WPP reports resilient performance in a challenging environment in Q3

WPP has reported continued good momentum in new business, with $1.6 billion won in Q3 2020, taking the year-to-date wins to $5.6 billion. WPP also reported strong liquidity and balance sheet, supported by tight working capital management, with year-to-date average net debt at £2.5 billion, down £2.0 billion year-on-year. This has put WPP on track to be towards upper end of the £700-800 million cost reduction target.

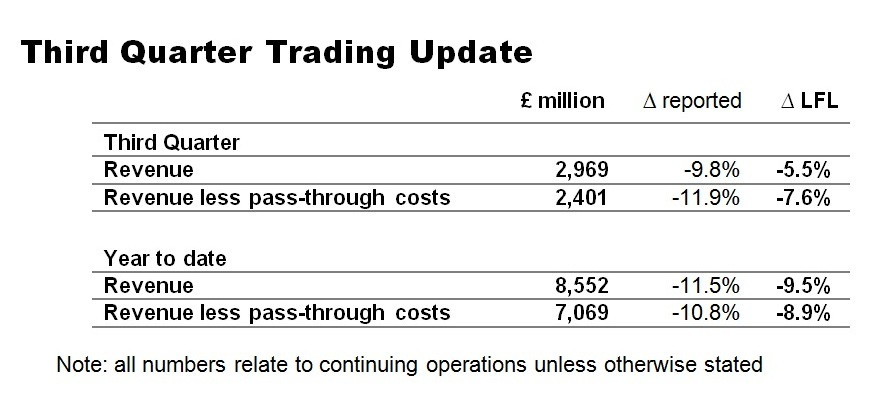

However, Q3 revenue saw a drop of -9.8 per cent, with LFL revenue at -5.5 per cent. Q3 LFL revenue less pass-through costs declined by -7.6 per cent. The Top 5 markets with Q3 LFL revenue less pass-through costs were:

US -5.5%

UK -6.5%

Germany -1.8%

Greater China -16.7%

India -16.3%

Full year 2020 LFL revenue less pass-through costs growth and headline operating margin is expected to be within the range of latest analysts’ expectations. Like-for-like growth in revenue less pass-through costs of -8.5 per cent to -10.7 per cent and headline operating margin of 11.4 per cent to 12.5 per cent. Equivalent ranges on August 27, 2020 were -10.0 per cent to -11.5 per cent and 10.4 per cent to 12.5 per cent, respectively.

Mark Read, Chief Executive Officer, WPP, commented, “WPP continues to demonstrate its resilience in a challenging market. We have maintained our new business momentum as clients seek out our creativity and our skills in media, technology, data and ecommerce. This month, Uber joined a growing list of major assignment wins that includes Alibaba, Dell, HSBC, Intel, Unilever and Whirlpool, and we continue to lead the new business rankings. We have also renewed and expanded our relationship with Walgreens Boots Alliance to encompass its data- and technology-driven marketing strategy.”

He further said, “Given the tightening of COVID restrictions around the world and uncertainty in the global economic outlook, we remain cautious about the pace of recovery. It is important that we maintain our strong financial position and we are on track to achieve cost savings towards the upper end of our £700-800 million target.”

“Our people have done a superb job in serving our clients, largely working from home, but the events of 2020 have, of course, created new pressures for everyone. We have increased our investment in employee support services, with a particular focus on mental health and wellbeing, and this will be an ongoing priority for our leadership,” Read added.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn