What makes Facebook the Moat Machine

Value investors Tanvi Mehta, Ramaswamy Ranganathan and Sudarshan Rajan attempt to distill the huge impact of audience coagulation, leading to significant competitive advantages for Facebook.

What is Facebook? A social media platform to connect, a media company, an advertising company.

To answer the above, FB is a combination, majority of its revenues are from advertising, so there is importance of reach with its no of users globally.

Advertisers seek reach and FB delivers that with great effect. FB is somewhat a media company, which generates its revenue from advertising by providing a huge platform to advertisers, but it also differs from traditional media companies, as all the content on FB is user based, and most important, free. This is why John Malone once said that Facebook has the best business model ever created.

Let us try to distill the huge impact of audience coagulation, leading to significant competitive advantages for the firm. The concept of competitive advantage lies at the core of business strategy; hence we would start the basic discussion on how has FB grown on its revenues and what are the margins it is generating. Margins and Market share or either one is great indicator of competitive advantages being present depending on the structure of the industry.

This kind of users globally is a dream for any firm, this is huge moat and with network effects.

The firm derives 95-98% of its revenue from advertising and the sheer size of the network acts like a magnet to get people and businesses to join, and from there on law of gravity takes over and coagulates the consumer to stay.

This becomes extremely hard to drop the place, especially where you have your friends and family as part of it, psychologically it becomes a task to leave. Juxtapose that for a business, the same reason, it is impossible for a business to leave where you have 2.89 billion consumers. The strength of the network compounds exponentially as it grows and with such a huge base. FB has been growing its user base consistently since 2015, as compounding now even of a small percentage would strengthen the MOAT to a fortress.

The critical thing to measure is what this has done to the firm. The vital check points are Profitability and Market share. The market share part is a no-brainer; no media platform has grown itself into a such a strong consumer captivity machine. The next source is to figure out the Profitability aspect to be consistent with the audience agglomeration.

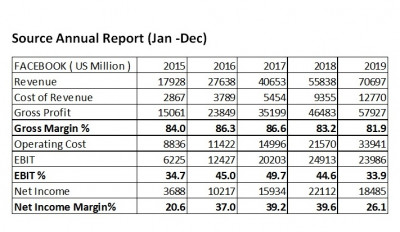

The Margins of FB have been stellar, to say the least. Gross margins of 80% on an average are a significant indicator of MOAT. The Sales of FB itself has compounded magically from 17.9 billion to 70 billion in 2019.

The Net Margins and Operating Margins have been spectacular, to say the least. The drop in Net income for 2019 is largely due to the $5 billion fine imposed on FB. FB has been increasing its R&D spends significantly. Just to give you a factual data, R&D spends in 2017 was $7.7 billion, the same figure in 2019 was $13.6 billion.

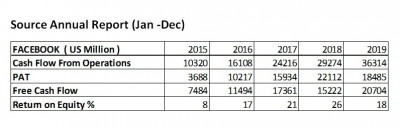

When analysis of Market share and profitability are consistent with one another as is the case with FB, the case of competitive advantage is robust. It is a criminal understatement to make that FB has been profitable. Facebook has been delivering a robust free cash flow in regards to its PAT and its return on equity has been robust to say the least.

The Free cash flow has consistently been above PAT over a period of 5 years barring 2018. Cumulatively if we match PAT and Free Cash Flow, Free cash flow has been 2 Billion above PAT. FB has been debt free and most of its capital represents equity.

The company has huge potential from Instagram (the growth engine has just started) WhatsApp, which has close to 1 billion consumers, is yet to be monetized. Over a 100 billion messages are sent across the company’s services and this remains main tool for communication in many countries.

We strongly believe that with such a huge market for digital advertising, migration which is happening and the way consumer behaviour is changing, FB compounds more cash than it can use; ($54 billion) is the cash on its books for 2019 ending. We strongly estimate that with huge opportunity for digital, operating leverage and free cash generation, FB is a Moat Machine.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn