Will COVID-19 shake up the 70:30 ad-to-subscription skew in print media?

A CRISIL ratings report released in May estimated that COVID-19 will shave Rs 25,000 crore from M&E industry’s revenue this fiscal. The analysis is based on 78 media and entertainment companies rated by CRISIL.

Earlier this month, the Indian Newspaper Society, an industry body representing 800 publishers, reported that two months into lockdown, its members have accumulated close to Rs 4,500 crore in losses and if the trend continues, additional losses of Rs 12,000-15,000 crore would pile up.

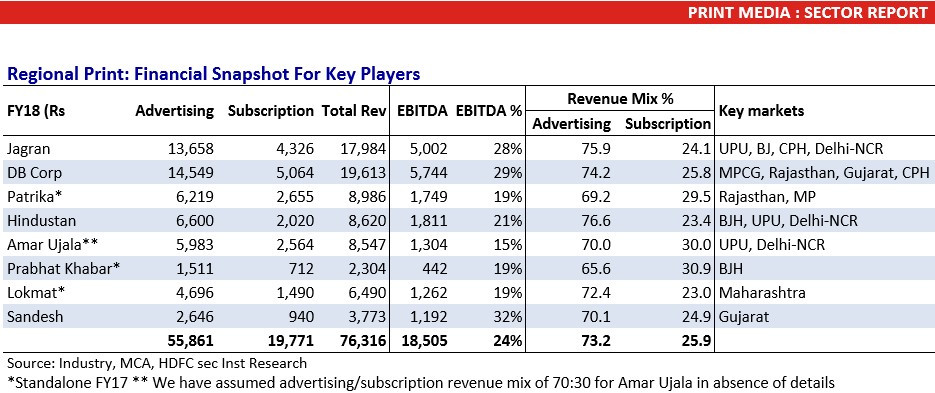

Advertising-to-subscription revenue ratio in Indian print media is 70:30 and the skew towards advertiser support has severely affected print media. Overall ad spends on media will decline by ~18 per cent this fiscal. It will drop by ~25 per cent if you exclude digital ad spend (CRISIL Ratings).

The plummet in ad revenues has physically manifested in newspapers as both English and Regional players shrink their publications down to 12 pages due to the high cost of imported newsprint.

In our previous report, we had discussed how regional print players are better poised for revival as their circulation numbers are robust and they deliver in terms of reach. Prominent regional print players report some encouraging facts about newspaper readership during the lockdown.

Satyajit Sen Gupta Chief Corporate Sales and Marketing Officer, Dainik Bhaskar Corp, said, “We have noticed that time spent on our newspapers has nearly doubled in the lockdown period. Engagement levels are high as readers consider print as the most credible source of news and facts. As we get out of this lockdown, we can see that Tier 2, 3 and 4 cities and towns are going to recover much faster. The effect of the pandemic has been less in these areas with mostly green and orange zones and the nature of consumption is different. Many shops and establishments have already opened and we can see high demand.”

M V Shreyams Kumar, Joint Managing Director, Mathrubhumi, remarked, “The print industry has died many deaths and its obituary has been written and rewritten many times over the past few years, the present lockdown stage has been challenging for the print industry, but people understand the importance of this medium, its credibility and is still considered the best medium to reach out target audiences. Kerala being the most literate state, with a great reading habit it will take a long time for newspapers to lose share to other media, it will certainly continue and remain after the end of lockdown.”

According to Varghese Chandy, VP – Marketing and Ad Sales, Malayala Manorama, “Lockdown was a true litmus test of the strength of the print media. What we have noticed is, not only that people have started spending more time on print, the GECs are showing a huge drop in their ratings due to the lack of original content. This could be the reason why the FMCGs are blocking the front pages of the newspapers particularly the regional ones. Post COVID-19 readers will make the time to read print.”

For the revival of print media, it won’t just have to woo advertisers, but also address legacy pain points that have come under the spotlight during this crisis. One such pain point is the strained relationship with newspaper vendors during the lockdown.

Here’s an excerpt from the blog Indian Journalism Review.

Modern living is so superficial that a paper boy is like a nameless COVID victim, but he does have a name if only you would bother to ask.My vendor, my paper boy, is Uday Kumar. He is 50. For over 25 years, Uday has delivered newspapers at our home, in the morning and in the evening, through rain and shine. When he started out in 1991, he earned all of 35 rupees per month, delivering newspapers to about 75 homes. In 2020 he and his son Chetan Kumar were delivering to 350 homes and apartments, earning 8,000 rupees a month. Thanks to COVID, thanks to the fear of contamination through newspapers and magazines, Uday Kumar’s distribution plunged to a little over 100 copies. In other words, his door delivery is down by two-thirds. His income, which comes by way of a commission, is down to a third.

According to media consultant A S Raghunath, “The issue that print faced in the last decade or so is, attracting new generation hawkers into its distribution. Though the door delivery of newspapers may have been a part time job for a hawker, but earnings of around Re 1 to Rs 1.50 per household per day is not certainly a paying job when compared with McDonald’s, Swiggy or Zomato delivery boys. These delivery boys work at odd hours of the day or night and earn better pay per house than what a hawker could make at the wee hours of the day. The print industry has to think of raising its subscription cost in order to pay the distribution better than now.”

He further said, “Newspaper reading is a habit formation. And any habit that may have been disrupted for over 40 days would need an extra effort by the print industry to restore the habit in them again. In my view, readers have to be pampered again to reading. And this would need a huge branding activation by the newspapers within the readers’ societies.”

Voices in the print industry have asked publication owners to adopt a ‘user must pay’ model and stop depending solely on ad revenue for survival. However, print players fear that hiking subscription price of newspapers during lockdown will have an immediate impact on circulation which has already been disrupted. These circulation numbers are critical when negotiating ad rates with advertisers during the revival.

In a news hungry environment, charging a premium for information makes a lot of sense. The New York Times (NYT) reported 3X revenue from subscriptions over ad revenue in Q4 2020. It added 587,000 net new digital subscribers in Q1 2020, a record. This was despite the fact that most of the content it offered during that period was outside its metered paywall. Thus, it has weathered the COVID-19 storm quite well compared to the industry. Similarly, traditional print should strengthen their digital subscription product as ad revenue from online media is negligible compared to its print business.

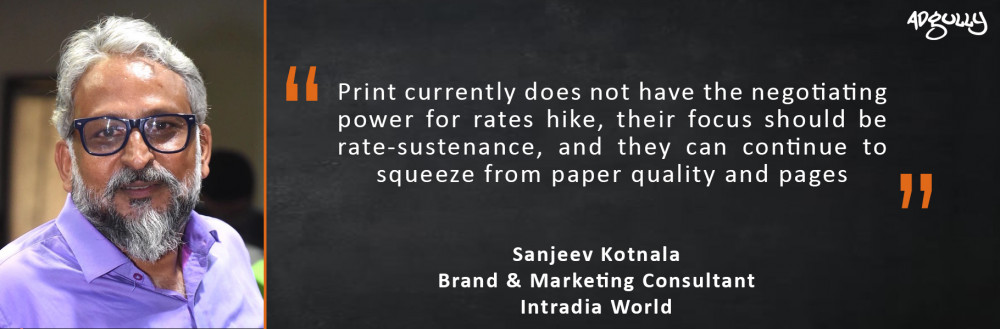

According to Sanjeev Kotnala, Brand and Marketing Consultant, Intradia World, “In the case of media, we have moved away from how many subscribe/ buy you to who buys you and now we are even asking why they buy you, how they consume you. This is where the newspaper has vague answers.”

One way to find out the answers to such questions is by bundling the offline and online subscription product as an offering to readers. Once again, the New York Times shows the way forward according to a report by Axios.

The New York Times will no longer use 3rd-party data to target ads come 2021, executives tell Axios, and it is building out a proprietary first-party data platform.

It has been a long complaint of news portals that Google and Facebook monetise their content via advertising without sharing the spoils. A report by News Media Alliance in the US that highlighted how Google made $ 4.7 billion in ad revenue from content published on news sites without paying them a single dollar.

These news portals existed in a symbiotic relationship with Google and Facebook to drive traffic to their website and use 3rd party data provided by these data aggregators. However, NYT will no longer rely on other sources of data to find out about its users.

Kumar opined, “There needs to be a complete study in place to understand and review the advertisers post lock down, there are many sectors which are affected and will take time to revive. We shall understand there needs and accordingly plan our strategies for them. We will offer more integrated solutions to them which will be cost effective.”

To plan effective strategies, print media players will need data on changing consumer habits on the fly and not quarterly as is published by the Indian Readership Survey. What better way to do this other than leverage their digital offering to collect data on the reader? They say there is an opportunity in every crisis and Covid might just be that for subscription revenue.

Kotnala remarked, “To woo the marketers, print needs to demonstrate the effectiveness and viability of a campaign in it. While print players talk about innovation it is hardly reflected in their activities and processes. They need to treat innovation as another marketing solution and definitely not overcharge for it. It is still not the time to milk the last drops. Print media players should, at certain places, form strategic alliances to help demonstrate RoI and work in partnership with the client and creative agency. They need to exploit the advantage of the fastest build-up of any topical and tactical communication. The medium needs to integrate and built on analytics and trust that they enjoy.”

Ad revenue could take a while to return to normalcy. Can print players afford to play the wait and watch game as losses continue to mount or should they pivot to a subscription strategy to mitigate the Covid blow?

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn