and of course expectations are terrifyingly high right now! You can well imagine I am spending a lot of sleepless nights before the budget worrying about market expectations. We are indeed in a sweet spot as far as India is concerned. India is a very big importing country and a big net importer of commodities starting with oil. So the commodity cycle being what is its right now in terms of prices and supply, is obviously is helping us a great deal. The sense is that the C.A.D. is likely to be down to around 1% next year. We may even have a few quarters where we run a surplus. That is a great situation to be in. Inflation coming down globally is spectacular for us. The fact that the world is awash in capital and India has a trillion dollar infrastructure, investment need is also a great situation to be in. Now the challenge in all of this is the in execution and delivering on these lofty expectations. What I am reassured about in this regard, is that we have a PM, a cabinet and political leadership that totally understands this and is determined to deliver in this regard as well. I just told you about PM's Jan Dhan Yojana that we will make sure that in every household will have a bank account in India and we got that done. The PM is an extraordinary executor. He is focussed, decisive, he leads from the front, he is absolutely clear when it comes to directions and signals that he gives out. So we are lucky to have someone like him leading the country because as you said, there is a tremendous tail wind that India has right now. All that being said, we have to temper expectations. India's economy is a $2 trillion in dollar terms and in purchasing power parity terms; it is a $6-7 trillion economy. It is a vast economy and it will take some time to turn the battleship around. We have inherited from the previous government a lot of difficult structural challenges as well. The NPAs in our banking sector, the mess in the education sector and what I was speaking to you earlier in terms of the distortions & subsidies in oil and gas are all examples of that. We have many intractable, knotted up and difficult problems due to 10 years of mismanagement and poor governance that we got from the previous government. These are very difficult problems to solve overnight. It is going to take us time, and that is what we have been doing for the past 8-9 months. It is probably going to take us this budget to get out of remedial mode. All of last year we have been on a remedial mode just to fix the problems that we have inherited. Going forward with this budget we will be able to take up things that are new and more innovative.

Samir Arora: Jayant, you recently organized this rather innovative PSU get together in Pune. What were the practical takeaways which we can see in the next 1-2 years, or even shorter?

Jayant Sinha To Samir Arora: Yes we had a wonderful workshop in Pune for public sector banks. The 2 very important things that came out of that meeting were that firstly, we made it very clear to our public sector banks that unlike the past where there was tremendous govt interference and involvement - in things like making the decisions on various loans, that it should go to this party versus that corporation - as far as our government is concerned, there will be no involvement in any of those kinds of decisions. Those decisions will be made in a way that is completely driven by commercial logic. Sadly, in the previous government, that was not the case. So we made that very clear to our banks. So that was one very important thing.

The second very important decision that we made there was that we said that we will go down the path of appointing chairmen and managing directors of these banks that will have significant tenure and then they will be then able to operate these banks with a slightly longer term focus than previous chairmen and managing directors were able to do. And so that will give them the space and the breathing room they need to put in place viable long term strategies. Now both of these two changes are really the precursor, if you will, for putting in a place a bank bureau as was suggested by the PJ Nayak Committee report and which you might want to look at, if you really want to understand more about how this roadmap could evolve. But if we have this bank bureau, it gives us the opportunity to work with these 27 public sector banks, to understand what is it they need to do to strengthen their talent and performance abilities, to be able to raise capital appropriately at the right evaluations and to come up with differentiated strategies for each of these banks. So, that is the roadmap that we are working towards and obviously our goal is to be able to strengthen our public sector banks to the fullest extent possible and make sure that they are successful in a very fast evolving financial landscape in India.

Siddharth Zarabi: The last round of questions, if they can be asked together, and will be answered one by one by Jayant Sinha.

Jim O'Neill: This time, next year, what would you have wished we would all be saying about India in the year that is going to happen?

Richard Harris: Minister, will you make it easier for foreigners to invest in India's domestic markets?

Taimur Baig: Will there be a new fiscal responsibility law?

Neelkanth Mishra: Currently, growth indicators are really bad; all corporate results have been really bad. What can the government do to revive the economy in the short term? The medium-term solutions of course you have outlined.

Jayant Sinha To Jim O’Neill: Well, I think it is very important for us to set a new direction for India's growth. What we would like to be able to do in the intervening period of time, in the next 12 months or so, is to be able to put in place a new framework for India's growth model. As I said earlier, our thinking is that we really need to focus on the supply side, build up India's productive capacity, and make 'Make In India' successful. We would like to be able to demonstrate over the next 12 months that despite the scepticism about 'Make In India', despite the scepticism about India's ability to be a world leading manufacturer and to innovate in India, we want to make sure that that in fact is successful. For that I think infrastructure and skill development are very important. So we want to show very good progress in that regard.

Jayant Sinha To Richard Harris: I think we have very open markets in any case, particularly on the equity side in India. As far as FDI is concerned, we have one of the most liberal FDI regimes in the world. So I think we have already done a pretty good job in making India very easy to invest in for foreigners. But of course we want to ensure that we are able to meet every global benchmark and are absolutely not just open for business, but welcoming of business around the world. So we definitely will continue to work in that regard.

Jayant Sinha To Taimur Baig: As of now there are no plans to change or bring into life a new FRBM Act. I think what we have right now is quite adequate. But of course what is more important is the intent of the government and our intent to be prudent in terms of our fiscal policies, which the honourable PM and the honourable FM have suggested multiple times. We are definitely going to proceed with that in mind, which is to be focused on fiscal prudence, not mindless populism.

Jayant Sinha To Neelkanth Mishra: I think is very important for us to dramatically increase public investment. Public investment in India has gone down from about 2% of GDP, which is what it has been, to 1% of GDP. We think it is important to increase public investment. It is obviously going to have multiplier effects in the economy in terms of demand for cement, demand for steel, demand for labour, and demand for skilled services of various kinds. So we think that multiplier effect will increase capacity utilisation and also then kick start the private investment cycle. So in the short run, almost in a Keynesian way, we think public investment is going to quite important to revive the economy.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn