Who is winning the Short Video War?

June 29th 2020, the day of the Great Purge: As border tensions simmered between India and China, India’s IT Ministry led, what’s been called a ‘digital surgical strike’ – kicking out 59 Chinese applications from the Indian Internet ecosystem.

The world’s most valuable startup – ByteDance was staring at losing its largest market outside China. India accounted for one-third of TikTok’s users worldwide. And poof – it was gone. Before ByteDance could mull over its crushed ambitions, Trump was already aiming to take down TikTok in the United States.

TikTokers in India, especially influencers on the platform, were shocked and in a frenzy to find alternatives. While users jumped on to several apps to keep scrolling, the night of June 29 was unending for TikTok stars. Imagine spending months on building an audience and even a living on a platform, and the next day – everything vanishes!

India needed TikTok, and Indian app makers answered. #AtmanirbharBharat (or ‘self-reliant India’) unleashed the short video apps race – TikTok clones emerged from everywhere.

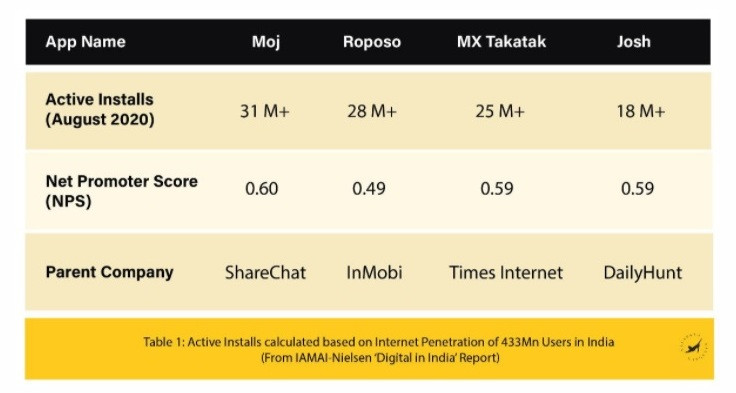

InMobi’s Roposo was positioned to rise, getting TikTok stars to announce their platform switch right away. Mitron and Chingaari led the headlines. ShareChat, freed from ByteDance breathing down their necks, launched Moj. DailyHunt, struggling to make waves in the ecosystem, released Josh. Times Internet wasn’t taking any chances and launched two services to fill the TikTok void. ‘Gaana HotShots’ leveraged the music streaming service with a special section in the Gaana App. MX TakaTak (Because TikTok didn’t sound Indian enough?) sprung up as a new app using the MX Player brand to shoot to the skies. Too much to take in? Let me break it down for you.

Moj

Backed by Twitter, ShareChat is one of India’s leading regional language social networking platforms. ShareChat has now emerged with renewed vigour to take over the ecosystem and solidify its presence. Since ByteDance’s applications – ‘Helo’, a serious rival to ShareChat, and TikTok were out – ShareChat wanted all the cake.

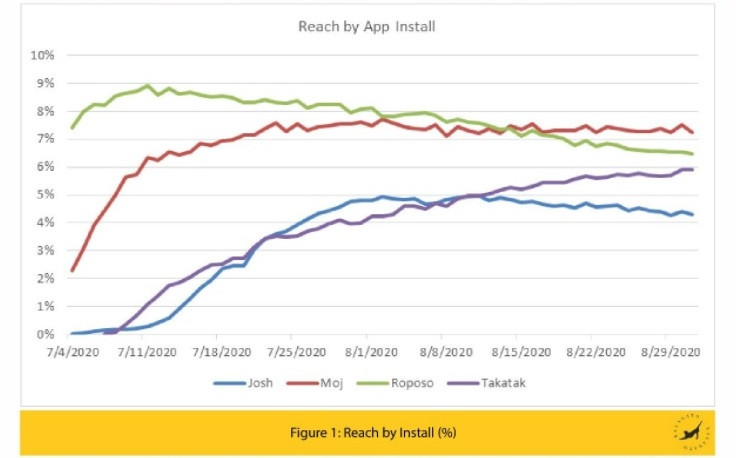

ShareChat’s Moj app was released almost immediately after the ban on Chinese apps, and has quickly risen to the top of the charts, unseating Roposo. Moj enjoys the most favourable rating of the four in the Play Store – however, users still lament the weak video creation tools in the app as compared to erstwhile TikTok. ShareChat, let’s have some rainfall and flower shower effects please?

Roposo

Roposo began as a fashion social network, but couldn’t get the glitter. Roposo pivoted to become a short video app, which InMobi acquired in 2019. InMobi’s Glance content service was already sitting on tens of millions of android lock screens and claimed to have DAUs in India lower only than Facebook and YouTube. Glance told InMobi that ‘short video’ really worked, and InMobi went all in.

After the app-ban, Roposo was the leading incumbent – but before long, all of India’s dreamers rushed into the space. Roposo’s user numbers grew significantly, but then flatlined. The big question is – how will Roposo hold its ground with sharks circling around? Already, Roposo seems to be struggling with ensuring a supply of the lifeblood for any short video app – Music!

MX Takatak

Times Internet, India’s Internet behemoth, looked at the TikTok opportunity. And replaced the ‘i’ and ‘o’ with ‘a’. TikTok -> Takatak. But what is more important is MX. In 2018, Times Internet spent over a thousand crores to gobble up a majority stake in MX Player to launch it as an OTT service. Today, MX Player claims over 200 million monthly active users making it India’s largest OTT service.

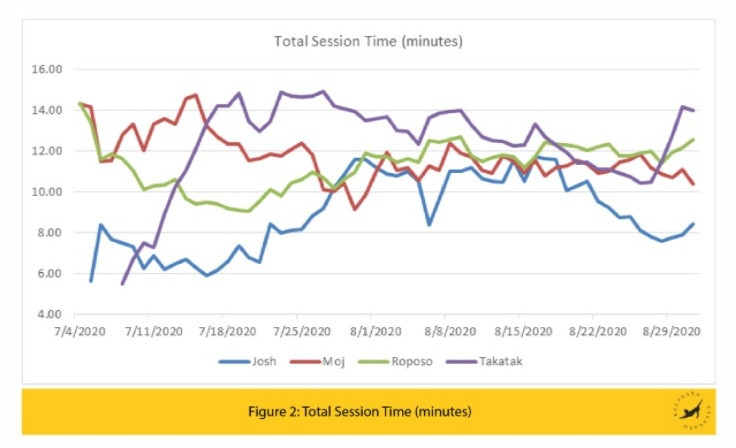

MX Takatak, therefore, jumped in standing on the shoulders of the MX Player brand. MX Takatak has seen a steady rise – and continues to rise, also leading the apps in the most time spent per day. MX Takatak is a serious contender for the top spot if it can scale up video creation capabilities for users and keep growing.

Josh

The story of Josh isn’t as exciting as the app sounds. DailyHunt, with ambitions to sit at India’s ad-giants table alongside Google and Facebook, hasn’t quite been able to crack the nut. Despite counting ByteDance itself as an investor, DailyHunt’s foray into short-video has been troubling.

While the growth of Josh seems to have flatlined – and even declining, what is more worrying is the time spent on the app. Users spent only about 8 minutes (per day on average) on Josh as compared to 12 minutes a day on MX Takatak. Josh trails the pack in both areas – and lacks basic engagement features like the comment box. But as a short video app backed by ByteDance itself, it’s hard to count Josh out of the race yet.

This guest article by Sidharth Rath, Founder of Swasthya Plus, a health media network for Bharat, is republished on Adgully kind courtesy Kalagato.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn