Balaji Telefilms’ Q1 FY20 revenues drop to Rs 82.9 cr; but growth in PAT & EBIDTA

Balaji Telefilms Limited has seen a fall in its Q1 FY20 revenues to Rs 82.9 crore from Rs 133.7 crore reported in Q1 FY19. This reduction in revenue has been attributed to no movie releases in the quarter.

However, the company became EBIDTA positive at Rs 10.6 crore in the first quarter ended on June 30, 2019, compared to -Rs 0.9 crore in Q1 FY19. Q1 FY20 profit after tax (PAT) was also up at Rs 2.5 crore as compared to a loss of Rs 1.2 crore in Q1 FY19.

Balaji Telefilms claimed that its TV content production business continues to dominate the ratings and account for 18% of the Primetime ratings. Balaji Telefilms had 8 shows on air during the quarter and 5 of these shows were slot leaders.

ALTBalaji, the OTT service from Balaji Telefilms, has reported revenues of Rs 12.3 crore in Q1 FY20, an increase from Rs 5.8 crore seen in Q1 FY19. ALTBalaji has also seen 27.3 million subscriptions sold since its inception (as of August 8, 2019). With 42 shows live, it has one of the largest content collections in the country.

During the quarter, ALTBalaji also entered into a first of its kind OTT collaboration with ZEE5 to co-produce 60+ Originals and share consumer insights. The co-created original content will only be available on both platforms and will be paid content. The partnership is expected to result in faster scale up and profitability for ALTBalaji and help conserve cash spend in a challenging business environment. The first set of shows as part of this alliance will stream very soon.

Also read: ALTBalaji & Zee5 to co-create Original content

Financial highlights:

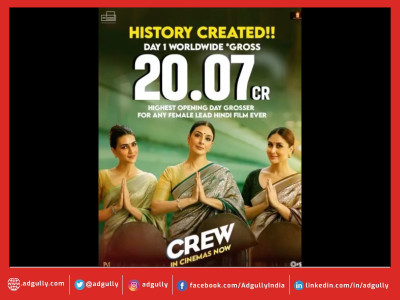

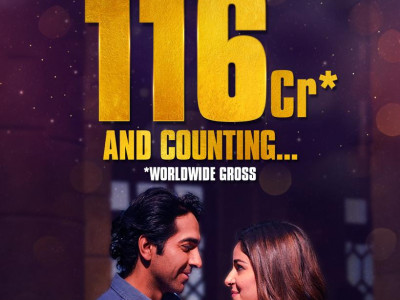

- Q1 FY20 Revenues from Operations at Rs 82.9 crore, compared to Rs 133.7 crore in Q1 FY19. Reduction in revenue on account of no movie releases in the quarter, Q1 FY19 had the hugely successful ‘Veere Di Wedding’ (Rs 51 crore of revenues).

- Q1 FY20 Gross Margins at 32 per cent, as against 16 per cent in Q1 FY19. Four of the current shows running for more than 1 year resulting in better margin profile. Improved cost control across all shows, especially new show launches.

- Q1 FY20 EBITDA at Rs 10.6 crore, compared to –Rs 0.9 crore in Q1 FY19. Q1 FY20 includes certain marketing costs for upcoming movies without corresponding revenue.

- Q1 FY20 profit after tax (PAT) at Rs 2.5 crore as compared to a loss of Rs 1.2 crore in Q1 FY19. Depreciation charges increased from Rs 3.1 crore in Q1 FY19 to Rs 8.3 crore in FY20 on account of IND-AS 116.

- ALTBalaji continues to grow its subscription revenues while maintaining its cash spend. Q1 FY20 revenues at Rs 12.3 crore, as against Rs 5.8 crore in Q1 FY19.

- Inventory as on June 30, 2019 – Movies Rs 68 crore, Digital shows Rs 146 crore.

- Investments: Total value of investments in Mutual Funds across the company as on June 30, 2019 stood at Rs 247 crore.

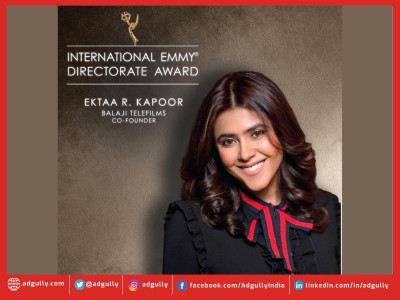

Shobha Kapoor, Managing Director, Balaji Telefilms Limited, commented, “Operationally this was a good quarter with strong performance across all business and the two deals in our movie and digital business dramatically improves our financial profile going forward and will allow us to pursue our growth ambitions. I also take this opportunity to thank Sunil Lulla, our Group CEO, who has decided to pursue other opportunities after a brief period with us. Sunil leaves Balaji Telefilms in a very strong position for future growth and the rest of the leadership team will continue to drive the business forward.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn