What is wrong with majority of CEOs?

Authored by Value Investors Ramaswamy, Tanvi Mehtaa and Sudaarshan .

Warren Buffet made the following observation: “the heads of many companies are not skilled in capital allocation, and … it is not surprising because most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration or, sometimes, institutional politics.” Once they become CEOs, they face new responsibilities.

They now must make capital allocation decisions, a critical job that they may have never tackled and that is not easily mastered. To stretch the point, it's as if the final step for a highly-talented musician was not to perform at Carnegie Hall but, instead, to be named Chairman of the Federal Reserve.”

Surprisingly little over 3 decades nothing has changed, and this still remains the major problem with majority of the CEOs, fewer than five out of the 100 CEOs on HBR’s 2014 list of best-performing CEOs even mention “return on capital” on their official biography.

You ask the CEOs his or her priorities, most will say GROWTH. Growth seems to be a panacea for them without understanding; growth can also be a weapon of profitless prosperity. Which in most cases CEOs seem challenged to even understand the dynamics of growth?

In the Listed space most CEOs want stock price appreciation, dutifully understanding how stock price moves eventually will make them understand to do a better job but sadly results don’t speak that way. Terrible acquisitions have happened on the shadow of growth, and have drained corporate resources. Most CEOs need to understand that bottom line are not cash throw ups at best its intention.

Reported profit would seemingly be irrelevant to the capital provider, unless the capital compounds itself into a high returns leading to cash pay-outs. Growth is looked as gelignite because it seemingly gives you the optical satisfaction of converging capital providers and business managers with promise of something remarkable. The ugly side of growth is if wrongly pursued it can surely compound a lot of problems.

The critical thing to understand is, growth compound’s the cash needs, makes the optics look pretty, but reported profit at best is a promise, at the end what counts in a business is what rate the business reinvests and at what rate it compound’s capital. Simple but not easy.

Most CEOs don’t even understand the basics of Return on Capital employed, Return on Equity and Competitive advantage. Most Business heads abuse the use of word “Competitive Advantage” but probing little deeper gets you nowhere, in fact you later figure out that understanding of competitive advantage itself is deeply flawed because it has no financial metrics and how on earth can you pursue a strategy without understanding the deep financial implications.

What is the Job of a CEO? Capital Allocation and only Capital Allocation. If this is his or her job, then he or she needs to understand deeply that its not Growth, but Growth tied with Return on Invested Capital (ROIC) drives value. Every CEO has a fiduciary responsibility to deliver shareholder value and take prudent capital allocation decisions but the real question is how many of them truly deliver on that premise?

The primary responsibility of a CEO is to figure out where his or her business stands in relation to the opportunity, pursuing opportunity just because it’s available, is very much like doing a stock buyback when your stock is peaking in the capital market and is trading significantly above intrinsic value. Connor Leonard has presented an outstanding framework for an investor, but this can seemingly be used by all the CEOs to understand and deliver value.

As Connor Leonard has brilliantly written on Legacy Moat and Reinvestment Moat.:

Connors goes on to describe this with elite precision. Outstanding companies are often described as having a “moat”, a term popularized by Warren Buffett where a durable competitive advantage enables a business to earn high returns on capital for many years. These businesses are rare and form a small group; however I bifurcate the group further into what I classify as “Legacy Moats” and “Reinvestment Moats”. I find that most businesses with a durable competitive advantage belong in the Legacy Moat bucket, meaning the companies earn strong returns on capital but do not have compelling opportunities to deploy incremental capital at similar rates.

There is an even more elite category of quality businesses that I classify as having a Reinvestment Moat. These businesses have all of the advantages of a Legacy Moat, but also have opportunities to deploy incremental capital at high rates.

What we can understand is Legacy Moats are Coke, Walmart, (both grow 3-5%) Reinvestment Moat is Amazon, Google, Facebook (all growing 20% and upwards) the most critical is not growth; it is opportunities to deploy capital at high rates. Coke has dabbled into all the types of other business with little success; the only thing which has remained a fortress is the soft drink business with outstanding margins and slowing growth.

The fundamentals of Growth in the long term is a function of ROE, ROIC and to drive growth with keeping Balance sheet light and with lower debt is not easy, and very few managers are able to do this successfully. Fundamentally, a company will find it impossible to grow beyond the ROE, in case of dividend paying company. So, the growth rate of the company in steady state would be Growth = ROE (1- Pay-out Ratio). Now think a new CEO comes to a large company and wants to drive growth (usually this is the agenda of majority of CEOs) irrespective of any understanding of financials. This is the Financials given to you and CEO has decided 40% Growth for year 3.

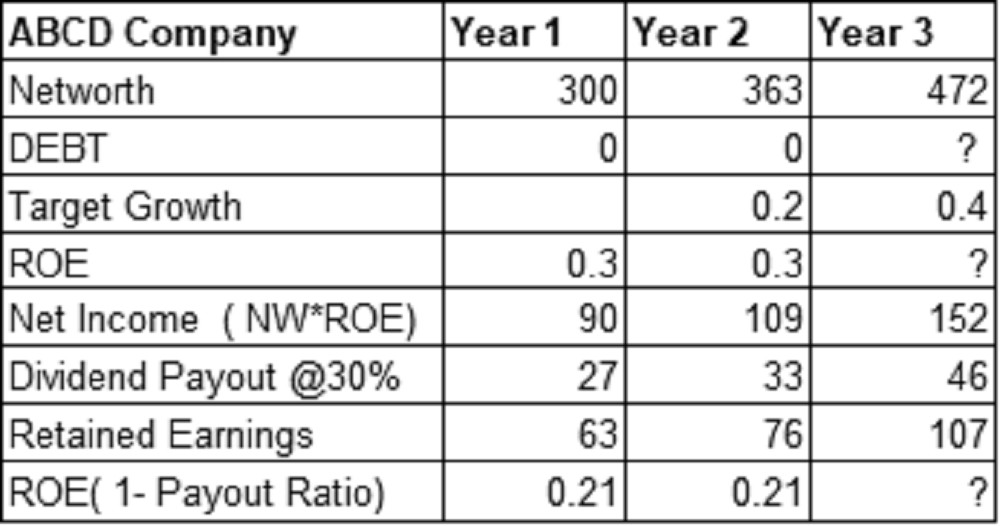

In the first year the company has a shareholder funds of 300CR and delivers ROE of 30% and has a dividend pay-out of 30% (so a Net income of 90CR, 63 CR is retained and 27 CR is paid out as dividends) ROE of 30% *(1- 30% of DPO) = 21%. Repeat the second year, and now 3rd year Growth CEO is charged to grow profits by 40% not 21%.why? Ambition?

So Targeted Growth on profits moves up by 91% (Growth from year 1 to year 2 was 21% on profits) Now we have Net worth of 472 CR (363 + 76) Now 472 CR of Capital with 30% ROE will at best provide you with Rs 141.6Cr of Profits. But Growth CEO wants 40% growth in profits. So, 40% growth in profits will be 152.6 CR (109*1.4) Difference between the two figures is (152.6 -141.6) = 11 Cr Now the big question is How much Debt to take to fulfil his ambition?

The company as said earlier has a ROE and ROCE which is 30% so, assume a cost of Debt of 8% and Tax shield of 30% so cost of debt comes down to 5.6 %. Adjusting the ROCE 30% the net addition to the profits will be 30% - 5.6% = 24.4% Additional Profits to be garnered to fire up the Net Income engine is 11 CR so how much debt the company needs to binge on 11/ 24.4% = 45.08 CR.

Understanding Growth is the most critical aspect of a CEOs Job and combining that with Capital allocation skills will eventually elevate the CEO to an unimaginable level. Very few get this, and hence very few are unimaginable too. Profit is not growth, its cash flows which matter eventually.

JP Dimon brilliantly puts it; a company could be losing money on its way to bankruptcy or on its way to a very high return on invested capital. Diligent management teams understand the difference between the two scenarios and invest in a way that will make the company financially successful over time. You need to invest continually for better products and services so you can serve your customers in the future. Earnings results for any one quarter or even the next few years are fundamentally the result of decisions that were made years and even decades earlier.

Next time when you hire a CEO, make sure he not only has his Growth figures which is what most CEOs would project, ask him what was his ROIC and how much of shareholder returns did he deliver during his tenure, trust us most CEOs would get ejected here itself, and if some Talent does come prepared with this, then it’s a no brainer for you to hire him.

To conclude if the CEO lacks Capital allocation skills, and you happen to hire him, then this is what is likely to happen, “CEOs who recognize their lack of capital-allocation skills (which not all do) will often try to compensate by turning to their staffs, management consultants, or investment bankers. Charlie and I have frequently observed the consequences of such "help." On balance, we feel it is more likely to accentuate the capital-allocation problem than to solve it”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn