YouTube most-used social media platform by influencers in India

India is one of the most diverse and growing markets in the world, with a social media population of 448 million users and a 21.2% year-on-year growth rate. At the same time, influencer marketing in India is a growing space, and one that is expected to stick in the coming years.

The report, titled ‘State of Influencer in India 2021’, released by AnyMind Group, an end-to-end commerce enablement platform, takes a look at the hottest influencer verticals in India, the most-favoured platforms by influencers, influencer category breakdown, and median engagement rates by platforms. Additionally, the report compares the top three hottest influencer verticals in India in terms of platforms, influencer categories and median engagement rates.

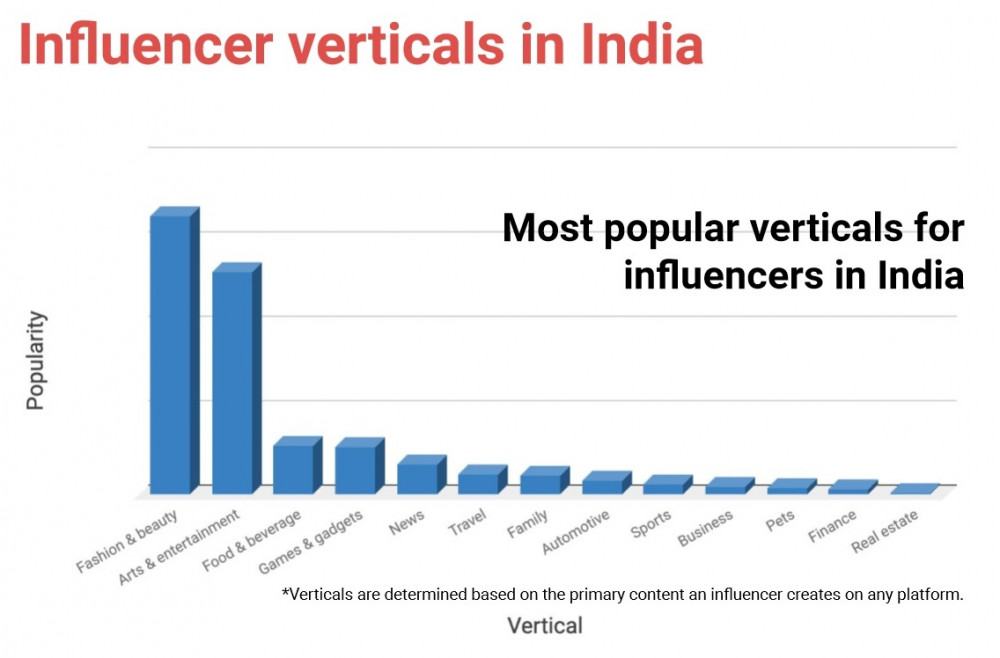

Based on data from the AnyTag platform, fashion & beauty, arts & entertainment and food & beverage, were the most popular influencer verticals in India. Apart from the relatively broader categories of arts & entertainment and fashion & lifestyle, food & beverage influencers are more known to create niche content, influence and expertise.

For brands, it’s important to note that the top two influencer verticals are highly diverse in the types of products that they can endorse, but it’s still critical to understand individual influencers and their audiences in order to ï¬nd the right influencer(s) for a speciï¬c campaign.

Compared to other markets in Asia, influencers that share (predominantly) news have a higher proportion versus the other influencer verticals.

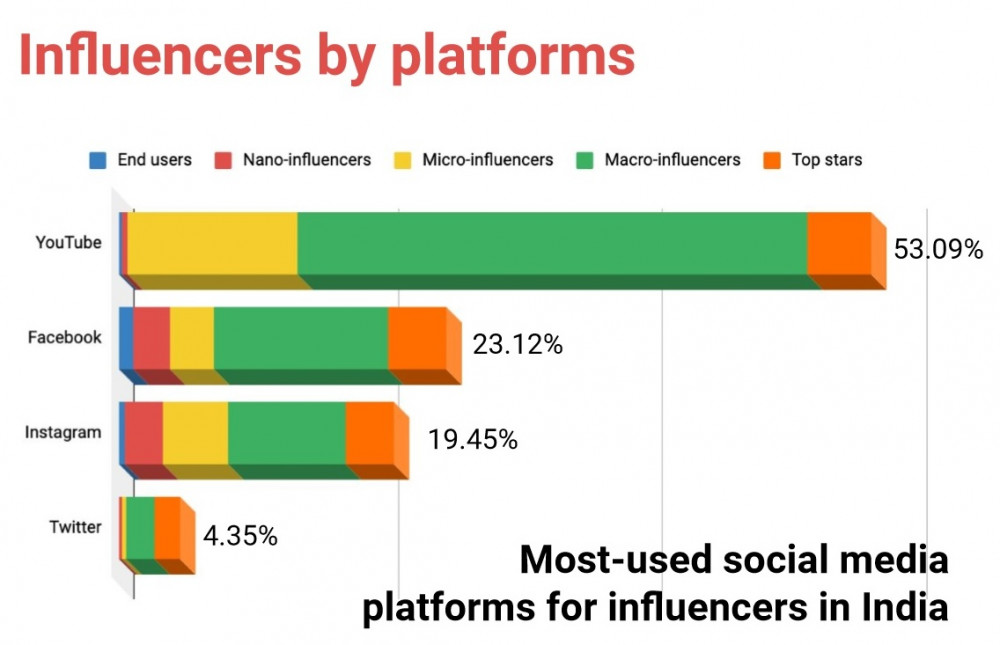

Most-used social media platforms for influencers in India

YouTube is the clear front runner for most-used social media platform by influencers in India, with just over 67.9% being macro-influencers (100K to 1M followers). Facebook also has a clear lead over Instagram, whilst close to 1 out of every 20 influencers in India use Twitter.

With that said, we’re seeing a large skew towards influencers playing in the macro-influencer space, with such high follower numbers common due to the sheer size of the social media population.

Looking deeper into the types of influencers in India, more than half (58.15%) of influencers are macro-influencers, with close to one in every four influencers being a micro-influencer. In the coming year, we’re expecting 9.32% of macro-influencers to increase their numbers of followers and turn into top stars.

At the same time, we’re seeing larger proportions of top stars (over 1M followers) in India compared to the majority of other markets across Asia, and Twitter has almost an equal ratio of top stars and macro-influencers on the platform.

On the other hand, nano-influencers are most populous on Facebook and Instagram, with few on YouTube and Twitter.

Across the board, YouTube is the de facto platform of choice for all three top influencer verticals in India, which also makes a lot of sense considering people in India spend the most time on YouTube compared to any other social media or video streaming app.

At the same time, influencers that create food & beverage content primarily have the most even usage across social media platforms.

Ultimately though, marketers need to understand where their target audiences are in order to decide on strategy and influencers to use.

Similar to the rest of the influencer population in India, the top three influencer verticals are mostly in the macro-influencer category, with more than half of fashion & beauty and arts & entertainment content creators falling in the macro-influencer category.

Looking deeper, food & beverage influencers are actually most populous in the end user, nano-influencer and micro-influencer categories, whilst arts & entertainment ranks top for the macro-influencer and top star categories.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn