What makes a desirable streaming brand in India?

Kantar has just launched their CX+ study, which evaluates the performance of companies in the Telecom, Media and Technology sectors, using Kantar’s unique CX+ index. The CX+ index looks at brands in the context of their category and uses customer centricity as its core to evaluate CX performance of a company. According to the study, just 37 per cent of consumers believe that companies offer truly customer-centric experiences.

The Kantar CX+ study has evaluated these companies based on their experience scores on dimension that are critical to the consumer journey, such as: clarity of brand promise; empowered employees; empowered customers; creating lasting memories; reinforcement ofbrand choice. Additionally, the study also identifies each brand’s Experience Gap – which quantifies the difference between the Brand Promise and the actual customer experience delivered.

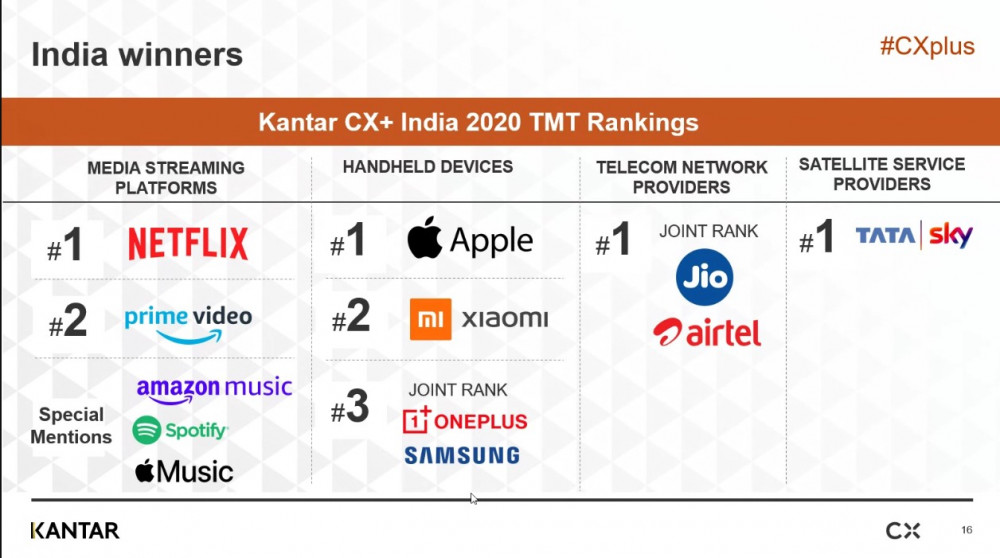

Here are the leaders in the TMT sector in India, according to Kantar CX+ 2020 study:

On the sidelines, Adgully caught up with Sushmita Balasubramaniam, Domain Lead for CX and Commerce - South Asia, Insights Division, Kantar, and Soumya Mohanty, Chief Client Officer, South Asia, Insights Division, Kantar, to understand what makes for a desirable streaming brand in India.

It was our understanding that for streaming services the user experience (UX) and customer experience (CX) were one and the same because the service was delivered digitally. But the Kantar spokespersons mentioned that not only did customers differentiate between the UX and CX experience, but the CX experience was equally if not more important to UX. More than 50 per cent of the customers were willing to switch to another brand if their CX journey on the streaming service was found to be lacking.

What were the factors in the viewing experience that made customers rate OTT services highly? (From most desirable to least desirable)

- Faster buffering speeds

- Better streaming resolution

- Greater variety of content (across genres, formats and languages)

- More content to choose from

- Access while travel

- Availability on devices

- Interactive and immersive content – social/ augmented reality/ virtual reality

- Better viewing recommendations

Kantar reported that in a shocking one-third of the cases, users tried to get in touch with the OTT platform via call centers if they faced an issue in any of the above user experiences. The last interaction has an exceedingly important role in creating emotional engagement with an OTT platform that helps engage, retain and drive value. Most customers were not only willing to pay more for services such services, but were also more willing to share their personal data to improve the overall CX experience.

Another key dimension of the CX evaluation, where streaming services were clearly lacking, was clarity in the brand promise. This was causing a confusion among customers when it came to selecting an OTT platform to subscribe to.

The leaders in the Kantar CX+ index in the category media streaming platforms exhibited the following strengths.

- The leader brand is seen as being 1.6x times more customer centric than those at the lower end of the index.

- The leader has 1.8x higher engagement levels

- OTT platforms that lead in the CX+ Index are 1.7x more likely to be recommended than those at the lower end of the index.

- The likelihood of their customers remaining loyal to them increases by 1.8x

- Even for a newer category like streaming platforms, basic CX attributes emerge as top drivers of CX - ease of getting in touch, value for money, customer centricity and download / buffering speed

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn