As Netflix lowers price, is its commitment to pureplay SVOD a sound strategy?

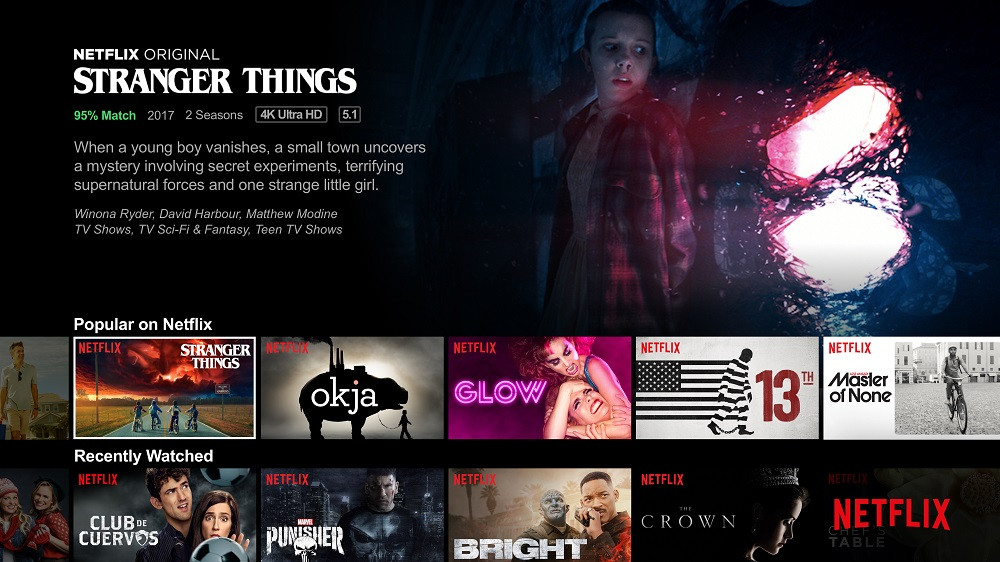

For long, Netflix has had the highest subscription rates amongst its OTT competitors in India and has been stead fast about its prices point. Now, the OTT player is out to change the game as it launches a mobile-only plan at a price point of Rs 199 per month.

In India, Netflix is not a leader in terms of subscribers, falling behind Hotstar, ZEE5 and Amazon Prime Video in market penetration. However, according to intelligence provided by KalaGato, the OTT player’s Average Revenue Per User (ARPU) is higher than other OTT platforms.

The report found that while Netflix may not have a large base of subscribers, they are all premium clients with a high ‘willingness to pay’. Their base of paying customers and ARPU is higher than other OTT platforms. At an average of Rs 655 per month, Netflix’s ARPU from subscription fee is much higher than other OTT platforms.

Another global player, Amazon Prime Video has edged out Netflix in terms of subscribers. According to a study by techARC-Unomer, Amazon Prime Video has a slightly better penetration than Netflix. Prime Video’s penetration is 15 per cent, compared to 13 per cent of Netflix. This is a result of Amazon’s close relationship with some smartphone OEMs, where Amazon apps like Amazon Shopping and Amazon Prime Video come pre-embedded or pre-loaded in the device. However, the delta does not commensurate the tie-ups that Amazon has compared to Netflix, which doesn’t have any such relationship with a smartphone OEM.

Also Read: Sacred Games Goes Retro In This Swanky New Photo Shoot

Globally, Netflix’ Q2 results showed that the OTT giant’s international subscriber base grew by 2.7 million, which is short of their target of 5 million.

Knowing that smartphones are driving OTT consumption in India, Netflix has had to rethink their Indian strategy and adopt a mobile first approach. Yesterday, the platform announced their Rs 199 mobile only plan for Indian users. They cited the FICCI-EY 2019 report, which found that Indians spend 30 per cent of their phone time – and over 70 per cent of their mobile data – on entertainment.

For now, it seems Netflix is moving in the right direction in the Indian OTT market. But is their commitment to remain a pureplay SVOD service a sound strategy?

Addressing rumours about tying up with ad business, Netflix in a letter to shareholders stated, “We, like HBO, are ad free. That remains a deep part of our brand proposition; when you read speculations that we are moving into selling advertising, be confident that this is false. We believe we will have a more valuable business in the long term by staying out of competing for ad revenue and instead entirely focusing on competing for viewer satisfaction.”

An App Annie report has found that there are 33 OTT players in India alone. Most of these players have adopted a freemium model with content offerings across genres. They have also inked strategic partnerships across the board with telcos, brands, and other digital platforms to strengthen their value offering to Indian customers.

On the other hand, Netflix, which does not have any such relationship with a smartphone OEM, reportedly spends $15 billion a year on expanding its content library and is one of the most aggressive marketers in the Indian OTT space. This year, they have 13 new films and 9 original series in the pipeline.

Netflix is pumping its entire resources into building its platform to become unrivalled around the globe. However, without advertiser support will they run out of steam before that happens?

Monetisation challenges

A senior industry source told Adgully that there are multiple models of monetisation in the market. Some, like SonyLIV, have chosen a hybrid freemium model for monetization, while some have opted for a freemium model. “On the basis of its strength, each company will have to decide on its business model and go for it,” the source added.

“OTT providers cannot rely on subscriptions alone to build a sustainable business model as they need to explore various monetisation models from sponsored content, pre-roll ads, branded video player scrubber bar, play ads during pause, brand placement and shoppable video element can all offer an OTT player a myriad of monetisation options to tap into,” remarked Greg Armshaw, Head of Media, Asia, Brightcove.

Gaurav Lulla, Co-Founder, Loose Cannons Content Studio, added here, “Everyone is adopting a different strategy. Some are playing to their strengths of having linear TV content and using the catch-up game. Others are moving to the freemium/ SVOD model. I personally feel that the monetisation strategy of the Indian OTT players should be dictated by their investment in original content creation. If this investment is low, they would be better off opting for the advertiser funded programming model and if they are serious about the investment in content, they can look at the SVOD model.”

Content

“I hear a lot of smaller OTT players worrying about the might of Netflix and Amazon to produce quality content. I think that’s a myth,” felt Lulla, who added, “There are a lot of creators and content specialists who need a solid platform to tell amazing stories. If an Indian OTT player decides to aggregate them and tell those stories, odds are that they would have greater throughput of interesting content at lower acquisition prices.”

Fundamentally, a combination of two things work in OTT – providing great content and user experience to customers. As more content is churned out, and the user base expands, the OTT players will have to focus on building content across genres, languages, etc. “Building a diverse content portfolio helps you gain customer loyalty for a long time,” the senior industry source said.

“Without content, there is no business, so yes, it has to be tenable,” remarked Armshaw. “That said, we will see innovation in the way content and the associated intellectual property is monetised moving forward. Content comes and goes, but what needs to be front and centre of any OTT players’ strategy is the customer user. What might motivate a current user to continue on with an OTT subscription will be completely different motivator compared to for lapsed or never users. OTT players need to devise different mix of tactics to attract and retain all three types of users.”

Market

Armshaw believes that a percentage of people are prepared to pay for premium content, and now more than ever they can find content that appeals to their tastes thanks to OTT services. “Even many of the basic smartphones provide a more than acceptable viewing experience, I do not believe that people value content less because the delivery medium is a smartphone. I do believe that on the smartphone, there are many more entertainment options so entertainment services need to work harder to earn the consumers discretionary spend,” he added.

Once users get used to paying for content, their subscription revenues will lead to a sustainable business model. “If I was an advertiser, I would be worried. Because if a sizeable part of my TG moves into this advertiser dark universe, it would get very challenging to reach them,” said Lulla.

“Digital advertising is a lot more efficient with less wastage than TV ad buys and there are a lot more opportunities to create branded experiences for advertisers,” said Armshaw. “Overall revenues will grow from both subscription and advertising. There are also additional revenue opportunities in the creation of branded content, branded access experiences, content-to-commerce and the creation of sponsorship assets.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn