DAN upwardly revises ad spend growth; India to see 10.5% growth to reach Rs 624 bn

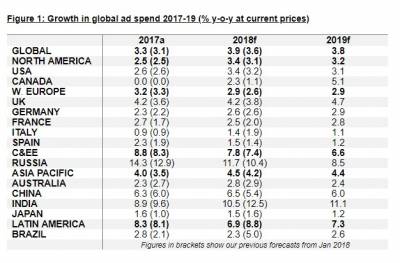

Ad-spend growth in the Asia Pacific region is expected to rise from 4.0 per cent in 2017 to hit 4.5 per cent in 2018, as per Dentsu Aegis Network’s biannual global forecasts. Pointing to a more positive 2018 for Asia Pacific advertising expenditure, the projected growth is higher than the 4.2 per cent forecast in January 2018 and taking total investment to $215.95 billion.

Regional events such as the FIFA World Cup Russia 2018, 2018 Winter Olympics in South Korea, Asian Games in Indonesia and Australian federal elections will play an important role in stimulating growth.

Geographically, Asia Pacific is a major growth region, contributing 41 per cent of the global increase ($613.5 billion). Comparatively, North America accounts for 32 per cent, Western Europe accounts for 13 per cent with Latin America at 8 per cent and Eastern Europe at 5 per cent.

Commenting on the latest forecasts, Nick Waters, CEO of Dentsu Aegis Network Asia Pacific, said, “The region as a whole displays a positive outlook with increasing growth rates. We are seeing upward revisions in most key markets, with India, the Philippines and Vietnam showing high rates of growth. Spend in China continues to grow at pace, though driven almost entirely by the ecommerce platforms, Alibaba, Tencent and Baidu. Digital remains the dominant growth area, with a quarter of Asia Pacific advertising spend expected to be delivered through mobile for the first time. Digital will be the leading form of advertising in half of the markets that we track in the region.”

Speaking on the Indian context, Kartik Iyer, President - Media Brands and Amplifi, Dentsu Aegis Network India, said, “India’s ad spend is projected to grow at 10.5 per cent, as compared to the beginning of the year when the growth was expected to be over 11 per cent. Digital continues its rapid growth (31.9 per cent), with online video gaining in share. This has been driven largely by the availability of high speed connectivity across the country, it is only set to grow faster. TV with a projected market share of 39.1 per cent continues to lead the media share of pie with Print at 29.3 per cent. It wouldn’t be a surprise to see some forward thinking brands trying to use Video instead of TV in a few test and learn cases.”

Key market trends

India: India’s advertising spend market is expected to grow in 2018 by 10.5 per cent to reach Rs 624 billion. Though there had been a slow start in Q1 of 2018, the market was picking up from March-April, fueled by a stable recovery post demonetisation/ GST/ RERA buoyed by the State Elections in Meghalaya, Tripura, Nagaland and Karnataka in April. The India-South Africa match in January and Budget announcement in February led to continued expansion and growth of regional newspapers and television. Both social and online video will see growth for the next five years as India continues to evolve their Internet, mobile, cloud audience.

China: China’s advertising market is predicted to grow 6.5 per cent in 2018, up from the previous forecast of 5.4 per cent, to reach RMB 630 billion – 16.2 per cent of global ad investment. Growth will be driven by digital, which is forecast to command 60 per cent of advertising spend and increase by 14.8 per cent. The online giants Baidu, Alibaba and Tencent (BAT) are projected to contribute around 80 per cent of this growth, underlining their dominance of the marketplace. Mobile payments are also one to watch in the coming years as platforms such as WeChat or Alipay make cash obsolete in large parts of the country.

Australia: Australia’s advertising spend is forecast to show continued growth in 2018, increasing by 2.8 per cent to reach AUD 15.7 billion. The main driver of growth will be election related advertising, which includes a boost in advertising by the governments involved as a means to promote the great things they have done during their time in power. In 2018, over 40 per cent of the growth is expected to come from this sector and a further 40 per cent to come from Gambling, Retail and Finance advertising. Digital media is expected to increase by 6.1 per cent in 2018, representing 48 per cent share of the total media spend, which could be a result of brand safety issues where advertisers and media owners look to more autonomy and control of their content.

Global Media trends

Mobile on the go

The mobile device is steadily becoming our primary point of access to all digital services and content. In 2018, 52.2 per cent of all worldwide online traffic was generated through mobile phones, up from 50.3 per cent in the previous year, according to Statista. People now spend an unprecedented amount of time on their smartphones – more than five hours a day, according to some estimates. This growth in usage is largely driven by the widespread availability of high-quality digital Video. Mobile Video consumption is exploding among all age groups and content categories. Nine in 10 social media users opt for mobile browsing, with mobile apps accounting for 70 per cent of time spent on social media.

Reflecting this, mobile is forecast to represent a quarter of global ad spend at 25.2 per cent this year, exceeding the previous prediction of 24.8 per cent. With mobile payments forecast to be more popular in the coming years, Mobile is set to continue on a positive growth trajectory with a forecast of 23.3 per cent in 2018 and 18.8 per cent in 2019.

Digital still calls the tune

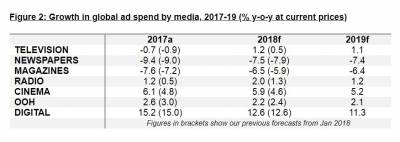

Worldwide Digital media spend is forecast to increase by 12.6 per cent in 2018, more than three times the rate of all media (3.9 per cent), to reach US$230.6 billion – a US$25.7 billion incremental increase year-on-year. Online Video (+24.6 per cent) and Social Media (+21.6 per cent) are particularly strong. Paid Search continues to account for the largest share of Digital (39 per cent). As previously predicted, Digital will overtake TV for the first time this year to account for 38.4 per cent share of total ad spend versus 35.5 per cent. In the US, Digital spend is forecast to overtake TV in 2019. Programmatic ad spend is expected to grow by 23.2 per cent in 2018 and 19.1 per cent in 2019 as the ability to consolidate programmatic buying strategies across formats and devices continues to be an opportunity for advertisers to reach the most valuable audiences at scale.

Traditional media spend is forecast to decline by just -0.5 per cent in 2018 and -0.4 per cent in 2019. Newspapers and magazines are expected to continue their downward trend, with falls of -7.5 per cent and -6.5 per cent, respectively. Radio (+2.0 per cent), Out of Home (+2.2 per cent) and Cinema (+5.9 per cent) spends are expected to show steady growth.

TV spend is forecast to move back into growth in 2018 (+1.2 per cent), following a -0.7 per cent decline in 2017, remaining a major medium in the mix with 35.5 per cent of the overall investment.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn